TOKYO – Global Brain, one of Japan’s largest venture capital companies, plans to invest more in startups in China and India as it looks to take advantage of geopolitical tensions that have hit valuations in the two countries.

The company plans to open offices in Shanghai and Bangalore next year, founder and CEO Yasuhiko Yurimoto said at a Global Brain event on Friday. It will invest in early stage startups with advanced technology from its 20 billion yen ($192 million) seventh flagship fund, as well as a planned eighth fund and a growth stage fund that may launch as early as next year. The two new vehicles may add up to around 30 billion yen.

Global Brain recently made its first investment in a Chinese mobility startup, and has made two investments in India, Yurimoto said in an interview.

In addition to its flagship funds, Global Brain is known for managing corporate venture capital funds on behalf of big Japanese companies like telecom operator KDDI and brewer Kirin Holdings. These funds, which aim to create partnerships between startups and the Japanese company, may also invest in Chinese and Indian startups, Yurimoto said.

Growing political tensions have hit startup funding in China and India, analysts say. Venture capital investment by U.S. companies in China for the first six months of 2020 likely fell to its lowest level since 2016, according to the Rhodium Group, amid a deepening U.S.-China trade war.

Meanwhile, India’s tighter regulations on foreign investments from China, and an extensive ban on Chinese apps, have prompted Chinese investors including Alibaba Group Holding and Tencent Holdings to scale back their investments. Both groups were big backers of Indian startups.

Read also – Cloud-based RPA solution Provider BizteX bags 630Mn yen led by Global Brain and others

The dynamics have “opened a window of opportunity,” Yurimoto said, noting that he decided to enter India one year ahead of schedule. “Startups are looking towards Japan for partnerships.”

Yurimoto said he does not expect the new U.S. administration to result in a major change in stance towards Chinese technology.

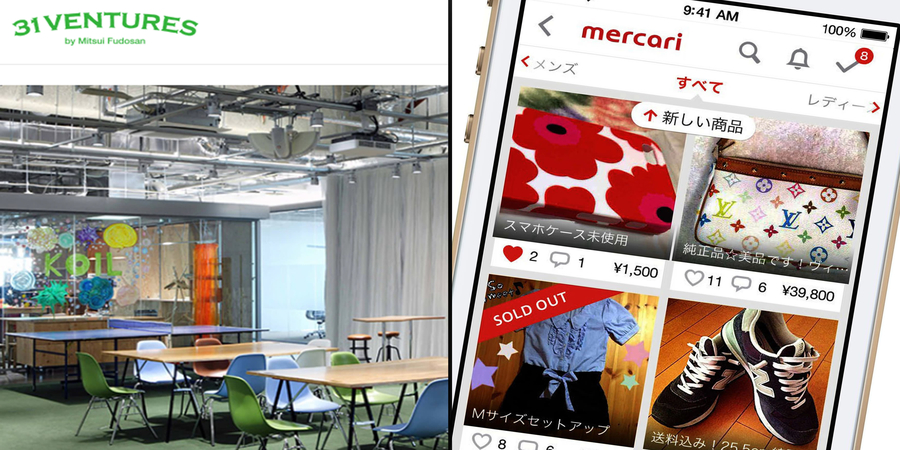

Founded in 1998, Global Brain manages 152 billion yen ($1.4 billion) and has offices in South Korea, Singapore and Indonesia, as well as the U.S. and the U.K. It also manages venture capital fund 31 Ventures on behalf of Mitsui Fudosan, a major Japanese real estate developer.

One of its most high-profile exits has been Japanese e-commerce startup Mercari, which went public in 2018 with a market capitalization of more than $6 billion.

Global Brain has been a prolific investor during the coronavirus pandemic — it is on track to invest in about 100 startups this year, compared to 77 in 2019.

Its expansion in Asia indicates growing investor interest in the region. Despite their proximity to Asia, Japanese corporations and financial institutions that invest in venture capital funds have generally preferred vehicles that invest in Silicon Valley, due to its reputation and solid track record, according to industry observers.

Yurimoto said a string of successful exits in Global Brain’s overseas investments outside the U.S., such as an Israeli startup that was bought by Walmart, has boosted the company’s confidence to venture further into Asia.

Read also – Japan’s handmade item C2C startup Creema files for IPO

Despite the geopolitical backdrop, industry observers say top U.S. venture capital companies like Sequoia Capital still enjoy an extremely high reputation among startups in India and China. The biggest ones also have deep pockets that allow them to invest in unicorns — startups valued at $1 billion or more. VCs in Japan are behind in both reputation and scale.

Yurimoto said Global Brain will initially build its network by co-investing with the top venture capital companies in the region, and offer access to top Japanese companies.