Tokyo-based WealthNavi, the company offering a technology-based asset management service under the same name, announced that IPO application to the Tokyo Stock Exchange (TSE) has been approved. The company will be listed on the TSE Mothers Market on December 22 with plans to offer 2.5 million shares for public subscription and to sell 1,559,400 shares in over-allotment options for a total of 13,094,300 shares. The underwriting will be led by SBI securities while WealthNavi’s ticker code will be 7342.

Based on the estimated issue price of 1,100 yen (about $10.5), the company will be valued at 49.5 billion yen (about $474.5 million). Its share price range will be released on December 3 with bookbuilding scheduled to start on December 7 and pricing on December 11. According to the consolidated statement as of December 2019, they posted revenue of 1.55 billion yen ($14.8 million) with an ordinary loss of 2.06 billion yen ($19.7 million).

Read also – Japan’s handmade item C2C startup Creema files for IPO

WealthNavi was founded back in April of 2015 by CEO Kazuhisa Shibayama who previously worked at finance ministries of Japan and UK respectively after graduating from the University of Tokyo. After leaving the public sector, he joined McKinsey to risk and asset management projects for institutional investors.

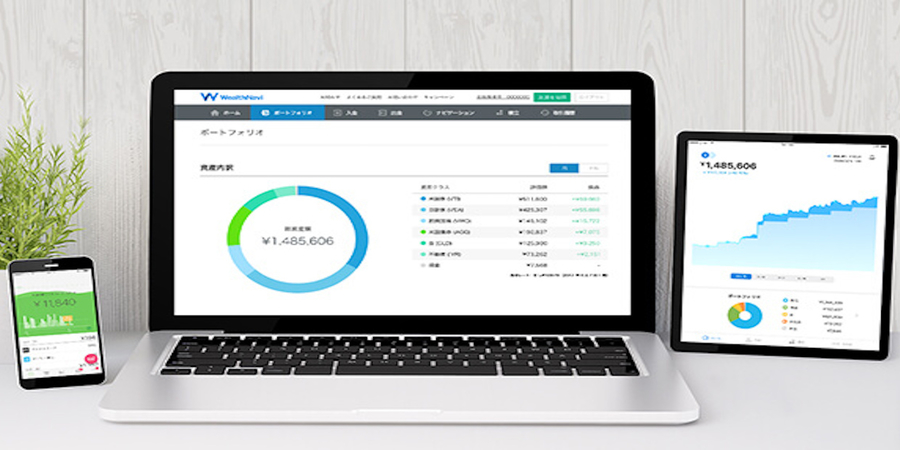

The robo-advisory service provides a fully-automated asset management platform so that users can enjoy long-term and diversified investments. The company has now acquired 340,000 accounts and managed assets worth over 310 billion yen ($3.0 billion). The company was ranked in 10 of the most valued private companies in Japan by Nikkei last year.

Read also – Chipmaker Kioxia postpones $3.2 billion IPO plan

WealthNavi is well known for having raised funds from more than 20 VC firms. Led by CEO Shibayama (24.84%), the company’s major shareholders include SBI Holdings and SBI Investment (13.5%), GREE Ventures (9.18%, now known as Strive), Infinity Venture Partners (6.39%, now known as Infinity Ventures), and Global Brain (5.96%, Global Brain also joins co-investment with Sony Financial Ventures), DBJ Capital (2.80%), and UTokyo Innovation Platform (2.40%).