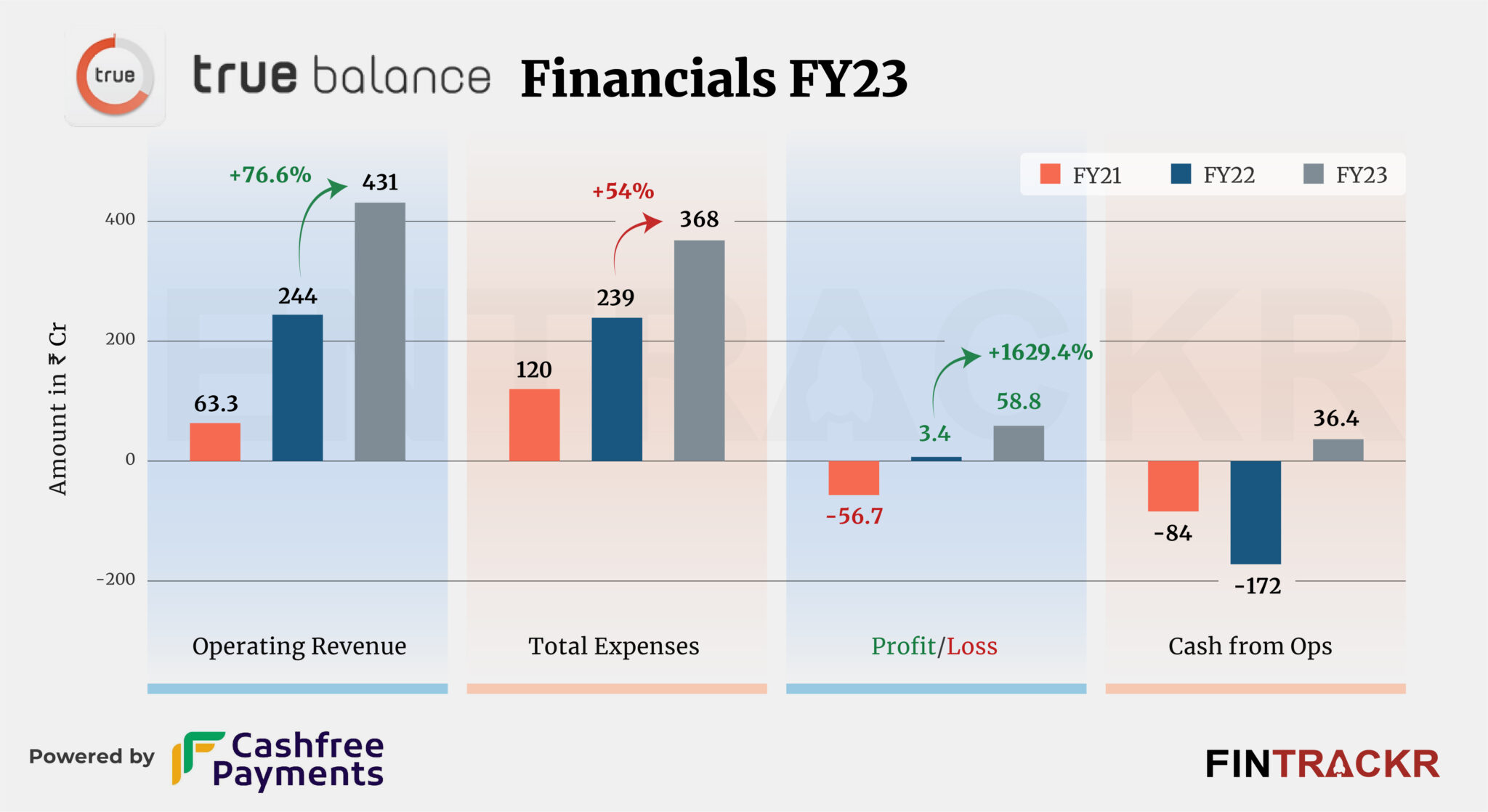

SoftBank-backed digital payments and lending firm True Balance has continued its growth story with a 76.6% rise in collection and a stupendous 17X surge in profit during the fiscal year ending March 2023.

Their revenue from operations grew to Rs 431 crore in FY23 from Rs 244 crore, according to the firm’s consolidated annual financial statements sourced from the Registrar of Companies.

Launched in 2014 by Korean entrepreneur Cheol-won (Charlie) Lee, True Balance is largely a cash loan financing app which offers loans up to Rs 1,00,000 with its registered NBFC True Credits Pvt Ltd.

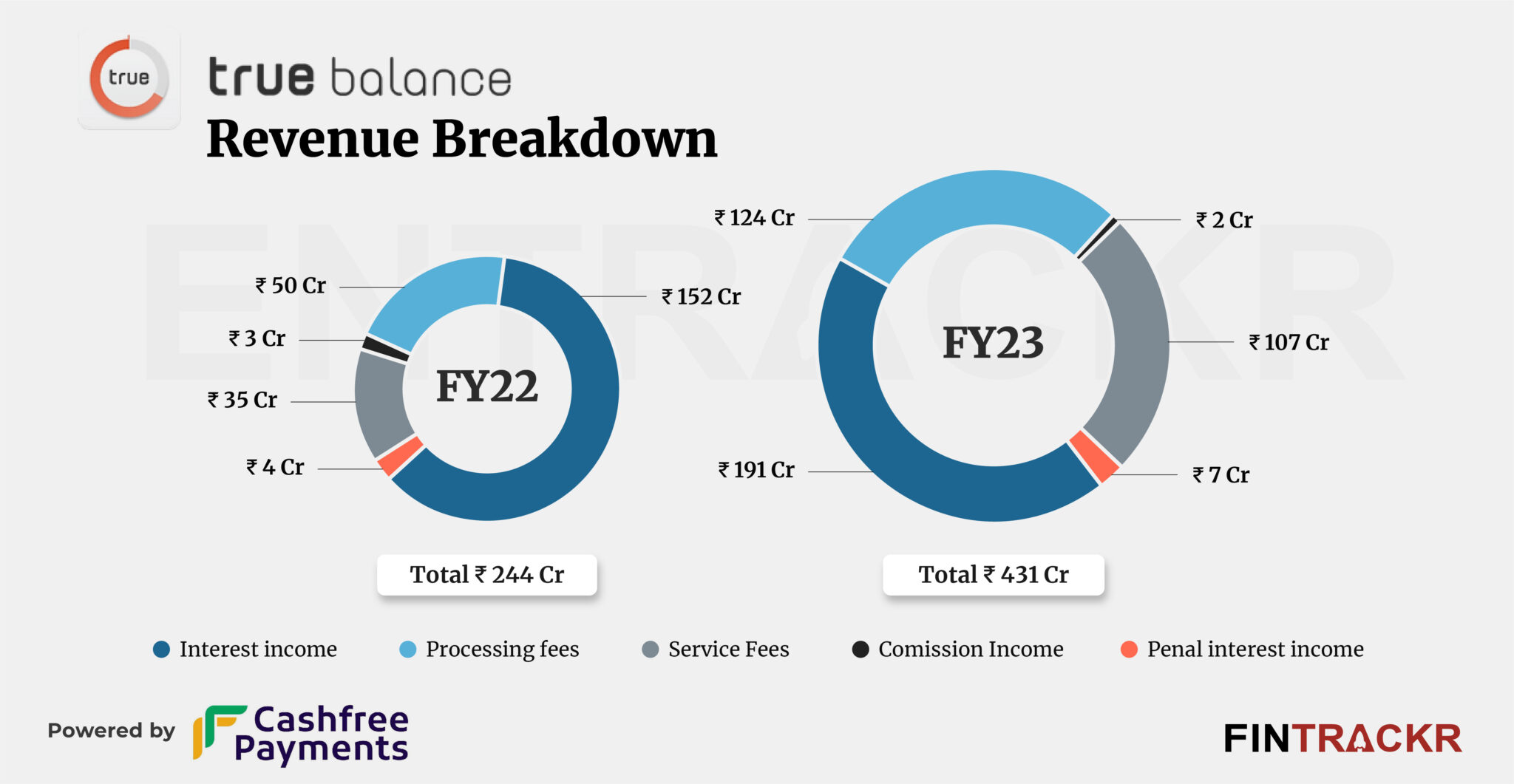

Interest income made up 44.3% of True Balance’s collection and grew 25.7% to Rs 191 crore in FY23. The Gurugram-based company charges 10-15% processing fees on the cash loan disbursement and this income soared 2.48X to Rs 124 crore.

Besides these income streams, service, commission, and interest income collectively pushed the company’s total operating revenue to Rs 431 crore in FY23.

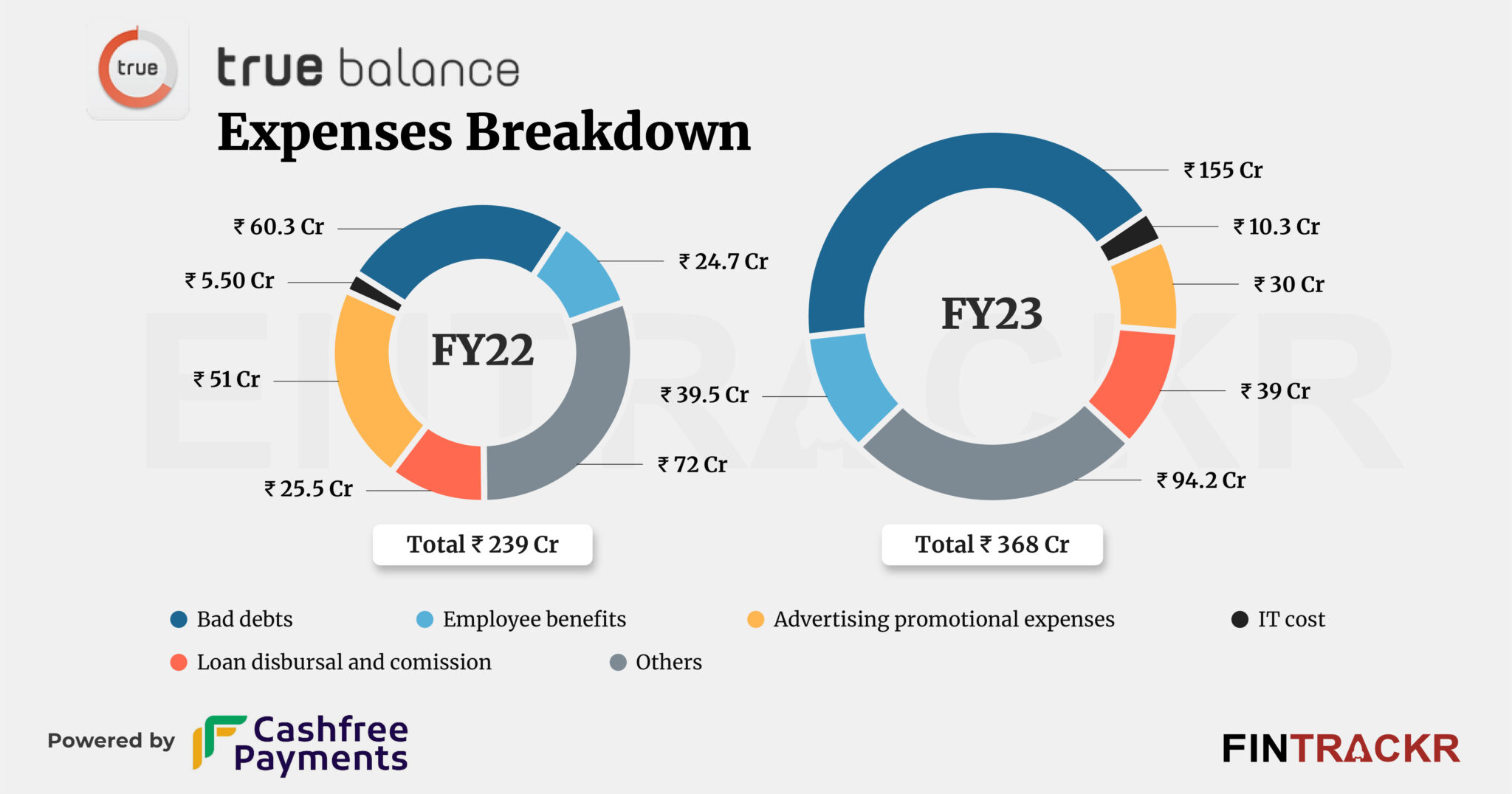

Akin to other NBFCs, bad debts formed a significant chunk of the overall cost: 42.1% in the case of True Balance, which blew 2.57X to Rs 155 crore in FY23. Its employee benefit cost increased 60% to Rs 39.5 crore.

True Balance’s loan disbursement/commission and information technology cost increased by 52.9% and 87.3% to Rs 39 crore and Rs 10.3 crore respectively. The firm also incurred Rs 30 crore towards advertising. In the end, its overall cost surged by 54% to Rs 368 crore in FY23.

Sizable growth in scale and reduction of cash burn helped True Balance book a 17X jump in profits to Rs 58.8 crore in FY23 from Rs 3.4 crore in FY22. Its ROCE and EBITDA margin stood at 32.28% and 22.56%. On a unit level, the firm spent Re 0.85 to earn a unit of operating revenue.

While True Balance’s numbers might indicate that usury is an official business in India, the limit to Rs 100,000 makes it clear this is yet another fintech that has managed to service a segment that banks have failed. Once again. While one would hardly blame the entrepreneur in this case for spotting and taking advantage of a legal opportunity, it is certainly an indictment of a banking system that continues to let down those at the bottom, despite tall claims to the contrary from the government as well as the banks themselves

The high processing charges are a consequence of the small ticket size and the need to maintain a semblance of normalcy on the interest charges no doubt, but there is no doubt that True Balance’s healthy financials have laid bare the true picture of credit access in India.