Quick commerce aka 10 minute delivery platform Zepto has become the newest and first unicorn of 2023 as the Mumbai-based startup scooped up $200 million in its Series E round. The round was led by venture capital firm StepStone with participation from Goodwater and existing backers including Nexus Ventures, Glade Brook, and Lachy Groom.

“There is no secondary component in this round,” said Aadit Palicha, Zepto’s co-founder and chief executive to Entrackr.

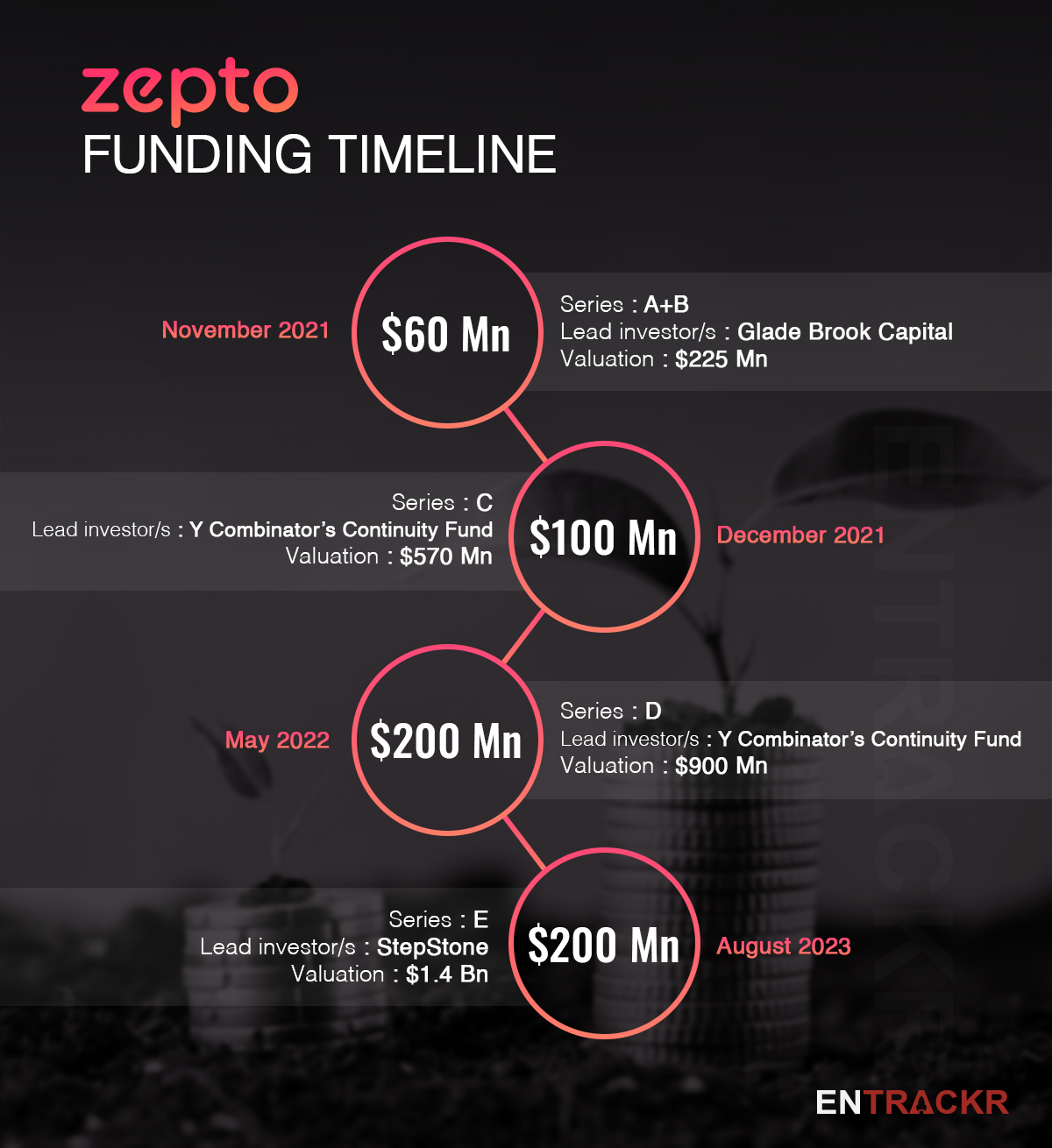

With this, Zepto has raised over $560 million to date and its valuation has soared to $1.4 billion from $900 million when it raked in $200 million Series D in May last year. Molbio was the last unicorn of India which gained the status in September 2022. While Zepto may not be the fastest to cross the $1 billion valuation mark, it took only 21 months to complete its journey from Series A to Series E stage startup.

“We will deepen our presence in existing cities rather than spreading wings to new cities,” added Palicha.

Zepto claims to provide quick delivery of 6,000 products across groceries, fruits, and vegetables in seven cities including Delhi NCR, Mumbai, Bengaluru, Kolkata, Hyderabad, Pune and Chennai. Mumbai, Bengaluru and NCR are its top three markets in terms of sales, as per Palicha.

As of Series D round, Nexus Ventures was the largest stakeholder in Zepto with 20.07% holding while Palicha and Kaivalya Vohra (along with their relatives) collectively owned nearly 28%. With its $200 million round, the company is likely to dilute around 14% from its existing captable, as per Fintrackr’s estimates.

“We closed FY23 with a 10-fold jump in revenue in the last fiscal (FY23) with an improvement in EBITDA. Our current monthly average revenue run rate is around Rs 400 crore and our growth numbers will see a similar curve in FY24,” added Paslicha.

While the company is yet to report its FY23 financial numbers, Zepto posted Rs 142.36 crore revenue in FY22 with losses of Rs 390 crore.

Zepto’s unicorn round will intensify competition in the quick commerce space as Swiggy Instamart and Zomato-owned BlinkIt have deep pockets as well. In terms of scale, Swiggy leads the pack with Rs 2,036 crore sales of grocery and FMCG products through Instamart in FY22 whereas Zomato collected Rs 806 crore revenue via Blinkit during FY23 and Rs 385 crore in Q1 FY24. Swiggy is yet to file FY23 numbers.

Dunzo, one of Zepto’s competitors, is trying hard for survival amid funding crunch. The Reliance and Google-backed company has already fired over 400 employees across three phases in 2023 and delayed salaries of several employees. Media reports also suggest that the firm may face a valuation mark down by 50% in case it manages to raise the next round. Dunzo registered only Rs 54 crore revenue in FY22 against Rs 464 crore loss. The firm has not filed audited financials for FY23.