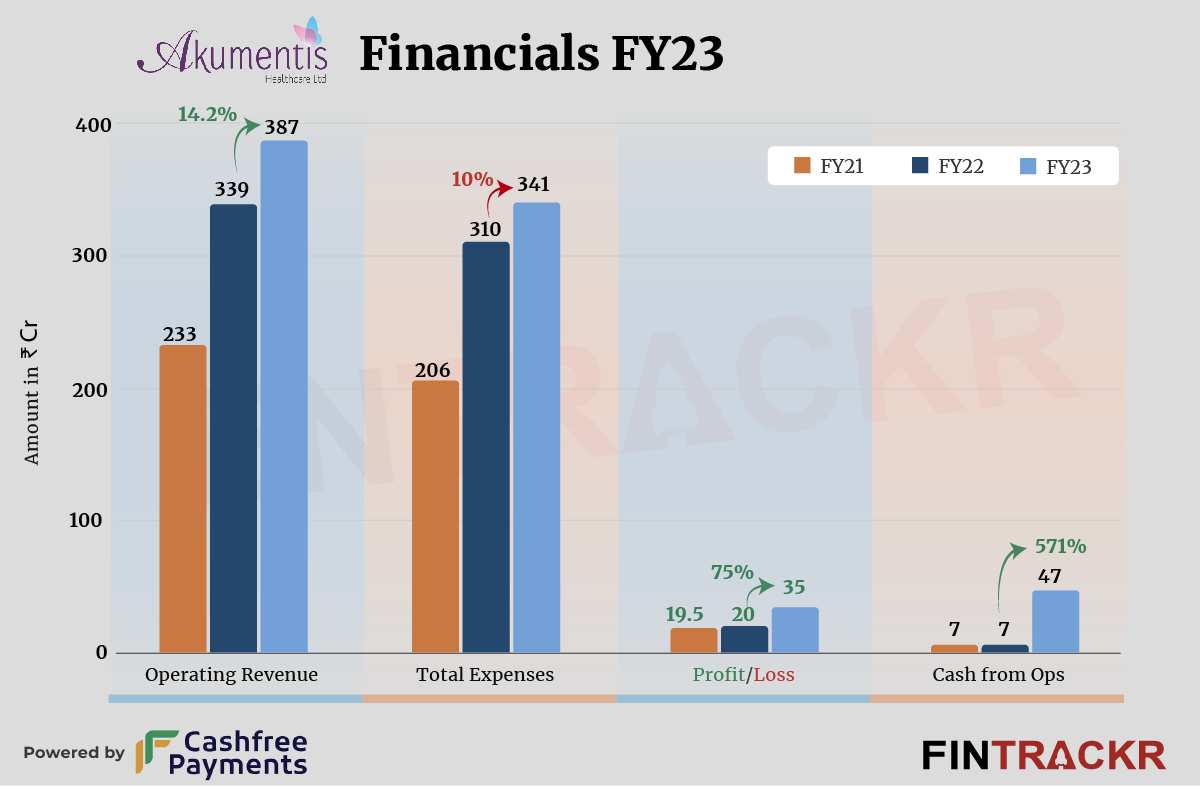

Pharmaceutical company Akumentis Healthcare has not been able to grow its revenue at the same scale in the fiscal year ending March 2023 as it did in FY22. However, it has certainly improved margins. While the operating scale grew merely 14%, profits rose 75% in FY23.

Akumentis Healthcare’s revenue from operations increased 14.2% to Rs 387 crore in FY23, according to its standalone financial statements filed with the Registrar of Companies. For perspective, the firm recorded a 45.5% growth to Rs 339 crore in FY22 from Rs 233 crore in FY21.

Launched in 2010, Akumentis Healthcare claims to have a network of 9 business units and 1,600 staff across the country. The Thane-based company offers a variety of products for derma, ortho, gynecology, critical care, cardiovascular, diabetic, and pediatric. The sale of these products was the only source of income for the company.

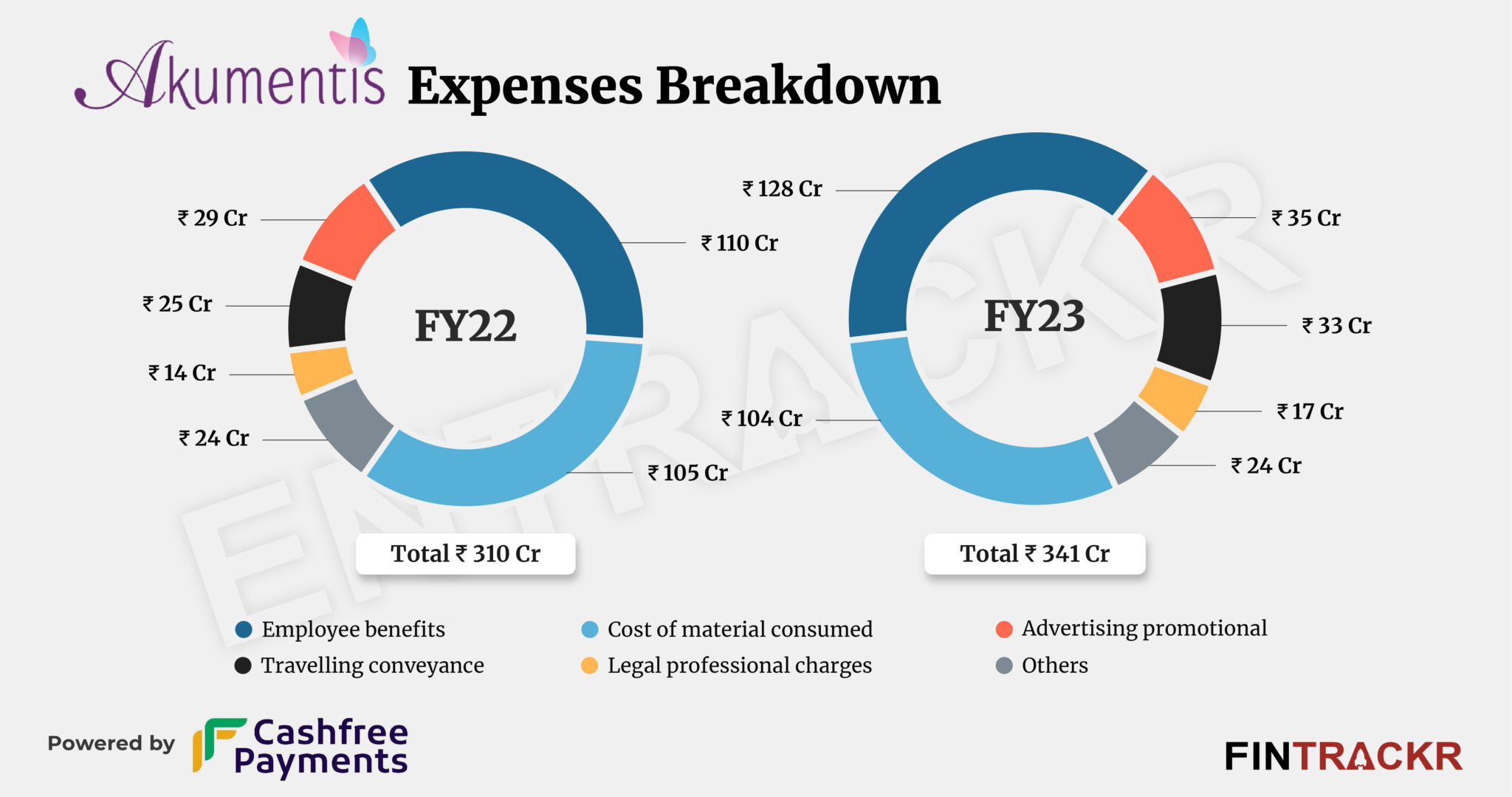

Moving on to the company’s cost sheet, employee benefits formed 37.5% of its total expenses. This cost surged 16.4% to Rs 128 crore in FY23. The cost of procurement of pharmaceutical products remained unchanged with Rs 104 crore during the same fiscal year.

Its advertisement and traveling expenses costs, however, grew by 20.7% and 32% to Rs 35 crore and Rs 33 crore, respectively. The company spent Rs 17 crore on legal and professional fees which pushed the overall cost by 10% to Rs 341 crore in FY23.

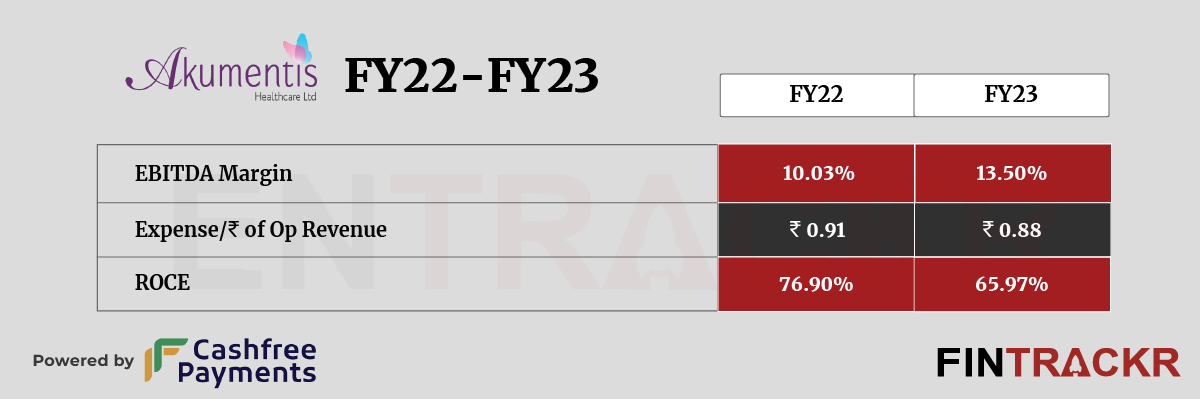

As reflected by the financial statement, Akumentis didn’t manage the significant growth in the last fiscal but stable spending on procurement helped it to register 75% growth in the bottomline. The company posted a profit of Rs 35 crore in FY23 as compared to Rs 20 crore in FY22. Its ROCE and EBITDA margin registered at 65.97% and 13.50%. On a unit level, Akumentis spent Re 0.88 to earn a unit of operating revenue in FY23.

The higher margins are reflective of a portfolio that is mostly outside the DPCO (Drug Prices Control Order), such a rise may not be sustainable. Akumentis, to that extent, will seek to make inroads into new segments or build stronger brands. As an essentially trading firm, competition is likely to be fierce the larger it becomes, as its performance will attract other players to the same segments.