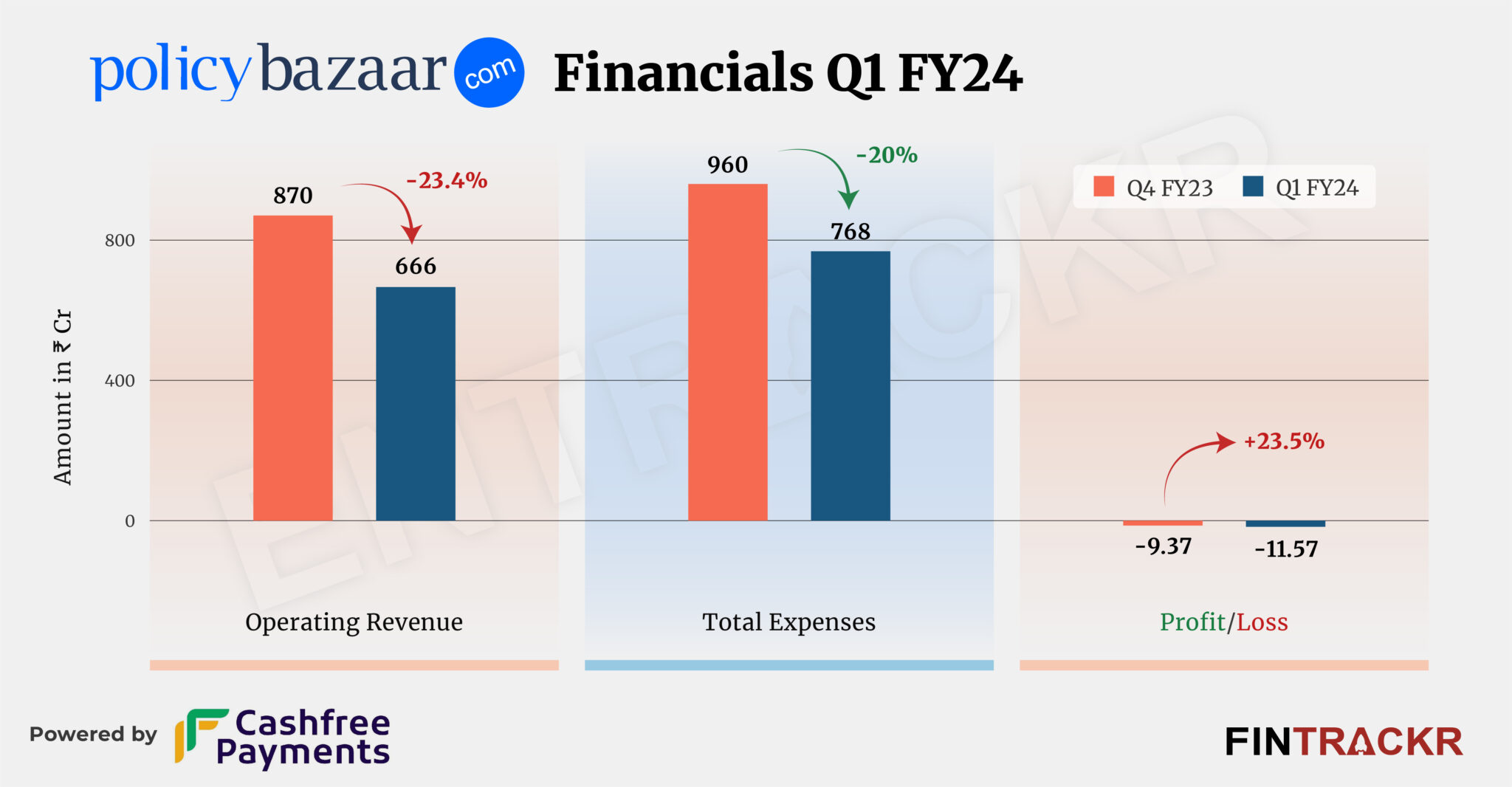

PB Fintech, the parent of Policybazaar and Paisabazaar, saw its scale decline by 23.4% to Rs 666 crore in Q1 FY24 ending June 2023 as compared to Rs 870 crore during the quarter ended March 2023 or Q4 FY23.

Importantly, the losses for the company surged 23.5% quarter-on-quarter to Rs 11.57 crore in the Q1 FY24 from Rs 9.37 crore in Q4 FY23, according to the consolidated financial statements accessed through National Stock Exchange filings.

Insurance broking formed 84% of the collections which increased 14.2% to Rs 506 crore during Q1 FY24. While the income from other operating activities, which include marketing, advertising, consulting and support services, plunged 62.5% to Rs 159.2 crore in the same period.

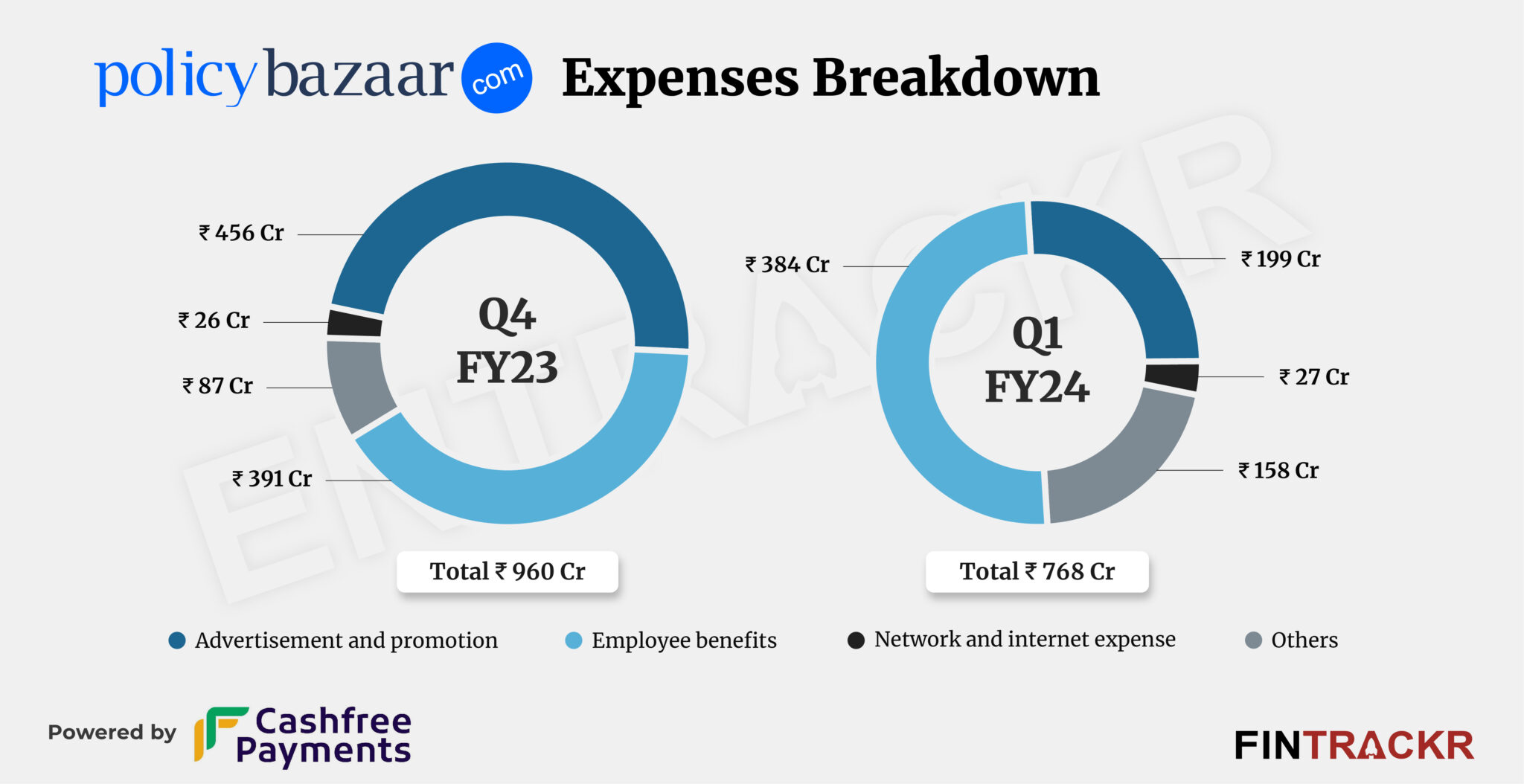

On the cost side, employee benefits accounted for 50% of the overall cost which remained flat at Rs 384 crore in the Q1 FY24 when compared to Q4 FY23. Its advertisement cost dwindled 56.4% to Rs 199 crore in Q1 FY24 from Rs 456 crore in Q4 FY23.

The company added another Rs 27 crore towards Network and internet expense which pushed its overall expenditure to Rs 768 crore in the quarter ending June 2023, where figures for the same stood at Rs 960 in Q4 FY23.

The company spent Rs 1.15 to earn a unit of operating revenue.

However, on a year-on-year basis, Policybazaar has registered a 32% jump in its operating revenue to Rs 666 crore in Q1 FY24 and also saw its losses reduce by more than 90% to Rs 11.9 crore during the period.

Policybazaar was anticipated to have improved top and bottom lines as the company recently granted new options to their employees under their existing plans. As per Fintrackr’s estimates, the value of new options issued by the company stood at around Rs 40 crore.

During FY23, PolicyBazaar’s revenue from operations surged 79.5% to Rs 2,558 crore as compared to Rs 1,425 crore in FY22. The firm also managed to control its losses by 41.4% to Rs 488 crore in FY23 against Rs 833 crore in FY22.

A bunch of startups that listed in the past couple of years have also been able to control losses or improve profitability.

Logistics company Delhivery’s losses shrank over 77% to Rs 89.5 crore during the quarter (Q1 FY24) from Rs 399.3 crore in Q1 of FY23 whereas SoftBank-backed Paytm controlled its losses by 44.5% from Rs 645.4 crore.

During the period, Zomato turned profitable while MapmyIndia and Nazara Technologies saw more than 30% year-on-year (YoY) jump in their net profit.