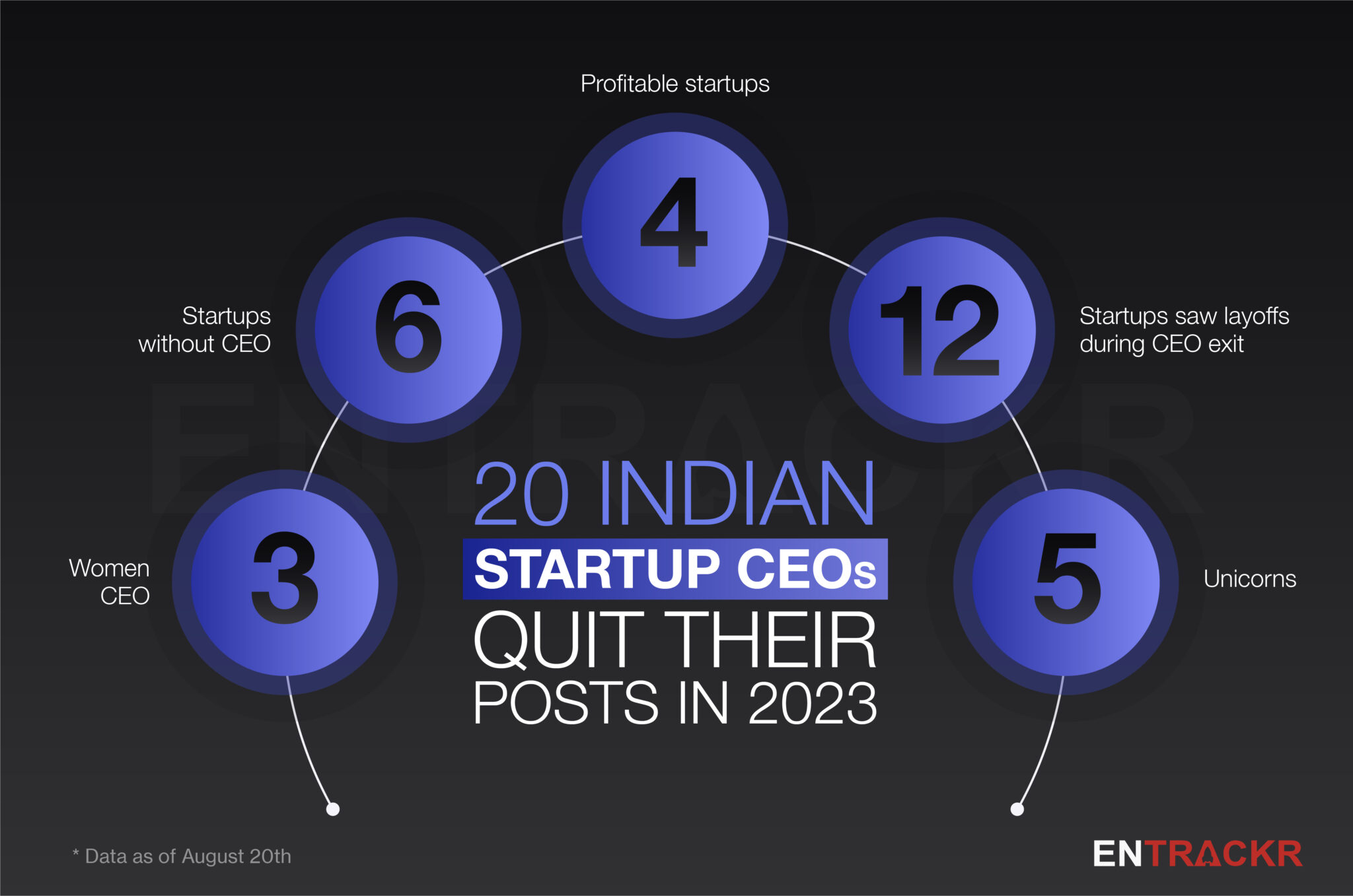

As the funding winter in Indian startups continues, attrition at the top level also saw an uptick this year. Data compiled by Fintrackr shows that within the first eight months of 2023, nearly 20 startup CEOs have left their position to either join a new firm or continue in the same company in a different role. Regardless of the nature of the transition, the number is significantly higher when compared to previous years.

The trend started in 2022 when BharatPe and Zilingo saw top level exits including their former CEO & MD Ashneer Grover and CEO Ankiti Bose due to financial wrongdoings. Other CEO exits in 2022 included Porush Jain from Sportskeeda, Avinash Shekhar from Zebpay and Arun Sirdeshmukh from Ola Cars.

Some of the top names that saw its CEO leave their roles include DealShare, BharatPe, upGrad, boAt, and Flipkart Health+ (owned by Flipkart Group), ZestMoney, Cuemath and Porter. Of the 20, five exits are from edtech followed by fintech and healthcare with four each. E-commerce and co-working saw three and two exits, respectively.

[CEOs who quit or joined a new firm]

Let’s begin with embattled fintech company BharatPe which saw a mass exit of top level executives including its CEO Suhail Sameer. Even as Sameer was replaced by interim CEO Nalin Negi in January, the company is yet to find a permanent candidate for the role. Like BharatPe, DealShare did not name the successor to its outgoing CEO Vineet Rao who quit the position in late July. Sameer and Rao served roughly three and five years as CEO, respectively.

To recall, both BharatPe and DealShare went through layoffs ahead of the departure of their CEOs.

In January, edtech company upGrad’s chief executive Arjun Mohan quit the company after a nearly three-year stint. Last month, Mohan joined edtech company Byju’s to lead its international business. Prashant Jhaveri, chief executive of Flipkart’s online pharmacy Flipkart Health+, also left the firm after serving more than a year at the company.

Similarly, fintech startup Slash and grocery tech startup Milkbasket are yet to announce their new CEO whereas Throttle Aerospace’s CEO reportedly stepped down from the company. Except Flipkart, all these startups have had an employee exodus in the past few months.

Recently, Slash was acquired by Bhavik Koladiya-led family office Finix Partners in an undisclosed deal. Entrackr exclusively reported the development. In May, all three co-founders including CEO of buy now pay later (BNPL) startup ZestMoney resigned from the company. As per media reports, the deal failed after fintech giant PhonePe decided to halt its proposed acquisition ZestMoney. The latter also saw large scale layoffs following the resignation of top level executives. The company also announced the replacement of then CEO Lizzie Chapman who is building a startup in stealth mode, according to her LinkedIn profile.

Earlier in March, DailyRounds’ CEO Deepu Sebin and FreeCharge’s CEO Siddharth Mehta announced their resignation after serving eight years and five years at their respective companies. Mehta also launched his startup called Kiwi and raised $6 million from Nexus Venture, Stellaris Venture and others in May. Unlike the other companies on the list, DailyRounds and FreeCharge did not see any layoffs.

[CEOs who took up a new role within the company]

A bunch of startup founders also quit their post of CEO voluntarily or were elevated to a new role by the company this year. For example, co-working space provider 91Springboard has replaced its CEO Anand Vemuri with Anshu Sarin. According to 91Springboard, Vemuri, who already served 11 years at the firm, will assume the role of executive chairman. Logistics company Porter also promoted its CEO Pranav Goel to executive vice chairman. Consumer electronic brand boAt, higher education edtech platform DataTrained, and Skincare brand SkinQ also promoted their CEOs to a new role within the company.

While there were no reports of layoffs or any difficulties in the above five companies, Cuemath sacked 100 employees as the company re-appointed Manan Khurma as its CEO. Before Khurma, Vivek Sunder served as CEO for nearly two years at the company.

Entrackr has also checked the financial health of these companies as per their latest available audited annual results. The data reflects that only four companies in the list were profitable in FY22 while the rest of the firms are still in losses. The profitable ones include boAt, FreeCharge, DailyRounds and Friyey (now shut down). The financial results of these companies for FY23 are yet to be filed.

[CEOs who left after shutdown or acquisition]

The list of outgoing CEOs also includes startups that got acquired or shut their operations this year. For example, car servicing startup GoMechanic was acquired by Servizzy, a consortium led by the Lifelong Group. This came after GoMechanic laid off 70% of its workforce as the co-founder Amit Bhasin acknowledged lapses in financial reporting. Following the acquisition, all co-founders including the CEO, have parted ways from the company.

Earlier this year, vernacular content platform Bluepad shut down its operations. The company’s CEO Sanjyot Bhosale later joined Koo as product manager. Meanwhile, coworking Friyey and healthcare company ConnectedH shut down their operations. The list could be longer as some startups silently shut their operations or are on the verge of closure amid funding winter.

[CEOs caught in legal tangle]

Notably, a few startup CEOs are facing legal challenges and they might end up shutting down their operations. For context, GeekLurn CEO Srinivas Kalyan was arrested in June on charges of defrauding thousands of students. Healthtech startup Mojocare was also staring at a shutdown as its investors do not see any meaningful sell-out option. The investors were also seeking legal action against both co-founders of the company. Meanwhile, Mumbai Police’s Economic Offences Wing (EOW) has initiated legal proceedings against 4B Networks’ co-founders Rahul Yadav and Sanjay Saini. Recently, Info Edge said that its investment in Yadav’s new startup was a mistake and it went on to write off its entire investment in the company.

It has rarely been easy to helm a startup as a CEO anywhere, and India offers its own unique challenges. While changes at the top are driven by, say, IPO plans that sometimes require a different sort of skill set, or acquisitions, or even the need for fresh blood after a period is fine, what should worry the ecosystem is if changes at the top are driven by governance lapses and related issues. To that extent, while the sample is small and many of the issues are sub-judice, we believe there is a serious need to relook internal controls and governance across startups without diluting the spirit of entrepreneurship that drives them.