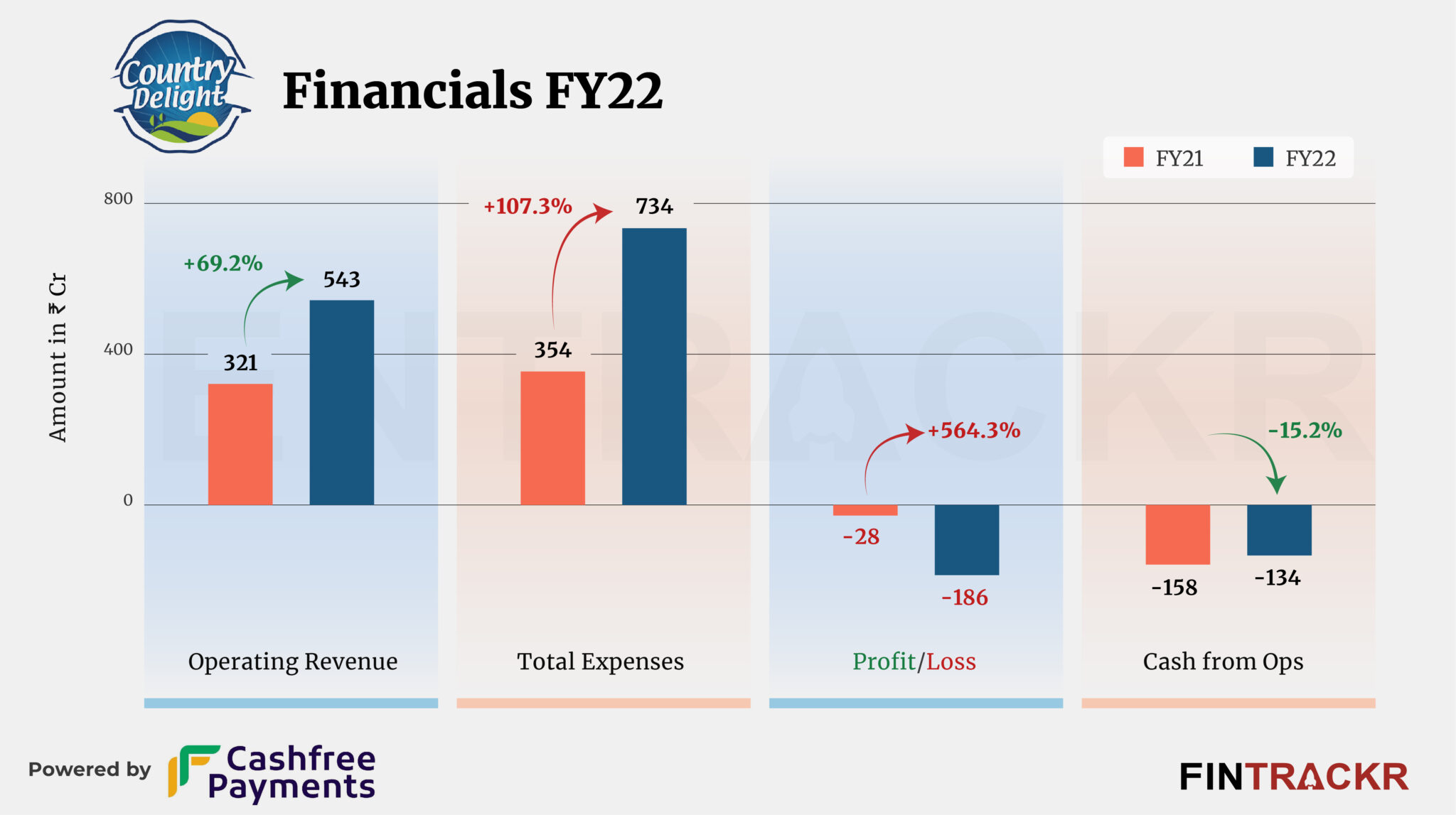

Country Delight’s scale rose nearly 70% to cross the Rs 500 crore revenue mark in the fiscal year ending March 2022. The losses, however, for the D2C dairy brand shot up 6.6X during the same period.

To be precise, its revenue from operations increased to Rs 543 crore in FY 22, up by 69.2% from Rs 321 crore in FY21, according to its annual financial statements sourced from Registrar of Companies show.

Country Delight offers a range of dairy products, including bakery goods, poultry, and farm produce. With operations in more than 25 cities, the company claims to have more than 600,000 customers, and works with more than 10 thousand farmers.

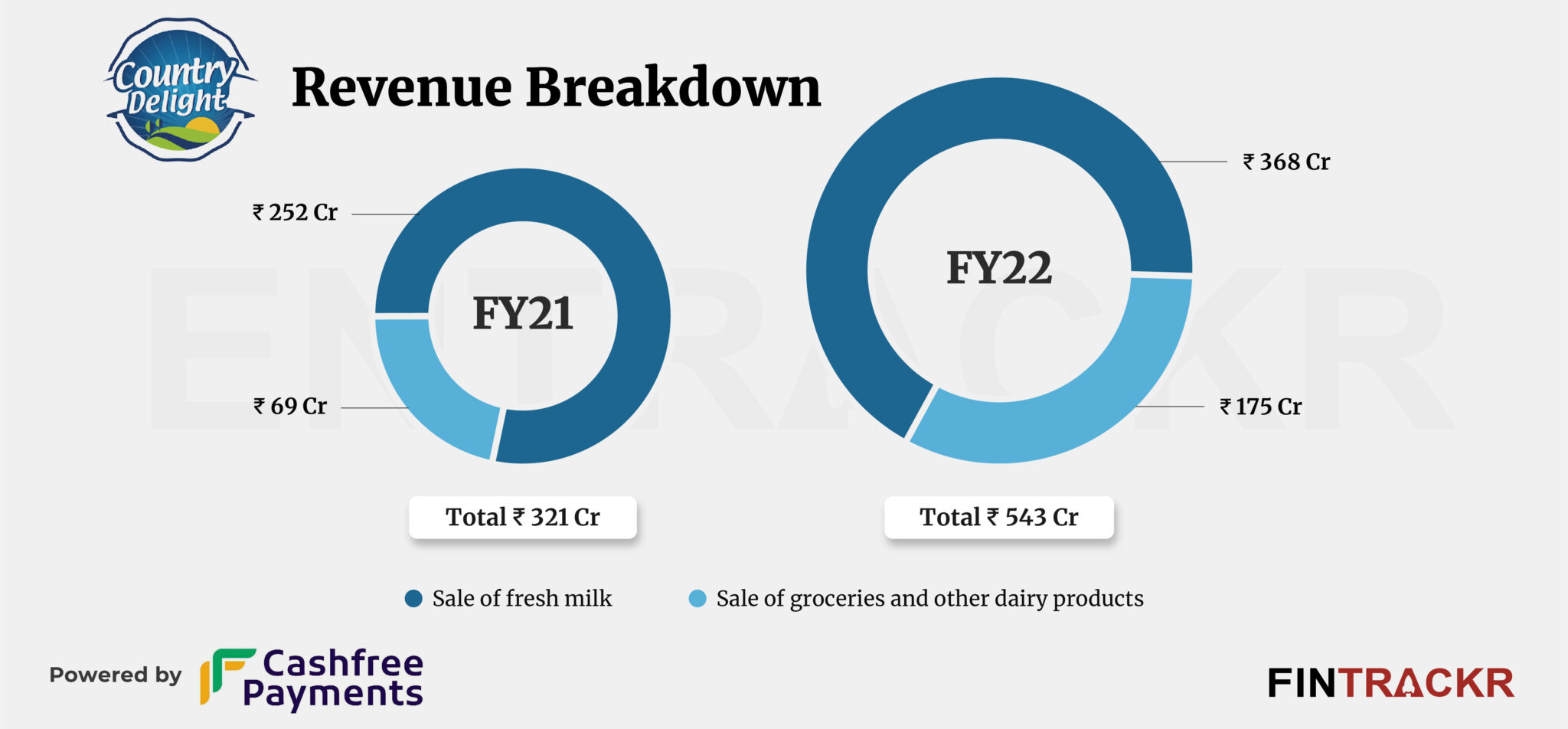

The sale of fresh milk, which is also the flagship offering of the D2C firm, formed 67.8% of the total operating revenue, which increased by 46% to Rs 368 crore in FY22. The sale of groceries and other dairy products, including paneer, curd, ghee, bread, etc., surged 2.5X to Rs 175 crore in FY22.

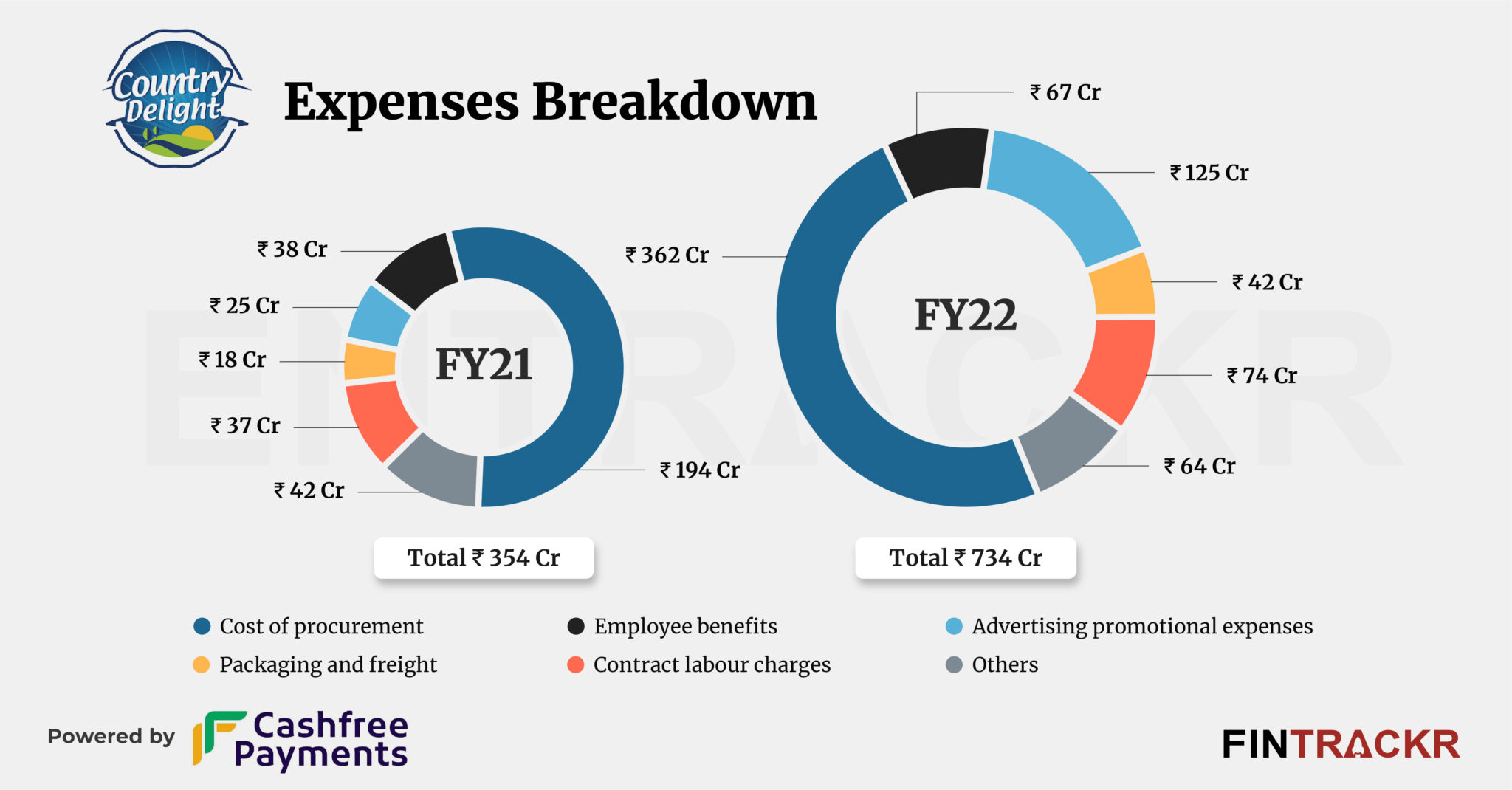

The cost of procurement accounted for 49.3% of the overall expenditure which spiked 86.6% to Rs 362 crore in FY22. The advertisement and promotion costs soared 5X to Rs 125 crore.Its employee benefits and contract labor charges were up by 76% and 100% to Rs 67 crore and Rs 74 crore, respectively, in FY22.

The company added another Rs 42 crore towards secondary packaging and freight, pushing the overall expenses 2.1X to Rs 734 crore in FY22.

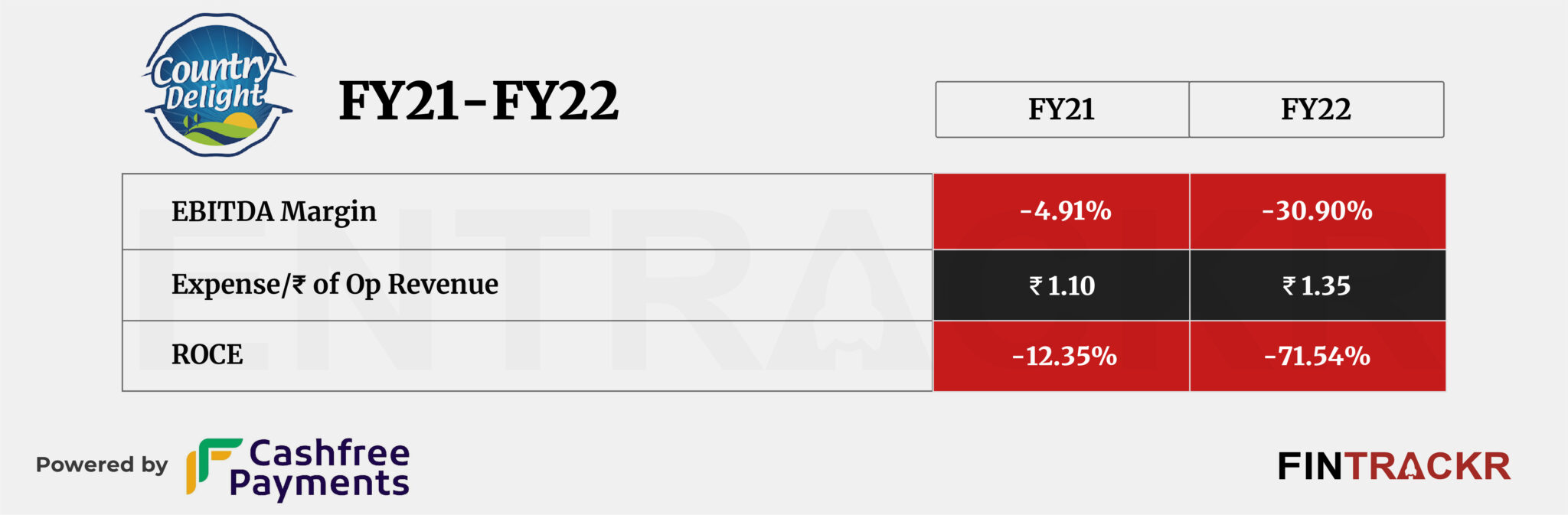

As numbers reflect, high procurement and advertising costs elevated Country Delight’s losses by 6.6X to Rs 186 crore in FY22. Its ROCE and EBITDA margin worsened to -71.5% and -30.9%, respectively, during FY22. The company spent Rs 1.35 to earn a unit of operating revenue.

Country Delight competes with Milkmantra, Parag Dairy, Akshayakalpa, whereas D2C bakery brands and platforms like Milkbasket and Otipy are its competition in non-core segments. After closing FY22, Country Delight raised $108 million in Series D round in May 2022 (FY23) for further expansion and foray into multiple food staple categories such as rice, wheat, pulses, grains, jams and pickles. For fiscal year FY23, it claims to have crossed Rs 1,000 crore revenue mark and aims to be profitable by FY24.

Profitability is bound to come only when non-milk sales cross over 50% of overall revenues, as margins on milk remain relatively inelastic. The fact that competition for distribution comes from a wide variety of firms, including the likes of Swiggy’s Instamart or even BigBasket and more, expanding margins seems a much more difficult target than rationalising costs like advertising and procurement, besides seeking more distribution efficiencies. The trend across the segment has invariably been towards adding more SKUs to the portfolio, something that has added costs more often than not, rather than deliver a quick fix on revenues or profits. With its main offering, milk, already at a significant premium to established mass market brands like Amul, Nandini, etc, we believe the potential to expand share or market in the core offering is limited from here on unless the founders get a large round of funding to ‘educate’ consumers. Without that funding, the firm will do well to arrest losses to avoid the risk of a sale under stress, for there is zero doubt that the firm has built a brand and infrastructure that is real value for multiple players in the game.