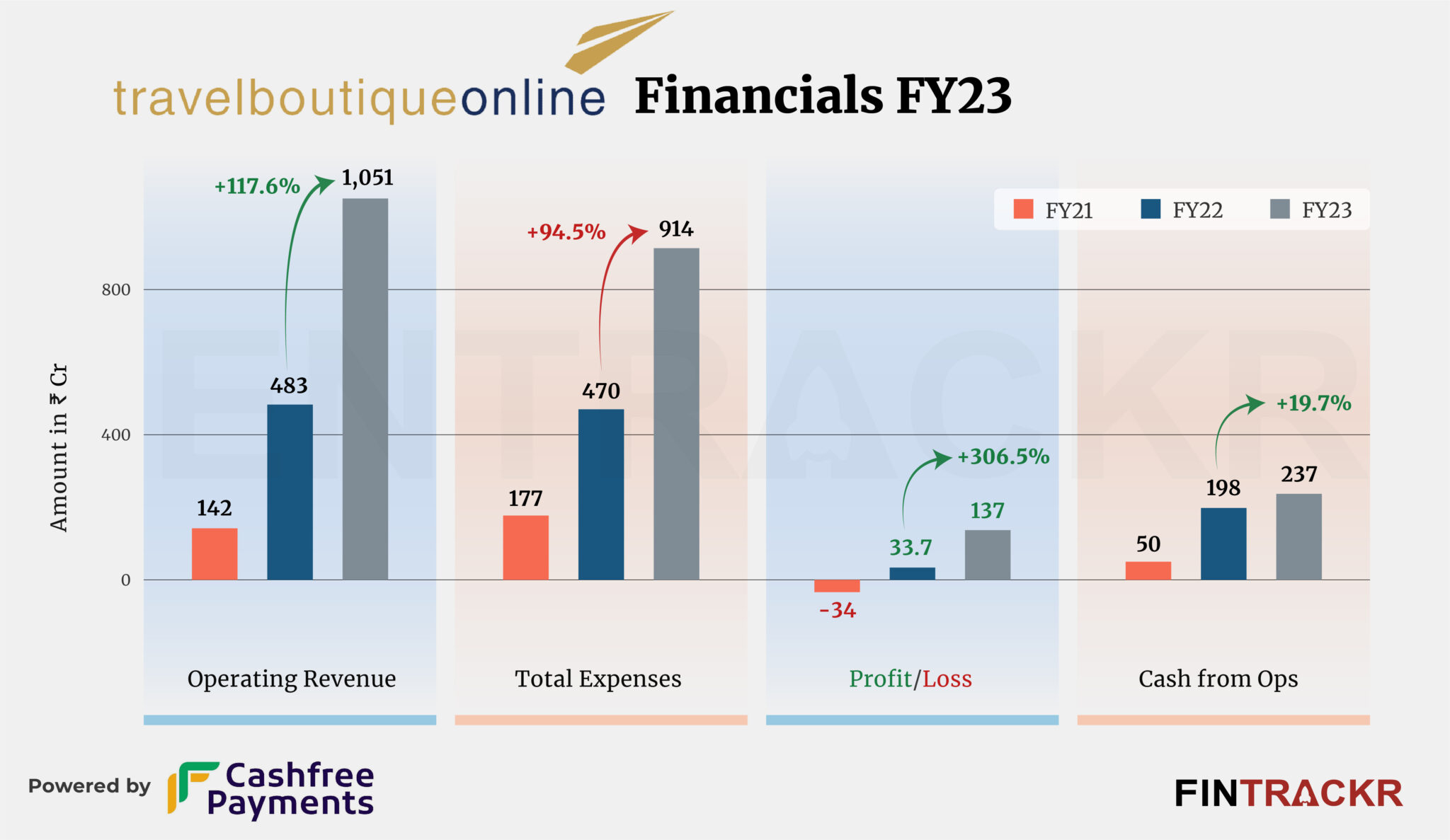

Online B2B travel distribution platform Travel Boutique has grown over two-fold during the last fiscal year ending March 2023. The stellar growth helped the Gurugram-based company register a 4X jump in profits during the same period.

Travel Boutique’s revenue from operations spiked 2.17X to Rs 1,051 crore in FY23, according to its consolidated financial statements filed with the Registrar of Companies.

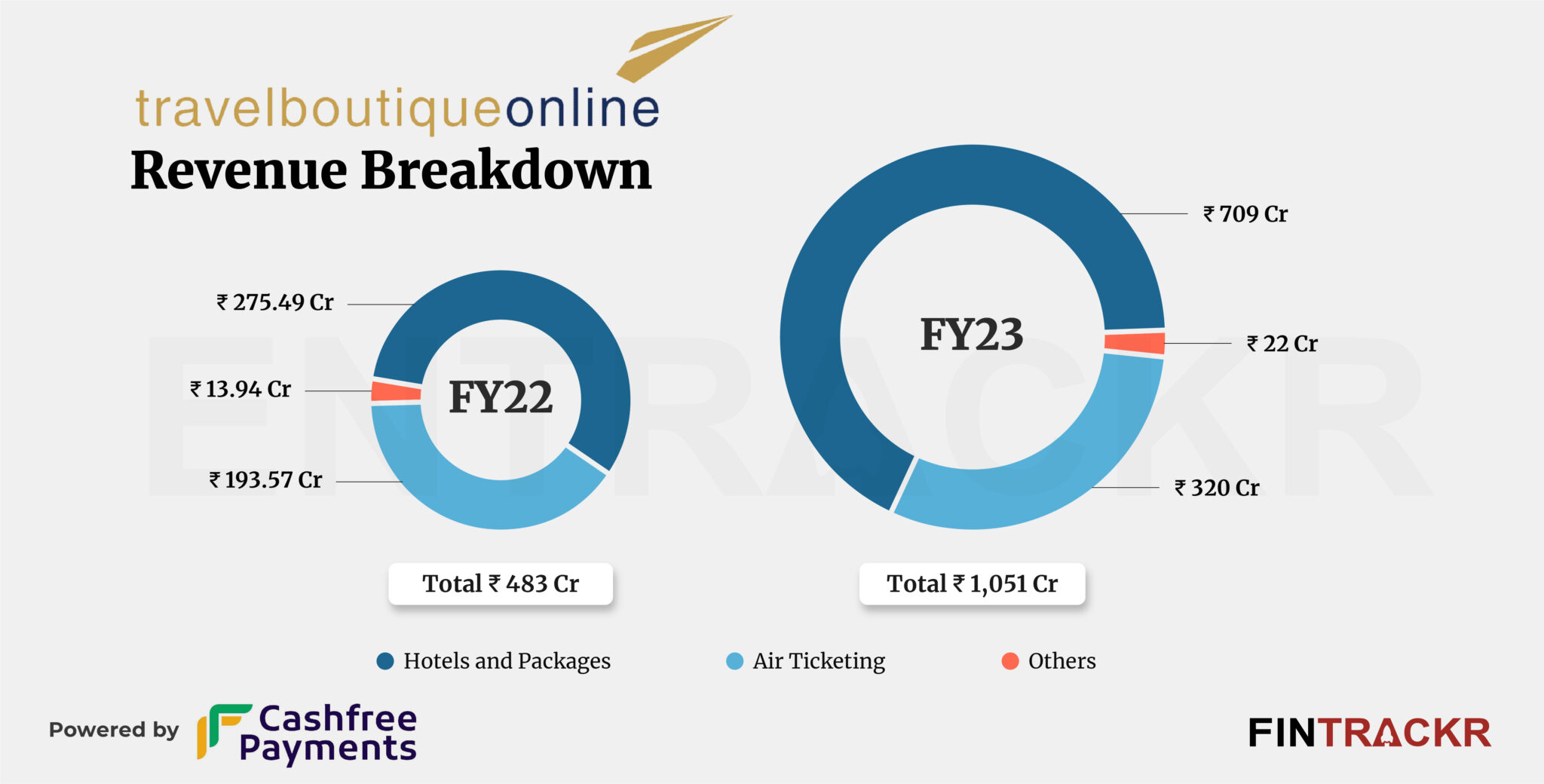

Travel Boutique is a travel distribution platform, extending white-label solutions to travel agents and tour operators. By facilitating air travel, hotel bookings, and tour packages, the platform makes money on commissions on these services.

The commission from hotels and packages formed a significant 67.5% of the operating revenue which surged 2.57X to Rs 709 crore during FY23. Commission from air ticketing contributed 30.4% of the total collections which grew 65% to Rs 320 crore in FY23.

The firm also charged annual maintenance fees from its customers and income from this service increased 57.8% to Rs 22 crore in FY23.

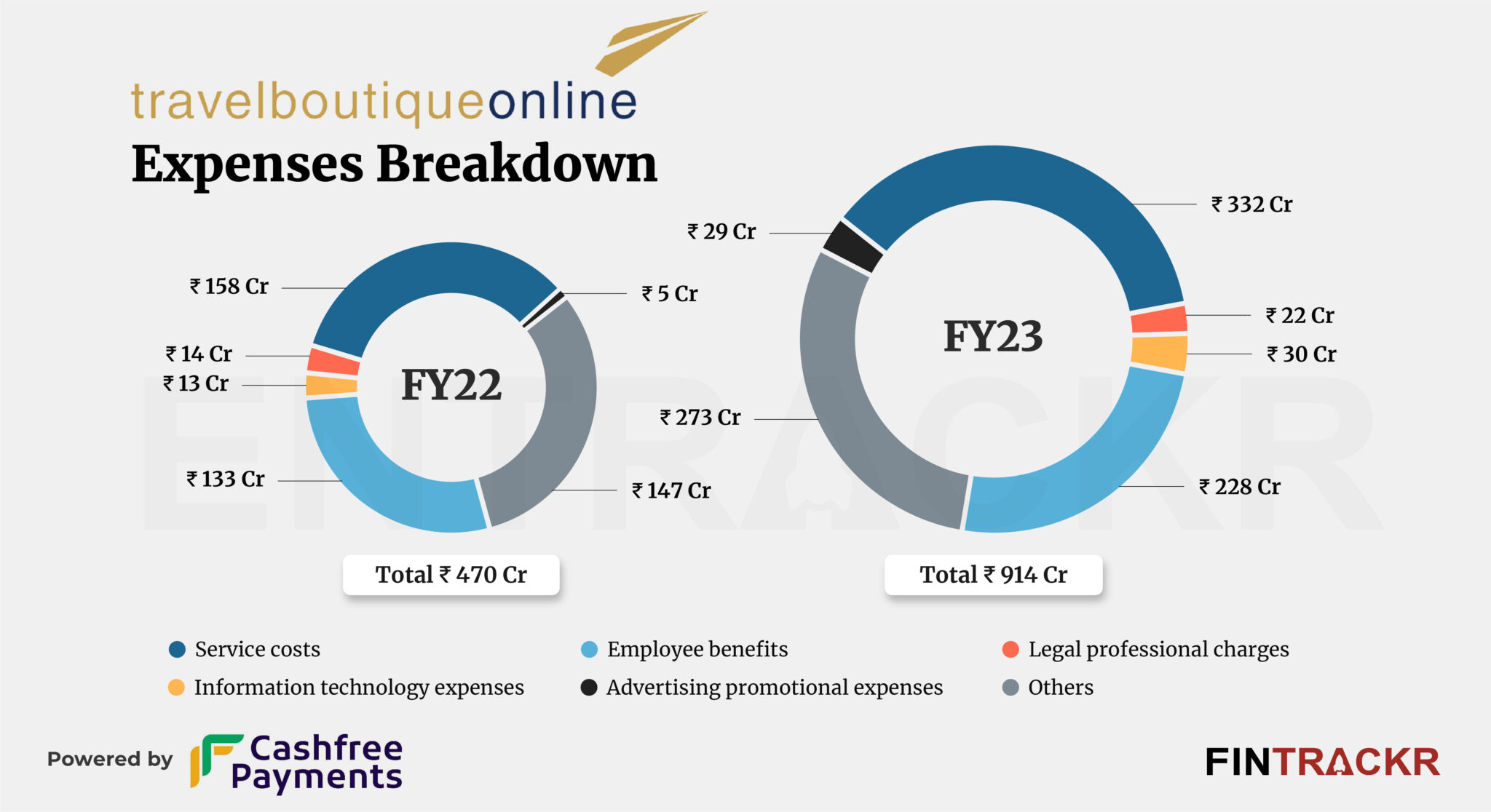

The cost of providing services for air ticketing, hotel, and packages accounted for 36% of the company’s overall expenses. In line with scale, this cost expanded 2.1X to Rs 332 crore during FY23.

To keep up with growth, Travel Boutique hired aggressively during the last fiscal year. This is evident through its employee benefit cost which grew by 71% to Rs 228 crore in FY23. Significantly, its information technology and advertising costs shot up 2.3X and 5.8X to Rs 30 crore and Rs 29 crore respectively in FY23.

The company further spent Rs 22 crore on legal and professional fees during the last fiscal which took its overall expenditure by 94.5% to Rs 914 crore in the same period.

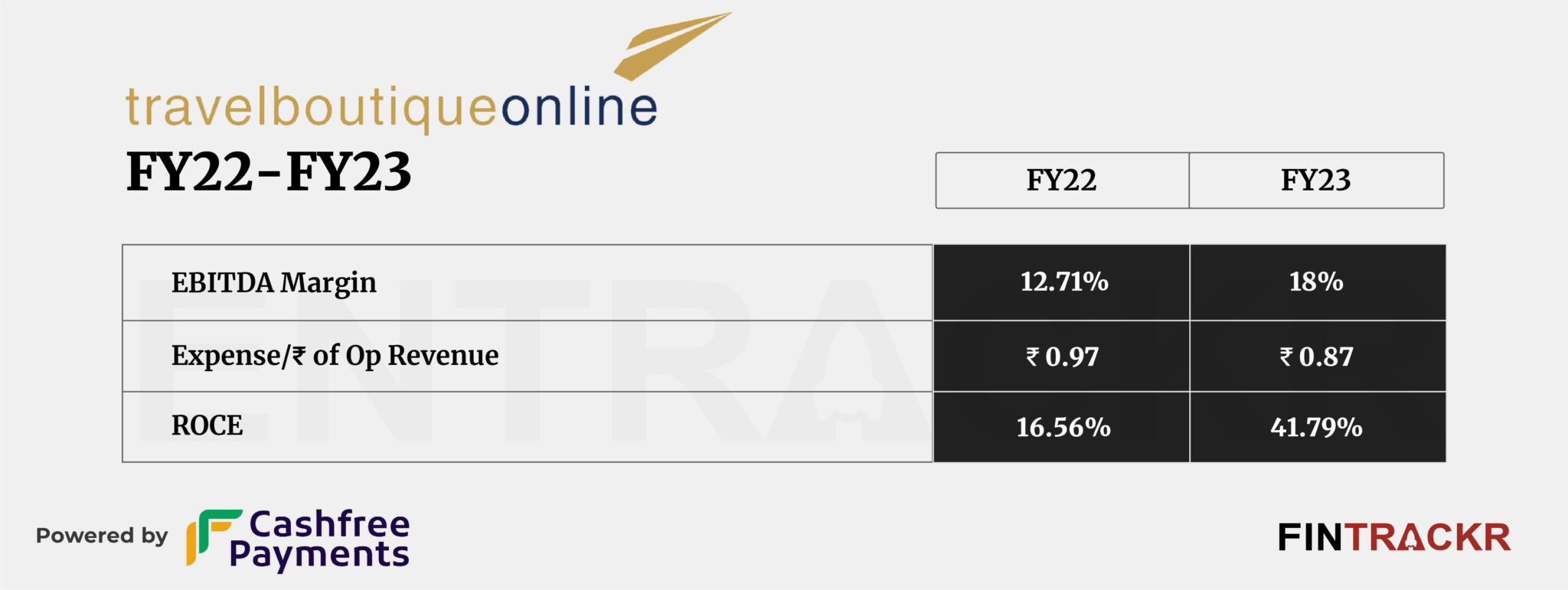

Growing scale and control over expenditure helped Travel Boutique to register a 4X jump in profits to Rs 137 crore in FY23 from Rs 33.7 crore in FY22. Its ROCE and EBITDA margin also improved to 41.79% and 18%, respectively. On a unit level, Travel Boutique spent Rs 0.87 to earn a rupee of operating revenue in the previous fiscal year.

Scale and profits. To achieve both in an intensely competitive vertical like travel takes some doing, and Travel Boutique’s FY23 numbers are more than credible. Interestingly, these numbers in a category that has its share of large firms should make it a candidate for an acquisition, or even an IPO soon. Let’s wait and see which destination beckons Travel Boutique first.