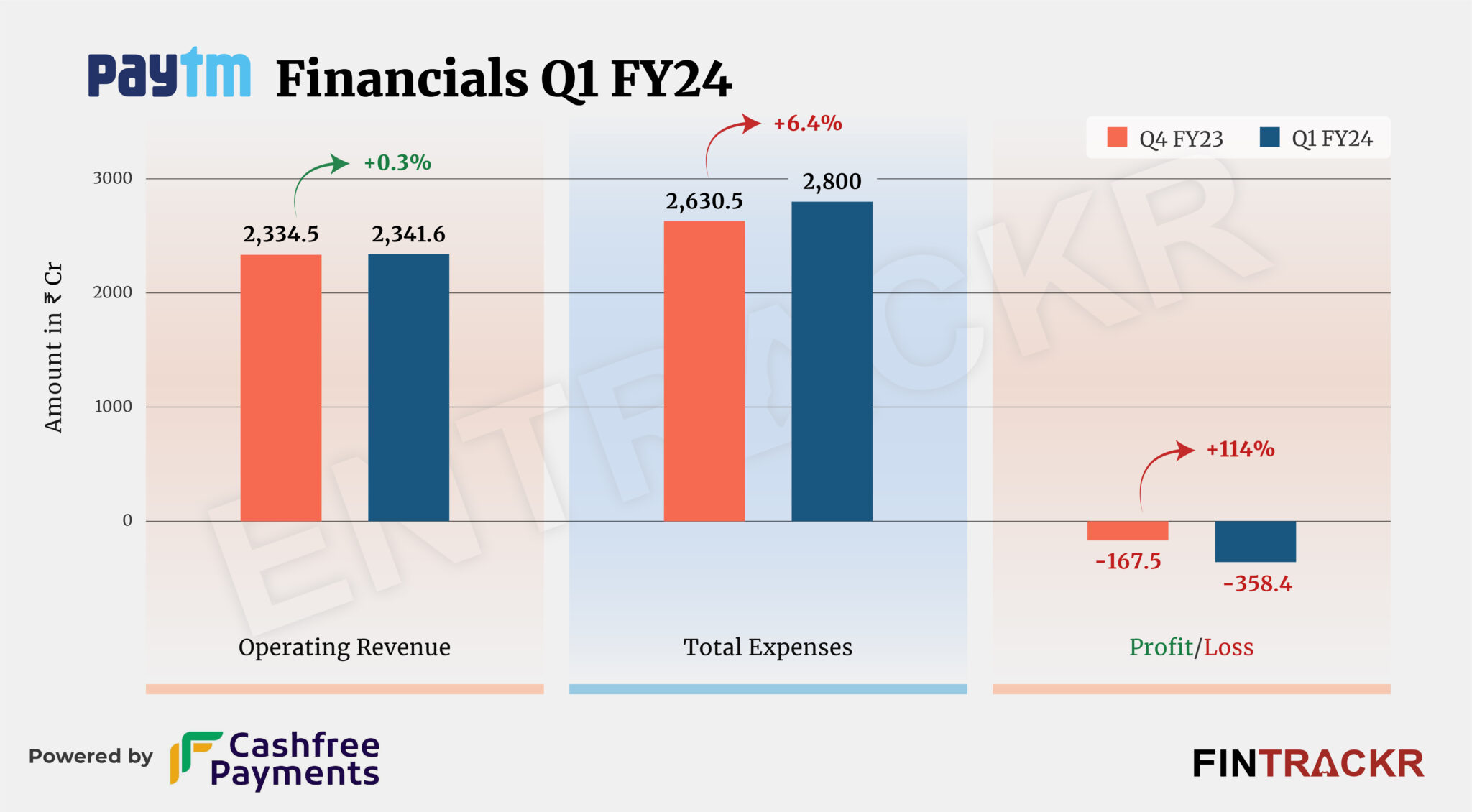

Fintech firm Paytm’s revenue from operations barely grew 0.3% to Rs 2,341.6 crore during the first quarter of fiscal year ending June 2023 (Q1 FY24) as compared to Rs 2,334.5 crore in Q4 of FY23, according to the company’s consolidated quarterly report filed with the National Stock Exchange.

Compared to the corresponding quarter of FY23 (Q1 FY23), Paytm has registered 39.4% growth in scale from Rs 1,679.6 crore.

Revenue from payments business surged 31% YoY to Rs 1,414 crore while GMV (gross merchandise value) inclined 37% YoY to Rs 4.05 lakh crore.

Revenue from financial services (loan distribution biz) and others soared 93% YoY to Rs 522 crore as loan distribution continues to increase with Rs 14,845 crore of loan disbursement, recording 167% YoY growth.

Besides operating revenue, Paytm also earned Rs 122.6 crore during the quarter which took its overall revenue to Rs 2,464.2 crore.

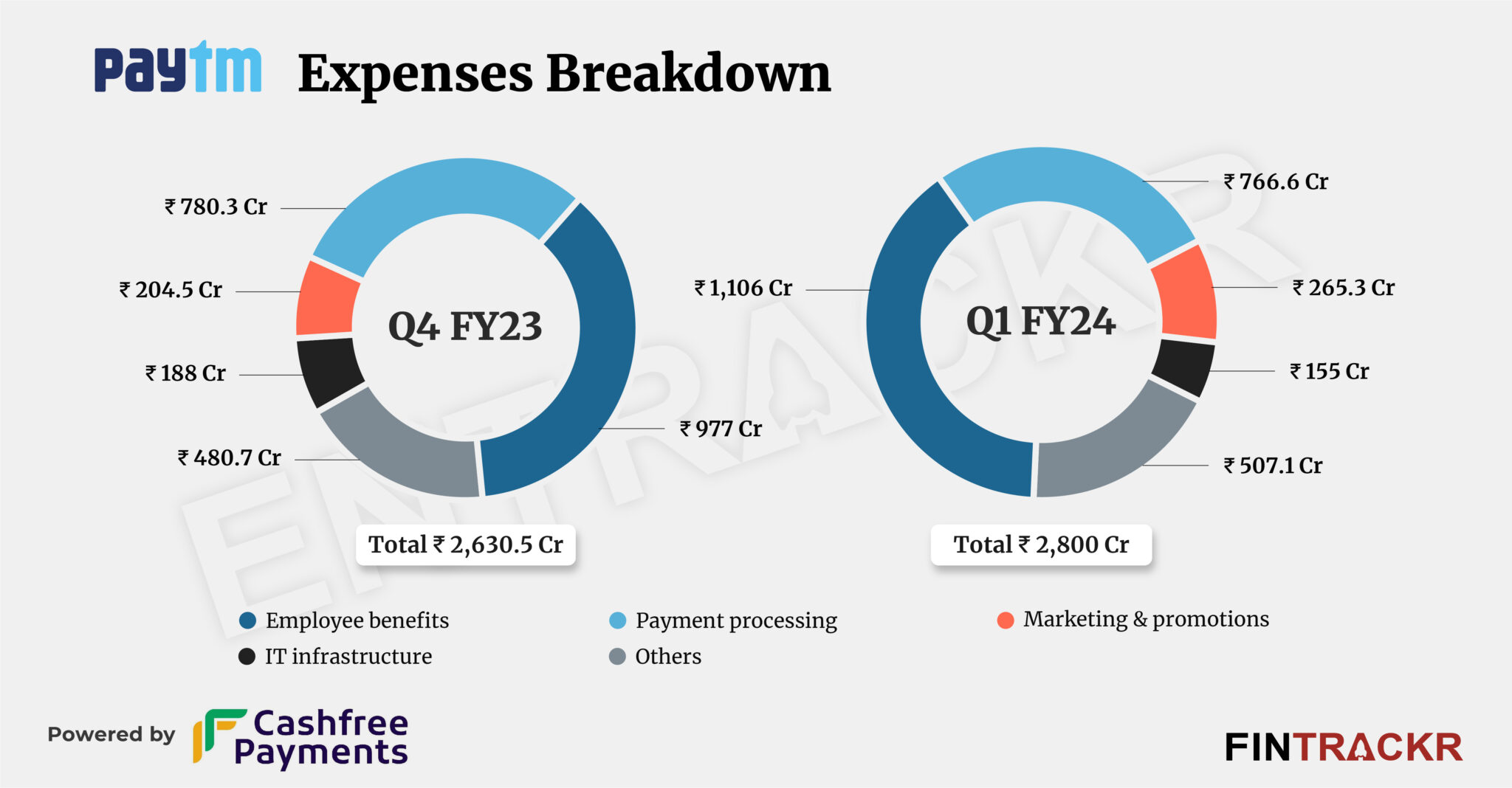

Paytm’s employee benefits costs formed 39.5% to the total expenses during the period. This cost surged 13.2% to Rs 1,106 crore in Q1 of FY24 from Rs 977 crore during the previous quarter (Q4 of FY23).

Payment processing expenses went down 1.76% to Rs 766.6 crore on a quarterly basis from Rs 780.3 crore in the previous quarter.

Spendings on marketing and promotions inclined 29.73% to Rs 265.3 crore during the quarter whereas IT infrastructure (software, cloud and data center) cost shrank 17.55% to Rs 155 crore.

At the end, the company’s total expenses increased only 6.44% to Rs 2,800 crore in Q1 of FY24 in comparison to Rs 2,630.5 crore in Q4 FY23.

A flat topline and increased expenses resulted in a rise in quarterly losses which spiked over 2X to Rs 358.4 crore during the quarter (Q1 of FY24) against Rs 167.5 crore in the previous quarter. However, compared to the corresponding quarter of the previous fiscal year (Q1 FY23), the company’s losses contracted 44.5% from Rs 645.4 crore.

Significantly, Paytm’s EBITDA before ESOPs stood at Rs 84 crore during the quarter from Rs 275 crore in Q1 of FY23. Cash balance of the company also improved to Rs 8,367 crore during the period.

On a unit level, Paytm spent Rs 1.2 to earn a rupee of operating income during the quarter.

On Friday, Paytm also granted new ESOP options to its employees under ‘One 97 Employees Stock Option Scheme 2019’. As per Fintrackr’s estimates, the value of new ESOPs granted stood at around Rs 145 crore, as per the company’s stock prices at the moment.