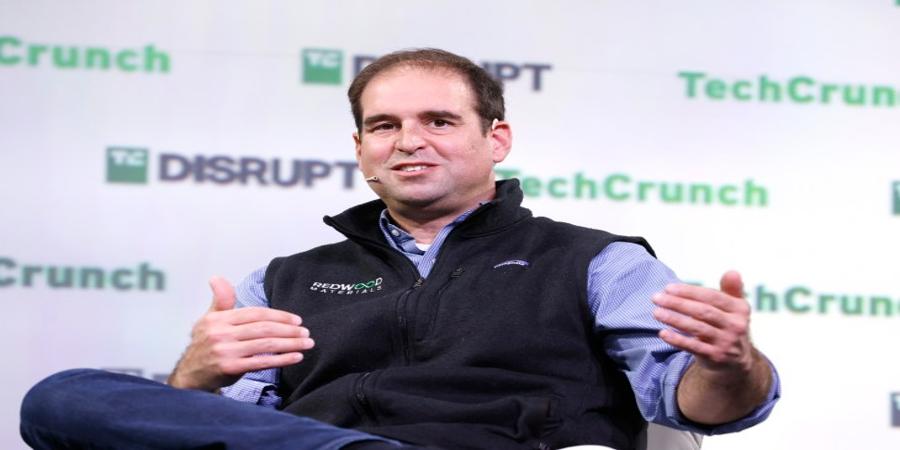

J.B. Straubel has worn many hats in his career: co-founder of Tesla, Tesla Board Member, and more recently, founder and CEO of battery materials and recycling startup Redwood Materials.

But in his heart, he’s a engineer, he said during a fireside interview at TechCrunch Disrupt.

“I think of myself first and foremost as an engineer. That’s actually what I love doing the most, and I feel like all these other activities are derived out of that. I don’t usually go seeking an entrepreneurial challenge or even sometimes seeking a company.”

But of course, Straubel has helped build some of the most technically challenging, industry-leading companies in the world: Tesla, which he co-founded and led as chief technical officer, and Redwood Materials, which he started in 2017. Tesla, of course, has become the world’s leading electric vehicle brand. Redwood’s mission is slightly different: to recycle up somewhere between 300-500 gigawatt hours (GWh) of batteries every year.

The challenge is enormous and extraordinarily capital intensive. Indeed, Redwood has raised over $2 billion, including a Series D round of over $1 billion that closed late last month, bringing its post-money valuation to north of $5 billion. In addition, the company has swelled to a workforce of 700-800 people. It’s a level of funding that few startups have ever reached – but even still, Redwood is still a startup, Straubel said.

Redwood “is definitely a startup,” he said. “We’re at the very earliest stages of revenue, we’re at the earliest stages of executing a multi-year capex deployment plan and building plan. I feel like we haven’t really turned a corner on having a massive impact on what we’re trying to achieve yet. We don’t have the systems built out to be a stable, historied company that hasn’t changed very much for many years. Month to month, quarter to quarter, we’re still changing dramatically.”

But even if a company is public, Straubel argued that companies should strive to feel as small as it possibly can and “to never have this sense that you’ve somehow made it.”

“I think the psyche of being a startup company is really important,” he added. “It’s hard to simulate. You can’t really make that up.”

Perhaps it’s no surprise, then, that Straubel said the company is not ready to enter the public markets. With his experience being on the board of Tesla and two other public companies – Quantumscape and SolarCity, which was acquired by Tesla – he’s seen the pros and cons of a public listing.

But there are plenty of downsides: “We don’t have predictability yet. And actually I don’t want us to have that level of predictability yet. We have to give up something of our innovation and creativity and dynamic nature to have the predictability.”

“It probably should happen at some point, I think that’s probably the right outcome for most companies as they grow, but I really don’t want that to ever feel like a goal in its own right,” he said.

Redwood company is currently recycling 10-15 GWh of batteries per year, which is a relatively large amount of batteries, but overall makes up just a portion of the batteries that are discarded on an annual basis. Redwood’s goal is to hit 300-500 GWh per year by 2030 or 2035, which it may be able to do across its two campuses in Northern Nevada and South Carolina.

Even at that point, though, the company would be recycling just 25-30% of the total market share. To put that number in perspective, in the United States alone, automakers and battery manufacturers are planning to manufacture over 1,000 GWh per year in the U.S. in the coming decade.

“I worry about how long it will take us to achieve these scales, even in the midst of this industry growing so fast,” he said. “That’s probably my biggest concern is achieving that scale.”

Source @TechCrunch