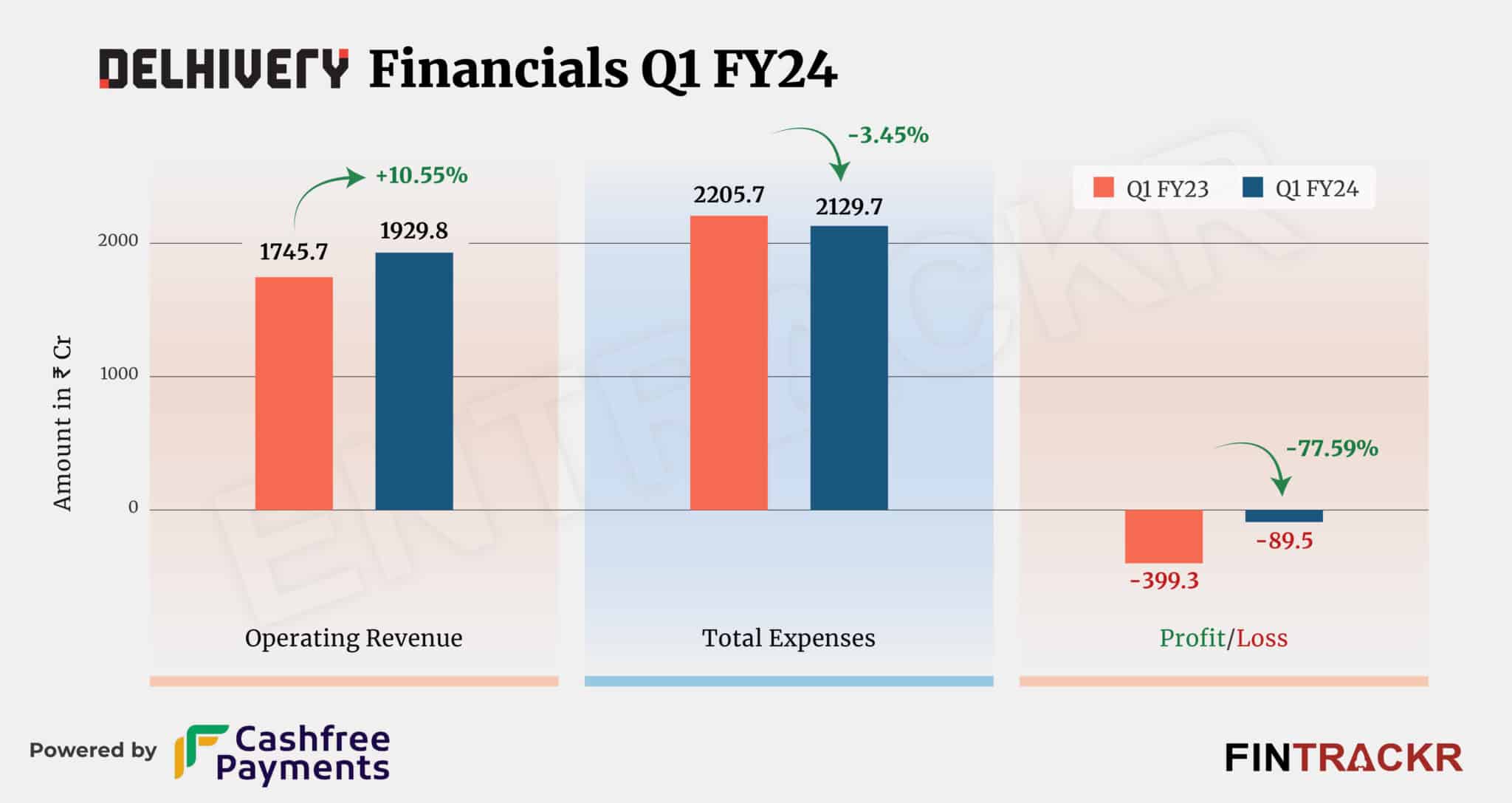

Logistics company Delhivery has recorded 10.55% growth to Rs 1,929.8 crore in revenue from operations during the quarter ending June 2023 (Q1 FY24) as compared to Rs 1,745.7 crore in Q1 of the previous year (FY23), according to the company’s unaudited consolidated quarterly report published on the National Stock Exchange.

Besides its operating income, Delhivery also earned Rs 101.32 crore worth of non-operating income (interest and gain on financial assets) during Q1 FY24, taking the overall revenue to Rs 2,031.1 crore.

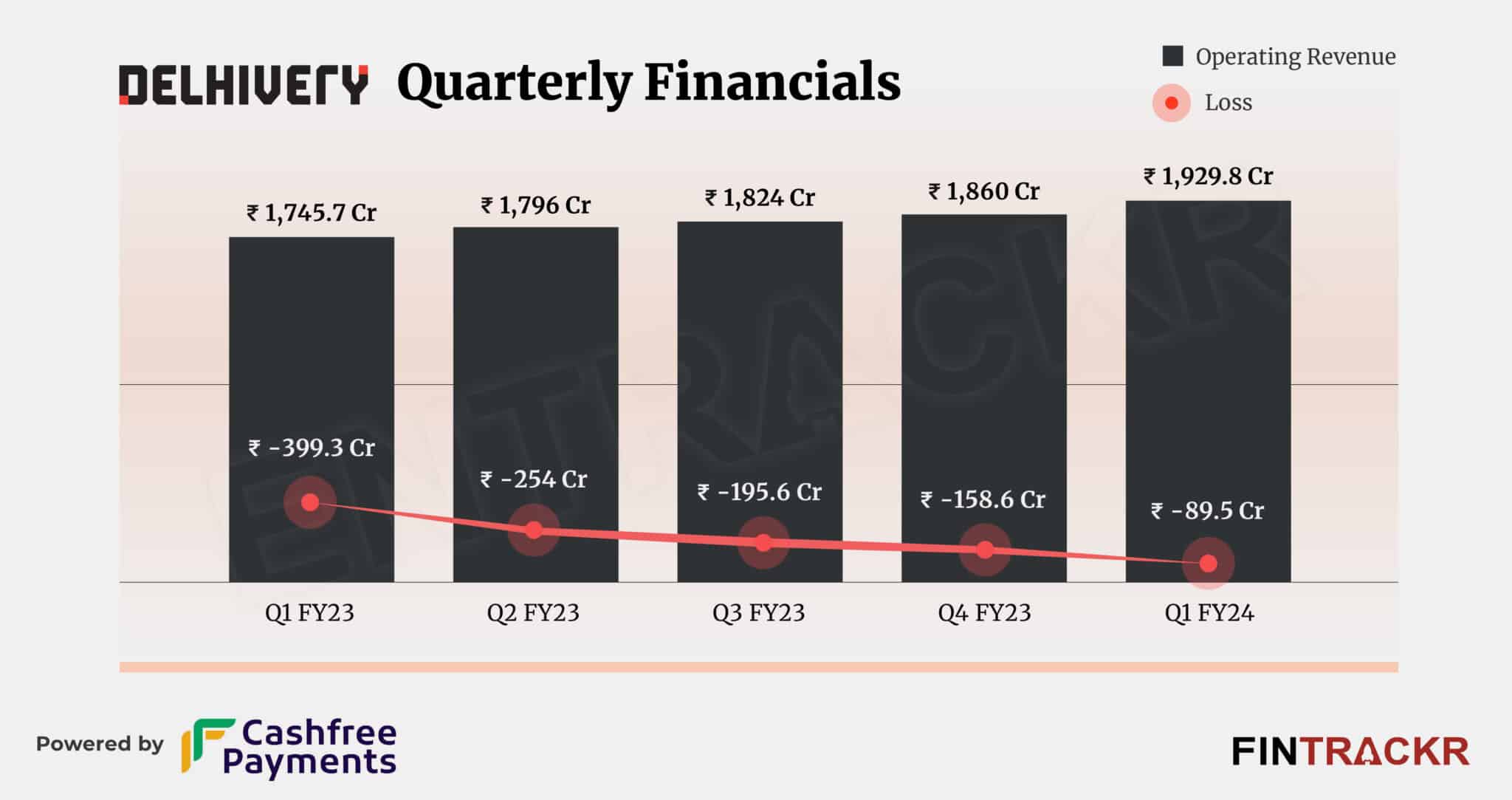

When compared to the previous quarter (Q4 FY23), Delhivery’s revenue from operations grew only 3.8% from Rs 1,860 crore.

Freight, handling and servicing-related costs formed 67.52% of the total expenses and stood at Rs 1,438 crore in the first quarter of FY24 whereas employee benefits expenses were registered at Rs 353.2 crore.

The company also booked depreciation and amortization cost of Rs 167.3 crore and finance costs of Rs 19.5 crore during the quarter which dragged the total expenditures to Rs 2129.7 crore during Q1 of FY24. In comparison to the same quarter of the previous year, its total expenses contracted 3.45% from Rs 2205.7 crore.

At the end, Delhivery’s bottomline improved as the company’s losses shrank over 77% to Rs 89.5 crore during the quarter (Q1 FY24) against Rs 399.3 crore in Q1 of FY23.

On a unit level, Delhivery spent Rs 1.1 to earn a rupee of operating income during the first quarter of FY24.

Taking a look at the company’s quarter-on-quarter growth, Q1 FY24 seems to be an impressive quarter for Delhivery as the company crossed Rs 1,900 crore quarterly revenue mark during the period. The growth also came with an improved bottomline, significantly the company has the lowest losses in the last quarter (Q1 FY24).

Delhivery ended FY23 with a flat growth of 5% and managed to cross Rs 7,200 crore in revenue. The company also controlled its losses by a small margin to Rs 1,007 crore in FY23 as compared to Rs 1,011 crore in the previous fiscal year.

Ahead of its quarterly results, Delhivery granted ESOP options to its employees. As per Fintrackr’s estimates, the granted ESOP options are worth around Rs 74 crore and every option will be converted into equity shares. Entrackr exclusively reported the development.

Meanwhile, Delhivery is evaluating an entry into hyper local delivery space. Last month, Entrackr reported that the firm is already conducting a pilot with a quick commerce firm where it’s taking care of packaging and delivery.

Besides Delhivery, Zomato and Paytm also announced their results for the first quarter of FY24. The Deepinder Goyal-led firm reported Rs 2416 crore in operating revenue and turned profitable in the last quarter. Paytm, on the other side, registered Rs 2,342 crore in revenue with an operating loss of Rs 358 crore.