Agriculture investment platform Growpital has grown at a fast pace since its inception in 2020. Importantly, the firm claims to be profitable even as it has grown.

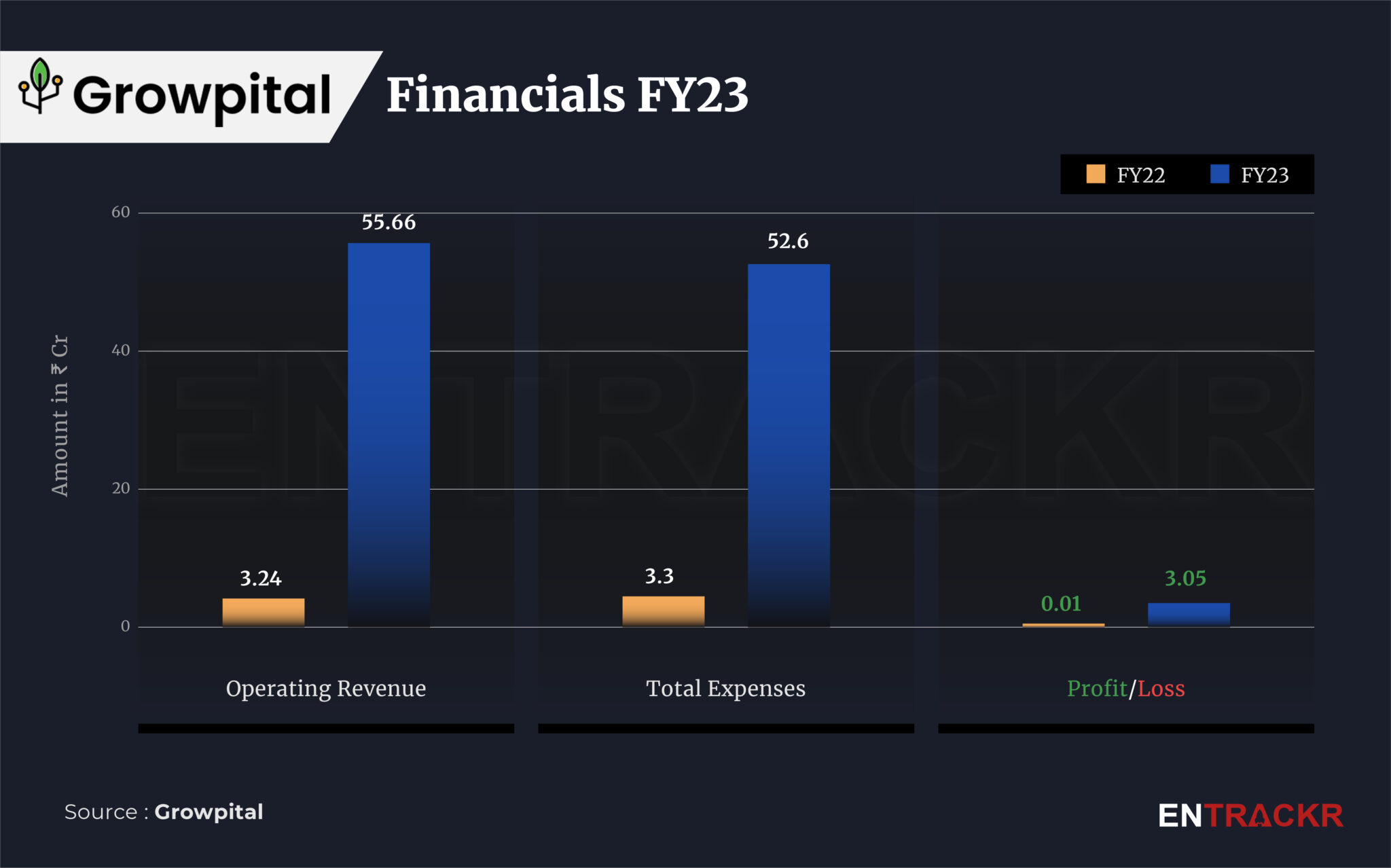

Growpital’s revenue from operations skyrocketed over 17X to Rs 55.66 crore during the fiscal year ending March 2023 in contrast to Rs 3.24 crore in FY22, the company said in an interaction with Entrackr.

Founded by Rituraj Sharma and Krishnna Joshi in 2020, Growpital allows retail investors and NRIs to invest in commercial agriculture projects and invests the funds and resources in a variety of agricultural projects. The funds sourced from the investors works as working capital for the company and it is allocated to agricultural projects that are supervised by a group of agriculture professionals and farmers.

The company earns revenue by selling the crop produce. It also has a lock-in period of 12 months. In case of early withdrawal, the company deducts all payouts from the original investment and pays the remaining amount to the investors.

Growpital claims to offer tax-free fixed-profit sharing to investors ranging from 10% to 15% on investments. As per the company’s website, it has raised over Rs 90 crore funds from more than 2,000 investors subscribed to its platform, and deployed these funds across 3,500 acres of land. It aims to encourage tax-free retail investments, as these returns are in the form of agricultural income which is exempted under the Indian Income Tax Act.

Farming expenses (including purchase of farm produce and other operational costs) emerged as the single largest cost, forming nearly 94% of the total expenses. This cost ballooned 15.6X to Rs 49.34 crore during FY23 from Rs 3.17 crore in FY22. Employee benefit cost for the company jumped 13.4X to Rs 1.18 crore in FY23 from Rs 8.8 lakh in FY22.

The company also spent Rs 10 lakh on traveling during the last fiscal which steered the total expenses up by 15.9X to Rs 52.6 crore in FY23. It recorded Rs 3.3 crore expenses during the previous fiscal year (FY22).

The rapid growth during the year also helped the company’s profits to grow. Growpital witnessed a multifold surge in profits to Rs 3.05 crore (profit before tax) during FY23 as compared to only Rs 1 lakh in FY22.

On a unit level, the company spent Re 0.95 to earn a rupee of operating income during FY23. Growpital directly competes with the likes of Upaj Farm and FAAB.

Growpital claims to bear the risk in case of flood, drought and other weather-related issues. However, it also tries to reduce these risks by investing in varied crops across different states, besides insurance one presumes.

The effort, while hardly big enough to be classified as a whole new investment category, has done enough to be taken very seriously though. With a market that is fast evolving with demand for exotic fruits and vegetables besides some staples, the potential, and need for such ventures has risen, as farmers on their own may not have the capital or the risk appetite to take the plunge. Being in the agri sector, with size, regulatory surveillance is bound to follow, but as long as the firm is able to make a case that it is doing something that is both sustainable and improving local livelihood opportunities, the firm can expect supportive environment. Longer term risks like climate change and extreme weather events also demand that such niche farming options be tried out to create dependable opportunities for food growth as well as rural jobs.