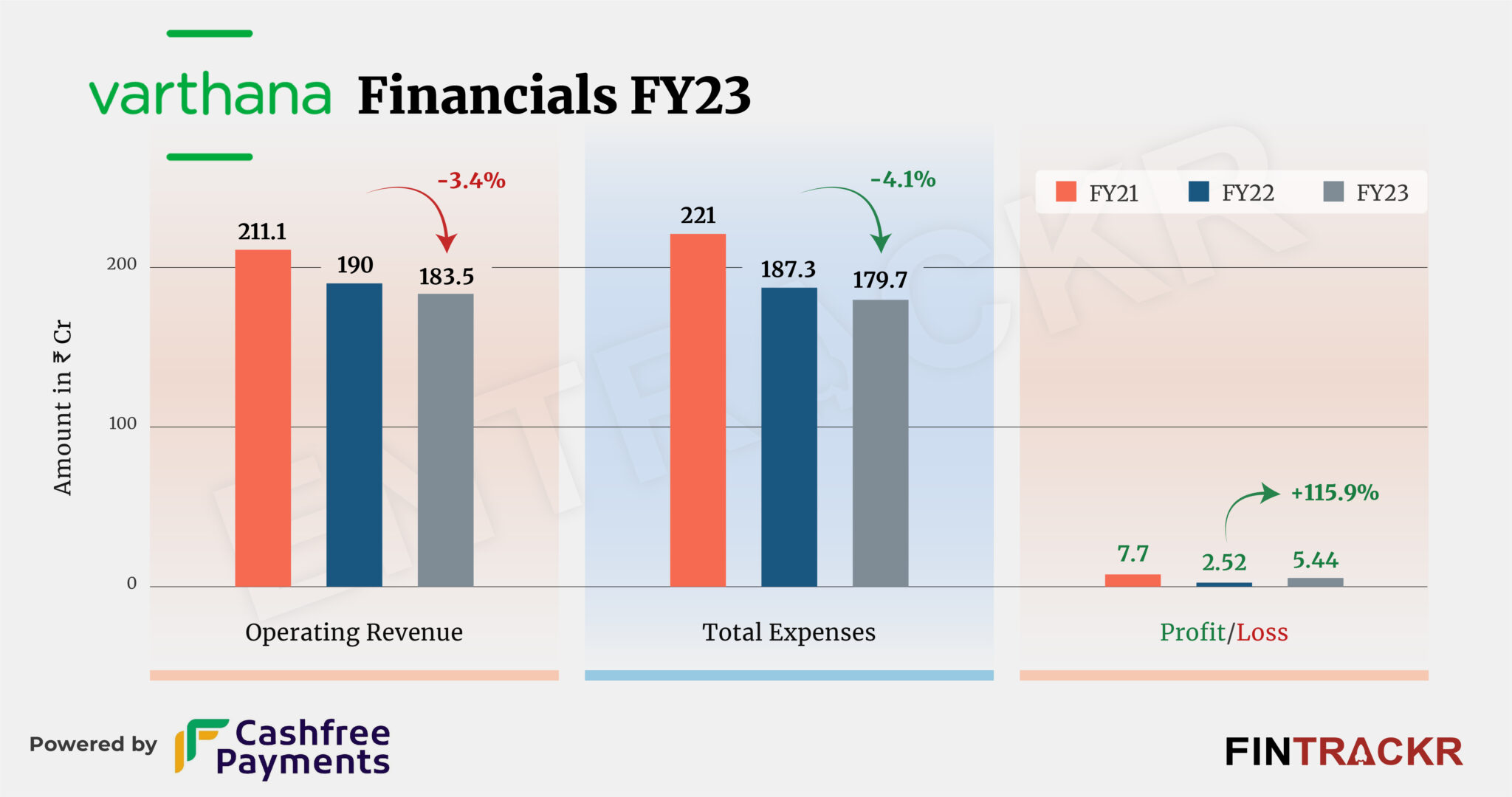

Varthana Finance, a Bengaluru-based school finance company, experienced a decline in scale over the last two fiscal years. The revenue dropped from Rs 211 crore in FY21 to Rs 190 crore in FY22, and further decreased to Rs 183 crore in the last fiscal year ending March 2023.

Varthana Finance’s revenue from operations contracted 3.4% to Rs 183.5 crore in FY23, according to its annual financial statements filed with the Registrar of Companies.

Established in 2013, Varthana Finance operates as a non-banking finance company (NBFC), that provides credit to low-budget private schools and students pursuing higher education in India. Varthana operates across 15 states, catering to more than 8,500 schools and benefiting four million students. The company has successfully disbursed over 15,000 loans and established partnerships with more than 750 loan institutions.

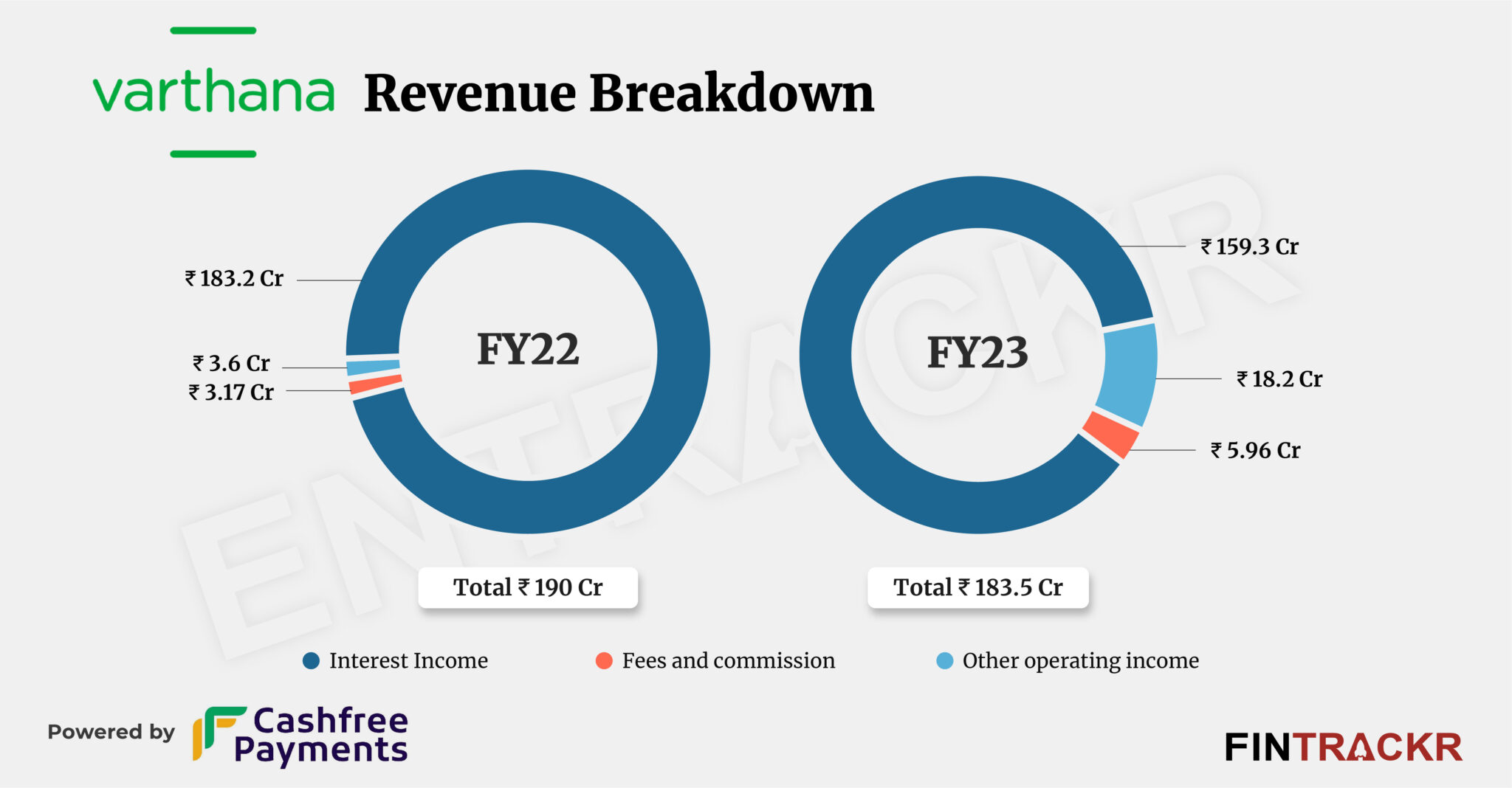

Being a loan financing firm, interest income contributed 86.8% of the total operating revenue. This income declined 13% to Rs 159.3 crore in FY23. Fees/commissions and other operating revenue collectively contributed Rs 24.15 crore to the collections during the previous fiscal year.

On the expense side, finance costs accounted for 35.5% of the overall cost. In the line of scale, this cost was slashed by 20% to Rs 63.83 crore in FY23. While the scale went down, its employee benefit cost and legal professional fees grew 17.4% and 78.4% to Rs 59.3 crore and Rs 6.6 crore respectively in the last fiscal year.

Varthana Finance booked an expense of Rs 41.7 crore towards the impairment of financial instruments during FY23. In the end, the overall cost of the company shrank 4.1% to Rs 179.7 crore in the preceding fiscal year.

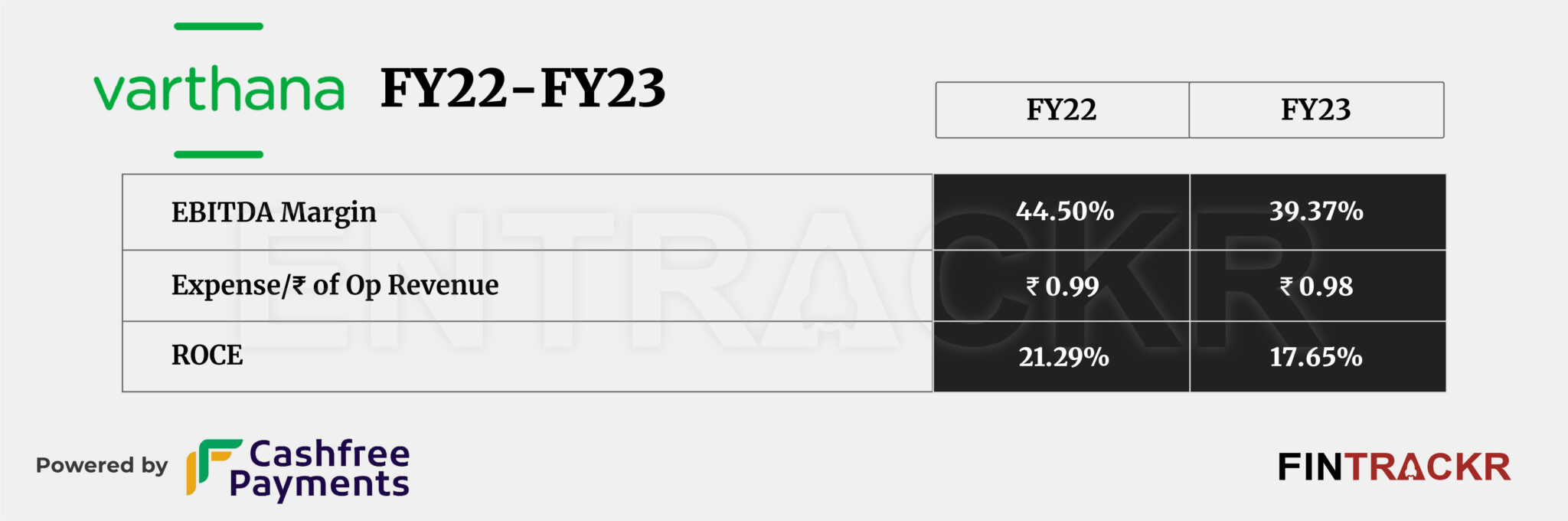

Even as the scale stalled, the company held a good hand over the expenditure. This reflects from its bottom line where the profits for the company surged 2.1X to Rs 5.44 crore in FY23. Its ROCE and EBITDA margin were registered at -17.6% and 39.37% in FY23. The company spent Rs 0.98 to earn a rupee of operating revenue.