French cleantech startup Calyxia has profitability within sight. The company just raised a $35 million Series B round that will help it further ramp up industrial production of its sustainable alternatives to microparticles and microcapsules, setting it on the path to profitability by 2026. But co-founder and CEO Jamie Walters says the B Corp is just getting started.

The ‘starter’ problem Calyxia is tackling is staggering at global scale: Microplastics are polluting everything around the world, from soils, rivers and beaches to the icy waters of the Arctic — they’re even getting inside our own bodies and brains.

Beyond that, the traditional production methods employed by the materials and chemical industries can cause a range of environmental issues. It’s imperative to green up industrial manufacturing processes if we’re to safeguard the environment for future generations and reduce the energy used to make stuff.

Walters said Calyxia’s mission for the next 5 to 10 years is to become the global leader in the microparticles and microcapsules categories. After that, he wants the company’s technologies to be transforming the industrial chemical industry more broadly.

Founded in 2015, the business was spun out of academic research between Harvard and ESPCI-Paris PSL, in which Walters was part of the scientific founding team, following his time at the U.K.’s Cambridge University — where he obtained his biotechnology and chemical engineering PhD and worked as a researcher. “At the very beginning, I was in a lab with a team of scientists exploring and discovering the limits of this technology, and simply having a dream of where that technology could go. How it could be transformed into products, and how it could change industries,” he told TechCrunch.

“We’re addressing a market for microcapsules today that is about $5 billion, and this is growing to about $10 billion in 2030. If we only capture 10% of this market, Calyxia can generate $500 million to $1 billion in five to ten years,” he added. “This will ensure Calyxia is a highly revenue-generating and profitable French industry leader, and […] become[s] the industry’s leader in this field. Then our vision, on a 10-year+ plan, is to emerge as a significant and innovative player in advanced sustainable chemistry — beyond purely microparticles and microcapsules.”

What is “advanced sustainable chemistry?” For Calyxia, it boils down to coming up with alternative, eco-friendly ways to run manufacturing processes to replace less clean methods and products.

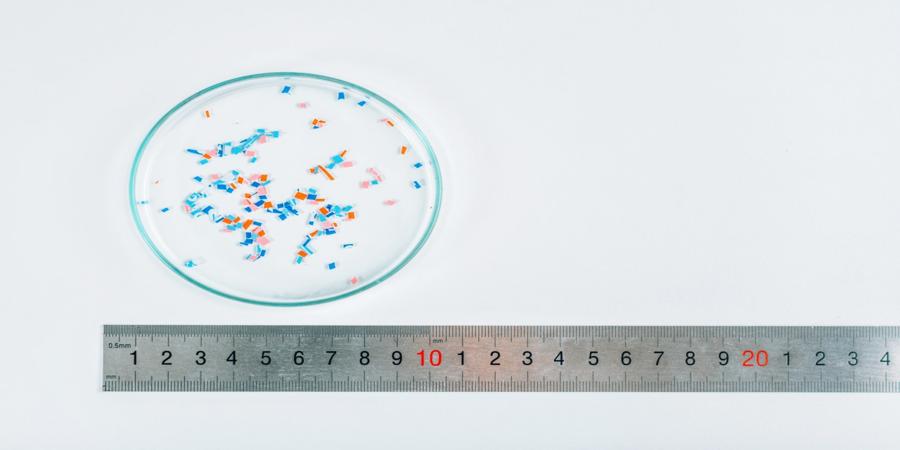

Calyxia’s sustainable microparticles and microcapsules offer manufacturers in its target sectors a way to swap out dirty processes with clean ones that involve making products with biodegradable alternatives, which, the company says, break down without leaving behind any harmful residue.

Its work in advanced materials is a little different. Calyxia has developed microcapsule technology that can be added to other materials to improve their wear-resistance. This, the company argues, prevents microplastics from being produced through wear and tear — an indirect form of microplastic production that is actually the main source of the scourge (compared with additive processes in which tiny plastic beads are added to cosmetics, such as face scrubs).

This use-case requires improving the durability of materials so they don’t break down into microscopic particles.

The startup’s customer list currently includes more than 20 “top-tier” industrial blue chip companies. Calyxia doesn’t disclose who its clients are, but it says they include major household brands that want to tout microplastics-free products to their consumers.

Calyxia’s customers also need to comply with new regulations, such as the October 2023 European Union law restricting the use of microplastics in products like detergents, cosmetics and fertilizers. Walters pointed to a similar incoming law in California that he expects to further ramp up demand for its alternatives in the U.S.

Since we last spoke to the startup in 2021, when it raised a €15M Series A, it has restructured its business to establish dedicated units targeting each vertical it operates in. One unit focuses on fast moving consumer goods, another is building agricultural use-cases, and the last one is an advanced materials division.

It’s also been busy building its intellectual property portfolio, and now has 60 patents worldwide. On the production side, it opened its first factory last year and has partly-financed a second one, which will also be located in France. Once opened, the new plant will take the company’s capacity up to 3,000 tons of capsules per year from 500 tons currently.

Walters said demand is fairly equally balanced across the three units so far, although he stresses the respective markets have different dynamics. “The material business tends to have more customers with low volumes, while agriculture has a small number of customers but each has extremely high volumes,” he explained. “In consumer, you have cosmetics, which is low volume and high value. And then you have home care, which is similar to agriculture: very high volumes. Each market has different dynamics, and we have a bit of a portfolio effect, but all three are equally sizeable in the short term, mid term and long term.”

What about end-of-life? Is Calyxia also thinking about reducing environmental impact where its technology has been used to make products last longer by reducing wear and tear? Walters agreed that improving product longevity doesn’t help with that sustainability challenge, but he said its advanced materials division is working on a couple of other areas that may help.

One of these is focused on making it easier to recycle products by separating different layers of materials — such as removing the label from a plastic shampoo bottle or separating layers of plastics. He says the startup has also developed materials that “help to self-heal and self-repair materials” — potentially further postponing that final end-of-life date.

But he agreed there’s still a sustainability challenge attached to plastic use, arguing: “We have to tackle one problem at a time.”

When it comes to reducing the energy use of manufacturing, Calyxia’s advanced materials division has a particularly novel technology that Walters suggests will have a major impact on shrinking greenhouse gas emissions from the production of coatings, composites, adhesives and resins.

Specifically, the startup’s technology alters the polymerization process used in production so it can occur at a lower temperature than usual.

“We encapsulate catalysts that are highly reactive,” Walters explained. “The protective coating around the catalyst protects it against reaction during processing and storage, and then when you activate — at 100 degrees C [vs. 180 degrees C, which is the standard for this type of polymerization] the catalyst is released on command, polymerizing the material into a wind turbine part, an electric vehicle part, a sporting goods component.”

The upshot is manufacturers of such parts can reduce the temperature used to make their products by 80 degrees C or more, per Walters.

“This reduces the cost for them, which is great because it improves the economics of production. It helps them to significantly reduce their greenhouse gas and carbon footprint, and also enables them to increase the manufacturing rate as well, because the catalysts we use are even more reactive than the previous catalysts.”

Calyxia’s Series B was led by Lombard Odier Investment Managers, through its Plastic Circularity Fund, and Bpifrance, through its Large Venture Fund. It also notes “strong support” from existing investors, which include Astanor.

Source @TechCrunch