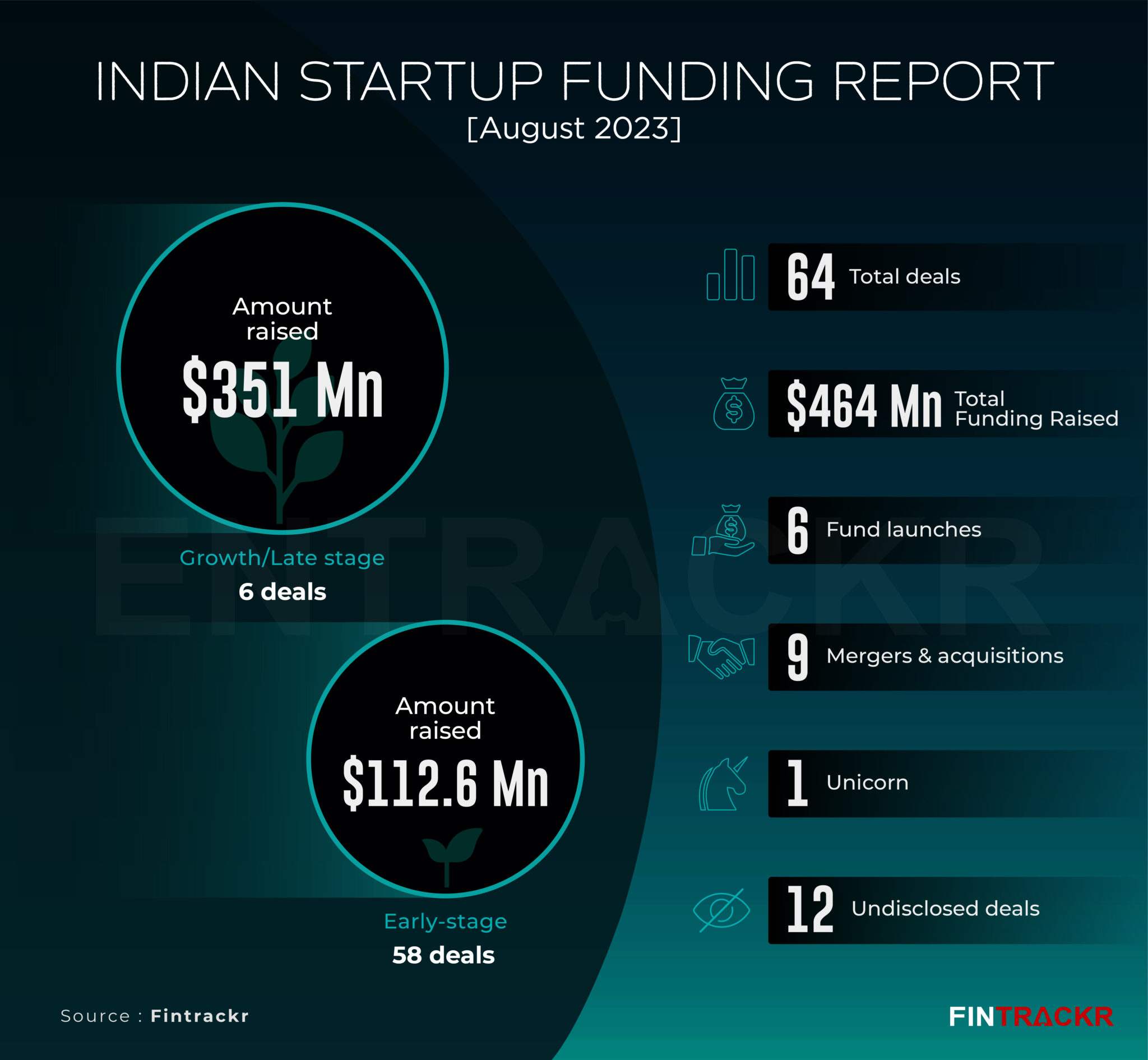

August was a month which produced one unicorn, had three shutdowns and more than a dozen layoffs.

India saw its first unicorn of 2023 in August after a gap of 11 months when quick commerce platform Zepto raked in $200 million in its Series E round to enter the $1 billion valuation club. However, the overall fund inflow remained below the $500 million mark in the last month despite the single round of $200 million.

Data compiled by Fintrackr shows that 64 startups announced their fundraise worth $464 million in August. This included 6 growth and late stage deals worth $351 million and 58 early stage deals worth $112 million. Early stage deals also count 12 undisclosed rounds.

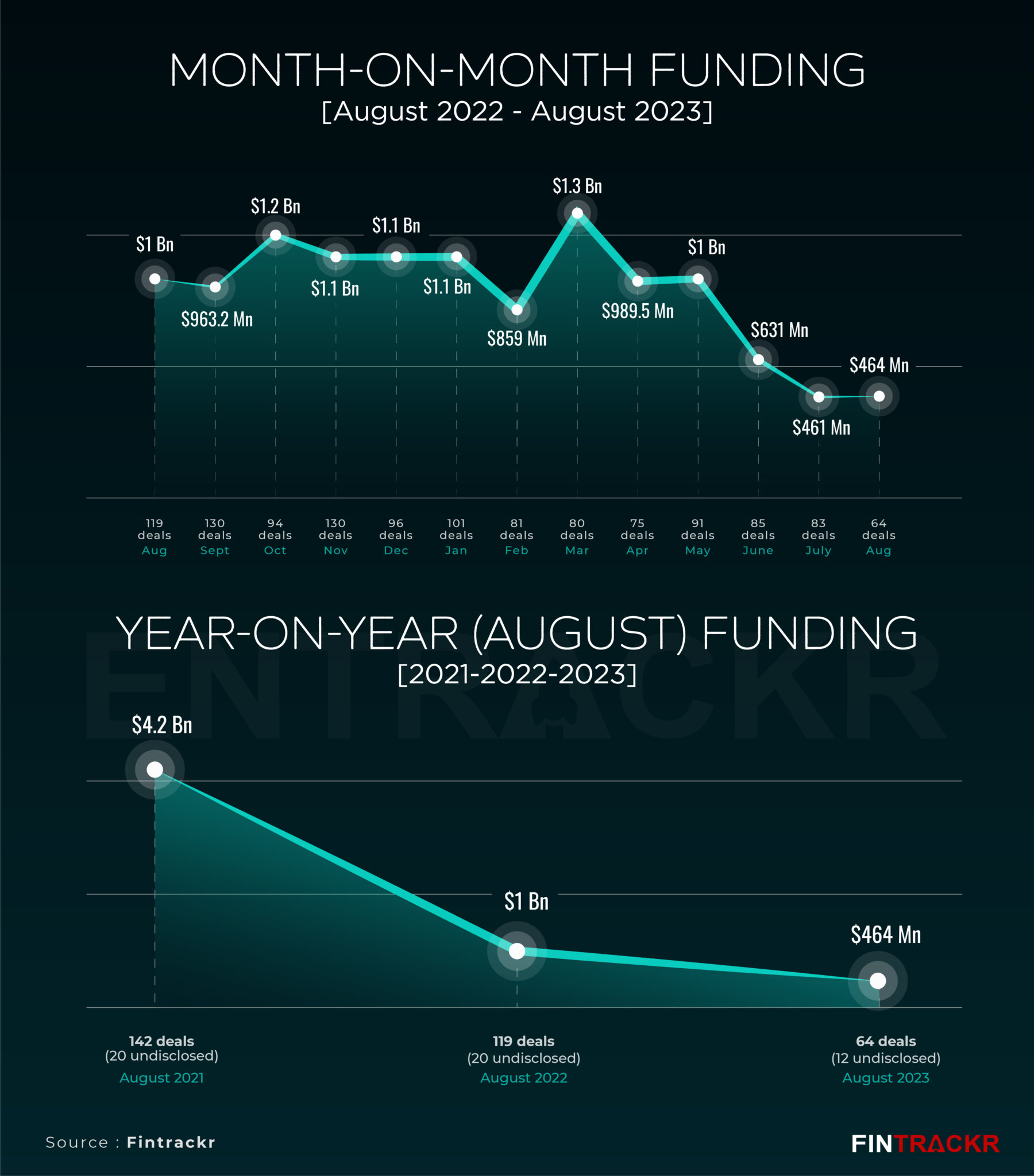

[Month-on-month and year-on-year trend]

This is a negligible jump in amount when 80 startups raised around $461 million in July. This year, the decline started in June when fund inflow fell from $1 billion to $631 million. This is the second time startups saw funding less than $500 million in a month since January 2021.

If we go by year on year trend, August 2021 saw $4.5 billion in funding and went down to $1 billion in August 2022 which further declined to $464 million this year.

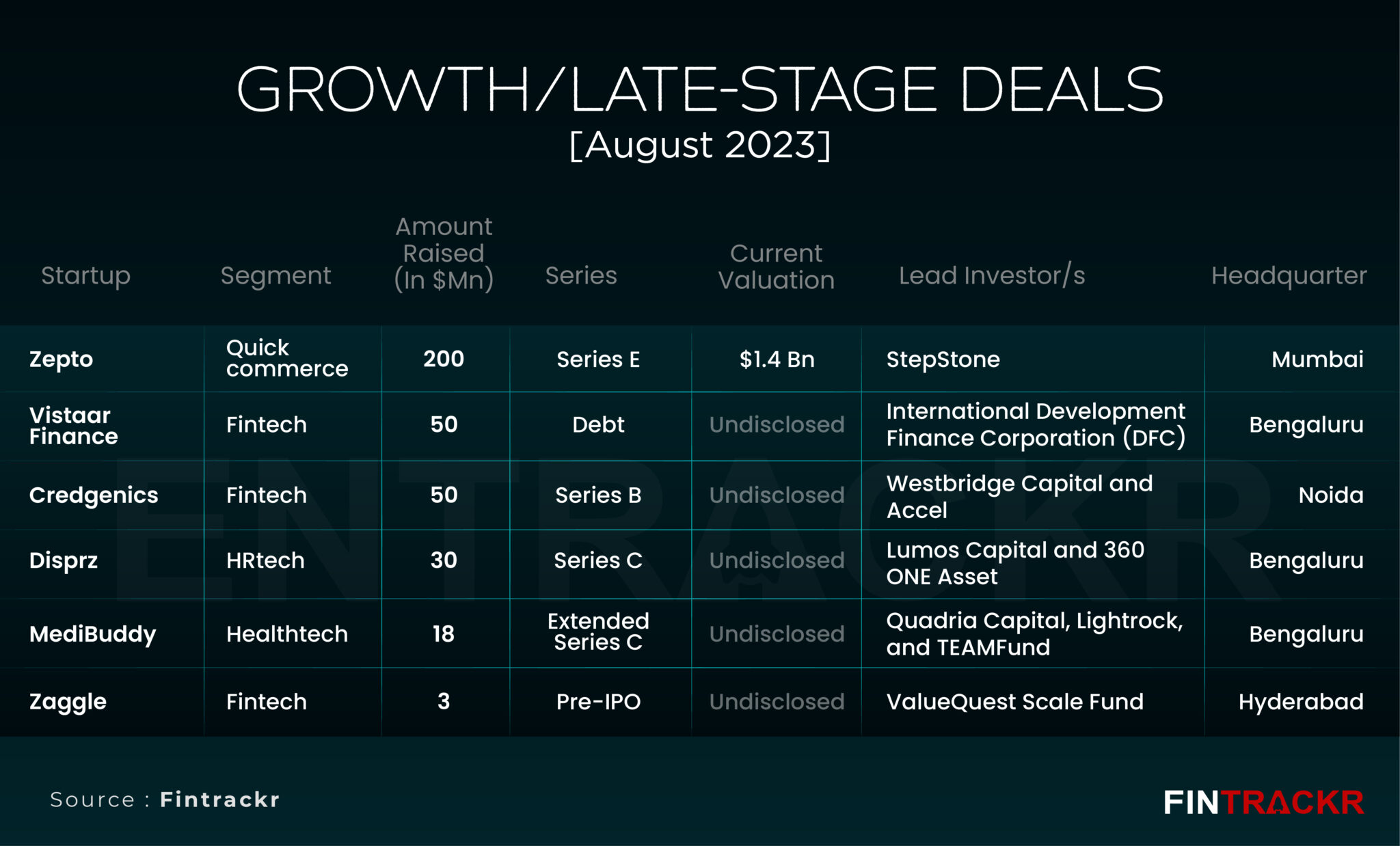

[Top growth stage deals]

After a long time, we see less than 10 deals in growth or late stage startups. Zepto was on top followed by two fintech companies Vistaar Finance and Credgenics which raised $50 million each. HRtech company Disprz, healthcare company MediBuddy and fintech startup Zaggle raised $30 million, $18 million and $3 million respectively.

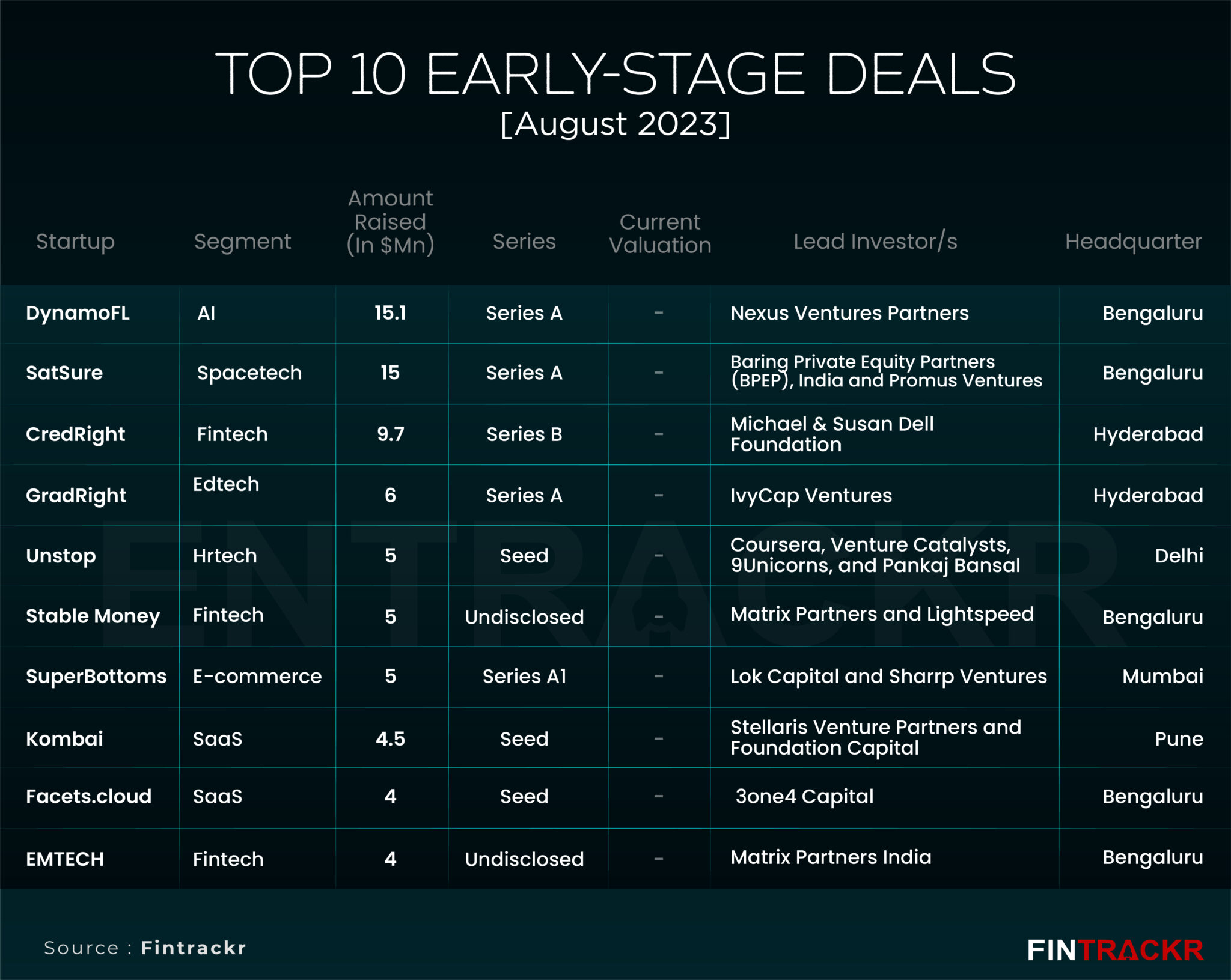

[Top 10 early stage deals]

Early stage deals were led by Bengaluru and San Francisco-based AI startup DynamoFL which raised $15.1 million. Spacetech startup SatSure was next on the list with $15 million in funding followed by fintech platform CredRight, edtech company GradRight and HRtech startup Unstop with $9.7 million, $6 million and $5 million in funding respectively.

Fintech startup StableMoney and e-commerce platform SuperBottoms also managed to raise $5 million each whereas Facets.cloud, Kombai and EMTECH made it to the top 10 list.

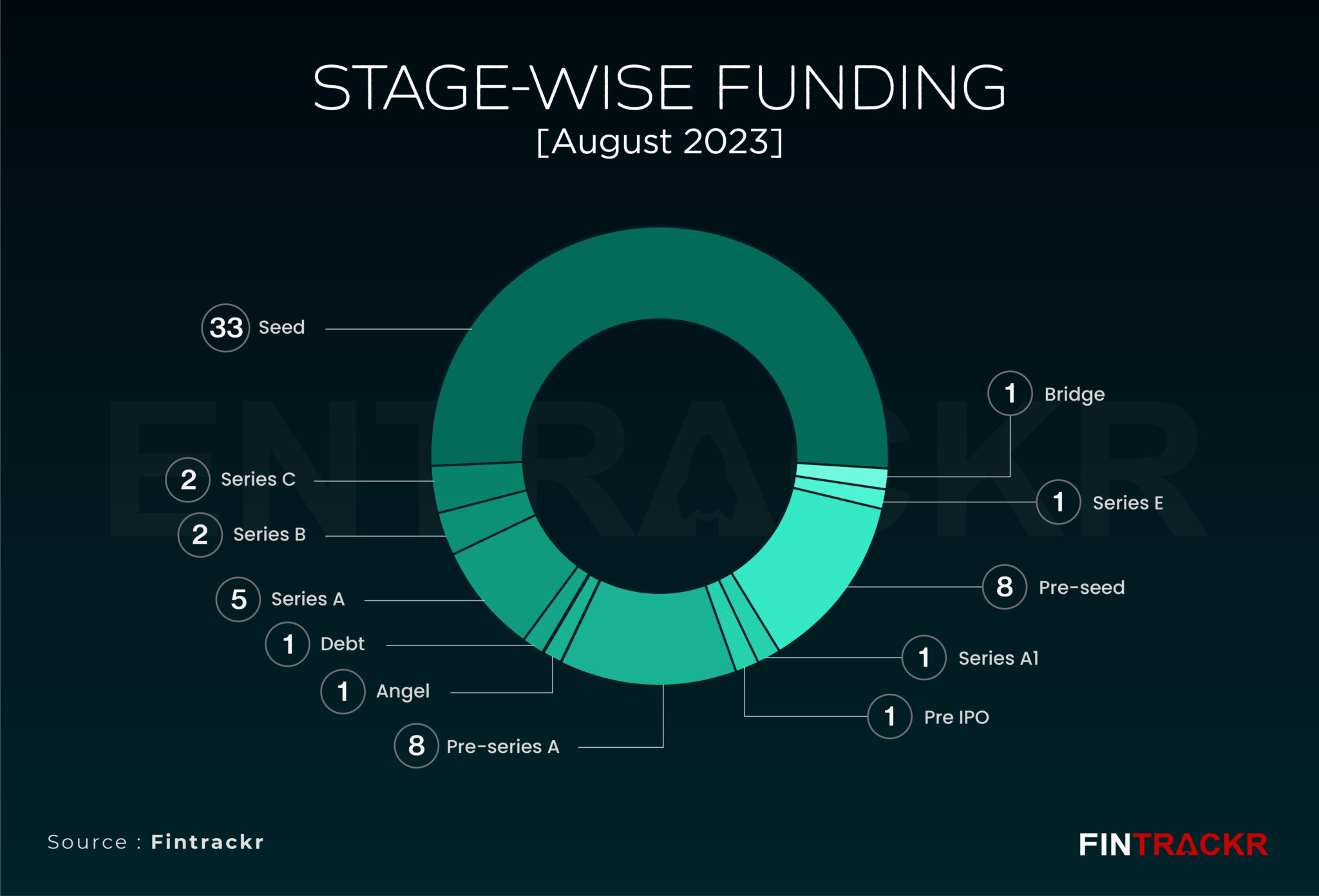

[Stage wise deals]

Seed and pre seed stage startups expectedly dominated the chart with 33 and 8 deals respectively. This was followed by 8 pre Series A and 5 Series A deals. In the growth stage, Series B and Series C saw a couple of deals each while there were no Series D stage deals in the last month. In the late stage, Series E saw one deal in the form of Zepto and a pre IPO in the form of Zaggle.

The complete breakdown can be seen in the chart:

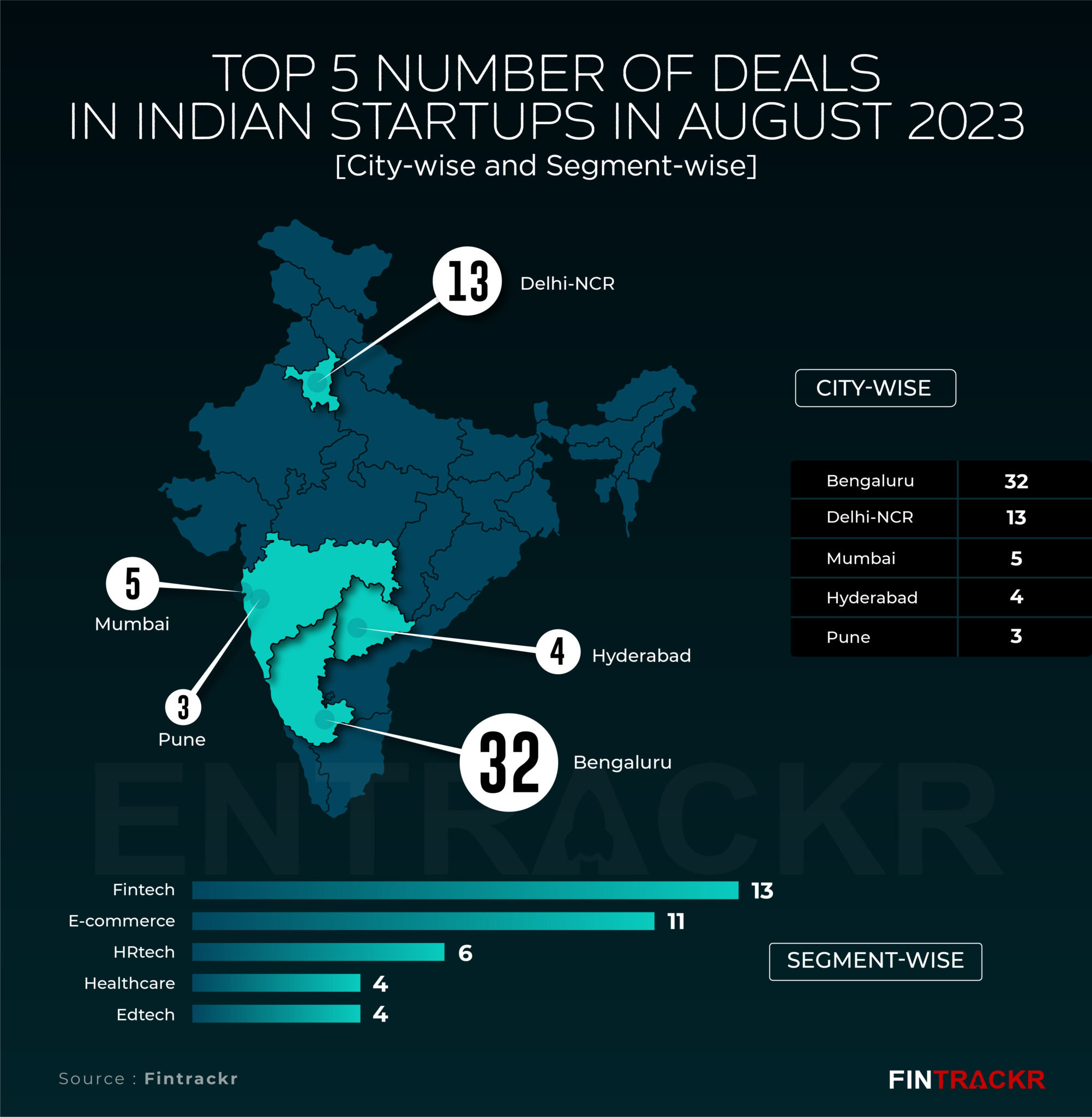

[City and segment]

In terms of city wise deals, Bengaluru remained on top with 32 deals worth around $160 million. This is close to 35% of the total funding during the last month. Delhi-NCR-based startups were the next with 13 deals amounting to $64 million. Mumbai saw only 5 deals but was on top in terms of the amount raised, thanks to Zepto. Hyderabad, Pune and Jaipur were next.

This time fintech startups dominated in terms of segment wise deals followed by e-commerce, HRtech, logistics and Healthcare. Interestingly, SaaS, EV and edtech did not manage to get in the top 5 list. Deals in agritech again saw a decline as only one startup in the space raised funds which was undisclosed.

[Mergers and acquisitions]

In August, Indian startups saw nine mergers and acquisitions deals, a fall from 13 deals in the previous month. While most deals were undisclosed, Microfinance institution Svatantra Microfin Private Limited entered an agreement to acquire Sachin Bansal-led Navi Group’s subsidiary Chaitanya India Fin Credit Private Limited for about $178 million.

E-commerce-focused logistics startup XpressBees acquired two-decade-old logistics and supply chain firm Trackon for an undisclosed amount. Besides acquisitions, Jungle Ventures merged with HealthXCapital and Holidify merged with TripCrafters.

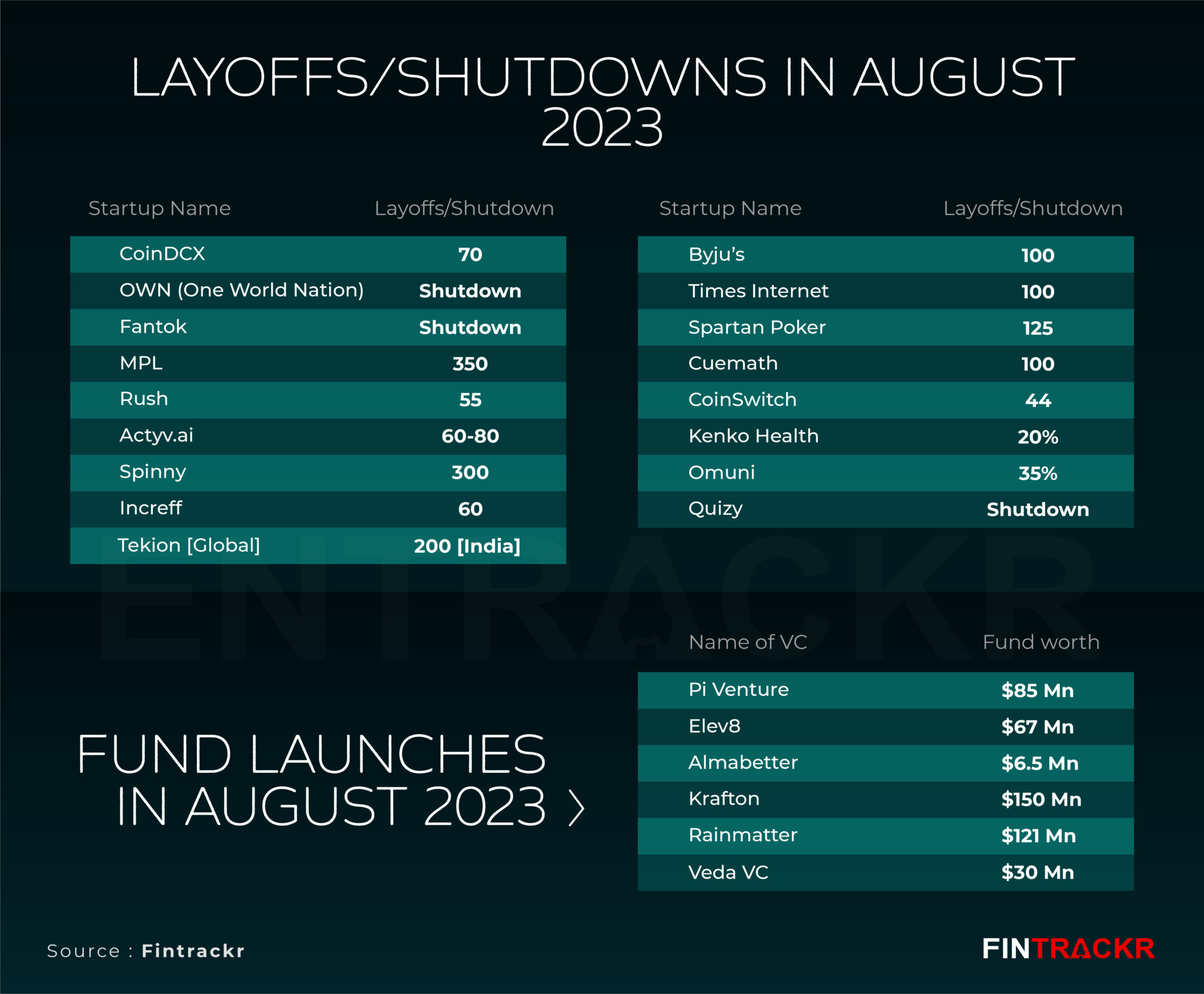

[Layoffs and shutdowns]

Shedding employees has become inevitable in the current scenario and this can be gauged from last month’s trend where more than 1,700 employees got laid off. This is a two fold jump in layoffs when compared to the previous month (July). MPL and Spinny were on top with laying off 350 and 300 employees respectively. In fact, real money gaming focused startups are facing a tough situation amid the government’s decision to impose 28% GST on such platforms. Besides MPL, Spartan Poker also fired employees while OWN, Fantok and Quizzy announced their shutdown.

Notably, Byju’s, CoinSwitch and Cuemath saw another round of layoffs or transition of employees during last month. Keep in mind that the data does not even begin to capture the slowdown in hiring, or the quieter layoffs that fly below the radar.

[Conclusion]

As predicted, the mood, and imperative for the sector remains one of conservation, of both cash and big bets. For founders, this is the time to double down on what has worked for them in the market, and take a tough call on what hasn’t. By all accounts, the funding wave is not returning until well into 2024. We can link it to any number of events, from a return to wider growth globally, to the general elections in India, or a change in sentiments, but counting on your next round where 4-5 rounds of funding haven’t brought market acceptance could be very tough for founders.