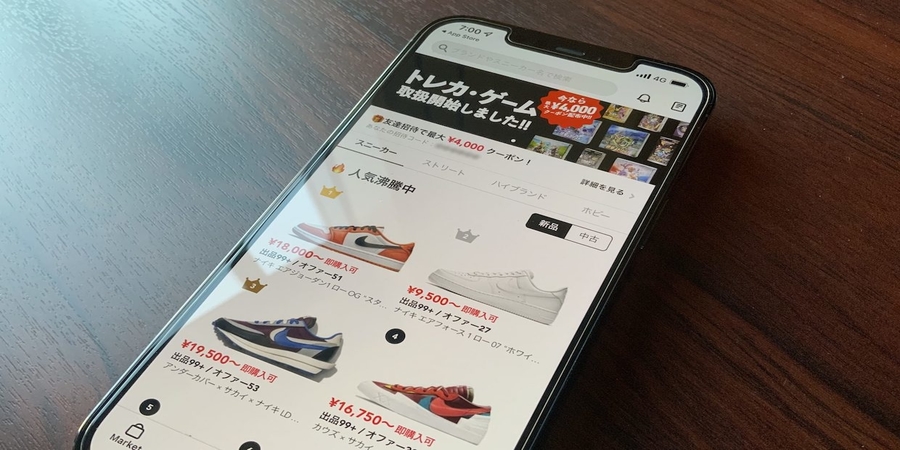

Tokyo-based Soda, the Japanese startup behind a marketplace specializing in sneakers and streetwear called SNKRDUNK (pronounced as Sneaker Dunk), announced today that it has secured an undisclosed sum in a series D round from SoftBank Vision Fund 2 (SBVF2), which brought the company’s valuation up to 38 billion yen or $340 million US.

This follows the company’s series C round back in July where it secured 6.2 billion yen (about $54 million US), meaning that their valuation became 1.6 times in just 4 months. The previous round was led by Korean tech giant Naver’s Kream with participation from Altos, SoftBank Ventures Asia, JAFCO Group, and existing investors including basepartners, Coloplast Next, and The Guild.

The funds raised in the latest round will be used for expanding into the Asian markets such as Singapore, Australia, and Hong Kong in addition to strengthening business expansion effort in Japan, AI-based logistics, authenticity assessment, and customer support. This is SBVF2’s second investment in a Japanese startup following cash injection into biotech startup Aculys Pharma.

SoftBank Vision Fund 1 (SBVF1) had been investing 100 billion yen in each startup on average, mainly focused on US-based unicorns which are valued over $1 billion. However, the average ticket size of the second fund (SBVF2) has been reduced to 20 billion yen ($177 million), and some of Japanese startups have been gradually becoming the fund’s potential investees.

In an interview with Forbes Japan, SBVF2’s managing partner Kentaro Matsui shared his fund’s five investment principles:

1. market size,

2. innovativeness of services, products, and technologies,

3. accelerating growth through AI (artificial intelligence) and data utilization,

4. entrepreneurs and management team with a clear vision, and

5. sustainability of the business and a clear path to profitability.

In the statement, Soda claims AI-based logistics as one of what the fund is used for. By optimizing the logistics process leveraging cutting-edge technologies, the company expects to allow customers to experience the new standard of trading – sell today, receive tomorrow. It’s unnecessary to say technology is the key to breakthroughs here.

According to the SoftBank Group’s financial results for the second quarter ending March 31, 2022, SVF1 and SFVF2 have 81 and 157 portfolio companies respectively.