Q1 2023 marks the first quarter Jumia’s new management implemented its strategy after riding out the blueprint of previous management in Q4 2022. The result? Jumia saw its losses decrease significantly: adjusted EBITDA loss dropped 51% year-over-year to $27 million, on track to meet the company’s end-of-year target of $100-120 million in adjusted losses. Similarly, operating loss was down 54% from Q1 2022 to $30.9 million per the company’s just-released financials.

The streamlining efforts of Q4 2022, where Jumia reduced its headcount by 20% affecting 900 roles across its 11 markets, were instrumental in reducing losses. However, the General and Administrative expenses for Q1 2023, which dropped by 32%, do not yet reflect the full impact of the headcount cuts of Q4 2022, as Q1 2023 still included the last months’ salaries of some of the leavers, the company reported. Jumia CEO Francis Dufay told TechCrunch that more layoffs could come as the e-commerce giant expects to reduce G&A costs by as much as $28 million by the end of the year.

Expenses in fulfillment, sales and advertising, and technology decreased 33%, 61% and 9%, respectively, from Q1 2022 numbers. “We’re reviewing how we do the logistics and supply chain by negotiating with suppliers and saving packaging costs, for example. We have improved the truck routes, which have minimal impact on customers and vendors but enabled us to save a lot of money,” Dufay said, referring to Jumia’s cost-cutting measures. “We’ve also reduced marketing spend a lot which was a huge driver this quarter because we believe that we can build the right fundamental for growth with much less marketing spent going forward.” The CEO noted Jumia will continue “rightsizing” its business in these departments and introduce more efficiency as part of its ongoing process to create a leaner cost structure that includes fewer customers.

Jumia’s quarterly active consumers declined 22% from 3.1 million in Q1 2022 to 2.7 million. As a result, orders and GMV were reduced by 26% and 22% year-over-year, respectively. Factors responsible for the decline in these categories include sustained macro challenges with high inflation affecting consumers’ spending power, sellers’ ability to source goods and the devaluation of nine out of 10 currencies used on the Jumia platform.

In addition, the decline in numbers comes from Jumia intentionally recalibrating its product and service portfolio in Q4 2023, including suspending its first-party grocery offering, logistics-as-a-service and food delivery operations in specific key markets. Also, by significantly reducing promotional intensity behind several services on the JumiaPay app, the fintech arm’s TPV and transaction volume dropped 31% to $48.6 million and 38% to 2 million, respectively. The fintech’s services accounted for over 25% of GMV decline and over 40% of orders decline in the first quarter of 2023, Jumia noted in its financials. Combined with the FMCG category, which includes grocery products, JumiaPay accounted for 55% of the decline in items sold and 34% of the GMV decrease during Q1 2023.

“We deliberately chose to reduce and downsize some activities in some categories, which has impacted sales a lot because we had a lot of customers who were hunting for good deals and bargains, especially on JumiaPay,” Dufay said. “We knew what would come, but it was the right thing to do for the business because it was not generating the right customer value.”

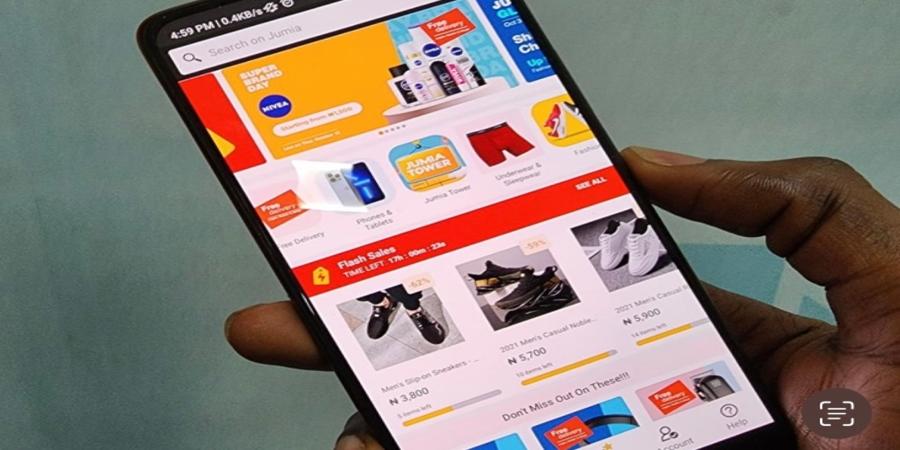

Dufay said the e-commerce giant is pivoting to a new model of growth, which includes three things — improving supply and assortment relevance (by attracting onto the platform high-quality brands and suppliers with a focus on core e-commerce categories such as phones, electronics, home appliances, fashion and beauty), enhancing seller management tools and processes to improve the experience of sellers in Jumia, and to increase its customer base, penetrating its addressable markets more effectively by tapping into the large consumer pools located in inner cities and rural areas where usual supply and retail coverage is poor.

Over the past few months, Jumia has opened new logistics routes and pickup stations in small cities outside populated areas, including Ivory Coast and Senegal. Dufay said the company is making good progress and “a lot of new cities are now part of our network and now we are at the stage of marketing activation to advertise and educate consumers in many of them.” Dufay asserts that duplicating this process in Uganda, Kenya, Tunisia, Morocco, Nigeria and other markets will fetch Jumia millions of loyal customers with better repurchasing rates.

Despite key customer metrics dropping, Jumia’s revenues almost stayed flat, falling 3% to $46.3 million year-over-year. This momentum resulted from the commission take rate increases Jumia implemented in mid-2022. Meanwhile, Jumia finished the quarter with a liquidity position of $205.4 million, comprising $86.9 million of cash and cash equivalents and $118.6 million of term deposits and other financial assets.

Source @TechCrunch