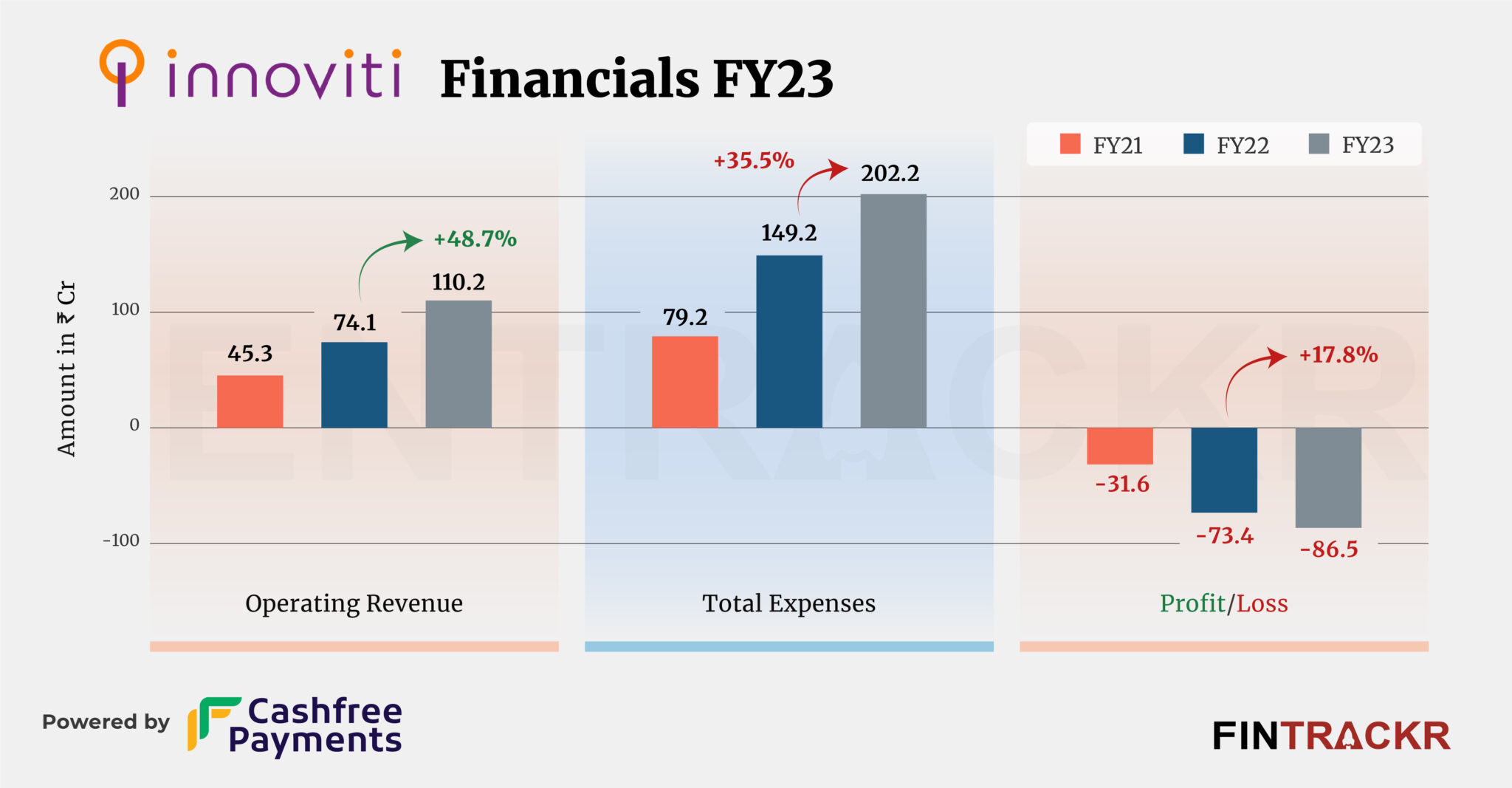

Payment gateway and point of sales (PoS) provider Innoviti Technologies closed its $45 million round in July last year with the funds helping the firm to grow its scale by 48.7% during the fiscal year ending March 2023.

Innoviti’s operating revenue grew to Rs 110.2 crore in FY23 from Rs 74.1 crore in FY22, according to the company’s consolidated financial statements reported to the Registrar of Companies.

The company provides payment gateway and PoS devices to merchants to facilitate online and card-based payments. Service fees charged from these facilitations were the sole source of operating revenue for Innoviti in FY23.

On the back of its Series D funding round, Innoviti made Rs 5.39 crore from the gain of sale of investments during the previous fiscal year (FY23).

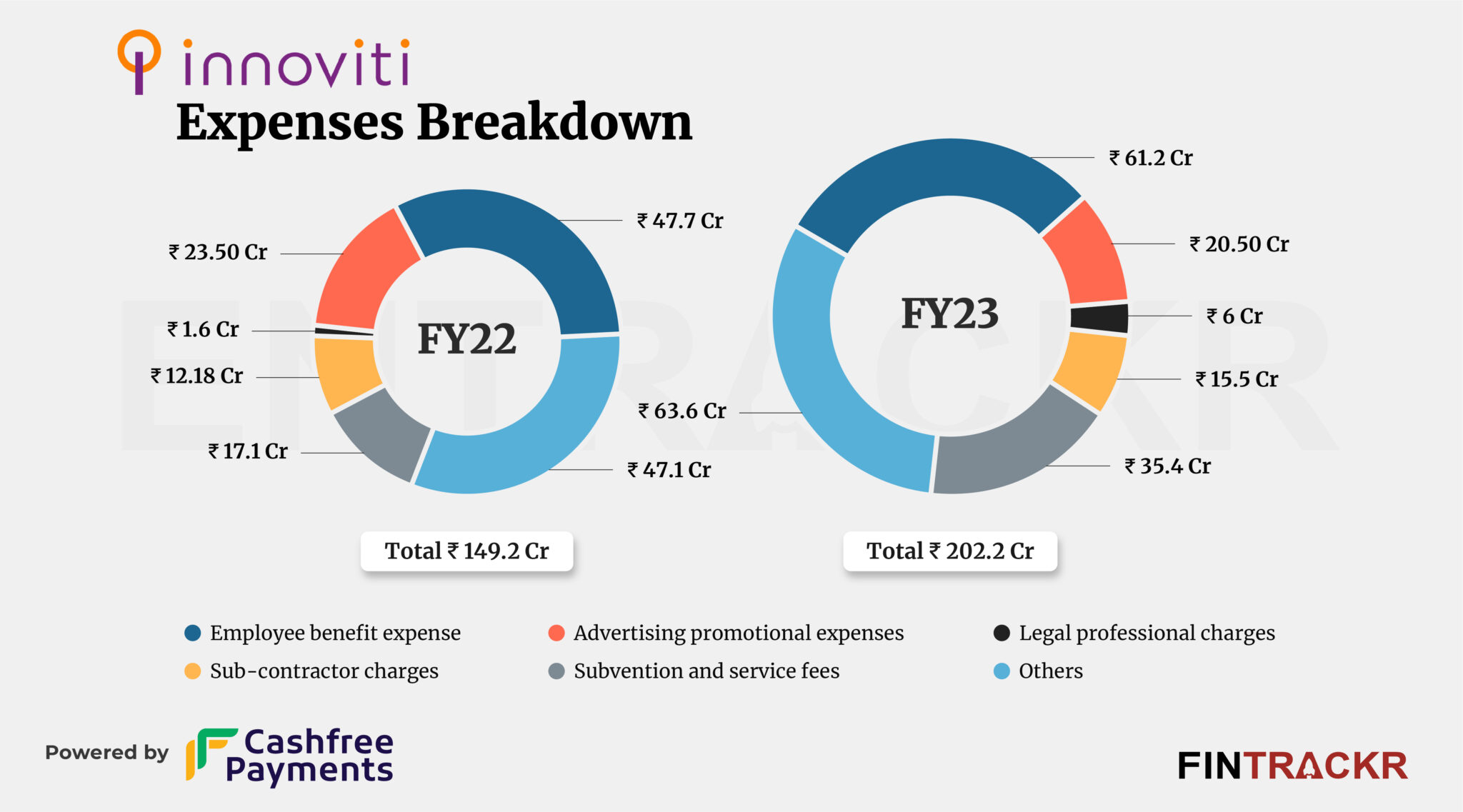

On the cost side, employee benefits accounted for 30.3% of the total expenditure which grew by 28.3% to Rs 61.2 crore in FY22. This cost also includes Rs 5.33 crore on ESOPs. Earlier this month, Innoviti also expanded its ESOP pool by 55 crore making it to Rs 160 crore.

Its service fees and subcontractors charges increased by 107% and 27.3% to Rs 35.4 crore and Rs 15.5 crore during FY23. The company added another Rs 20.5 crore and 6 crore towards advertisement and legal fees. At the end, its overall cost stood at Rs 202.2 crore during the previous fiscal year.

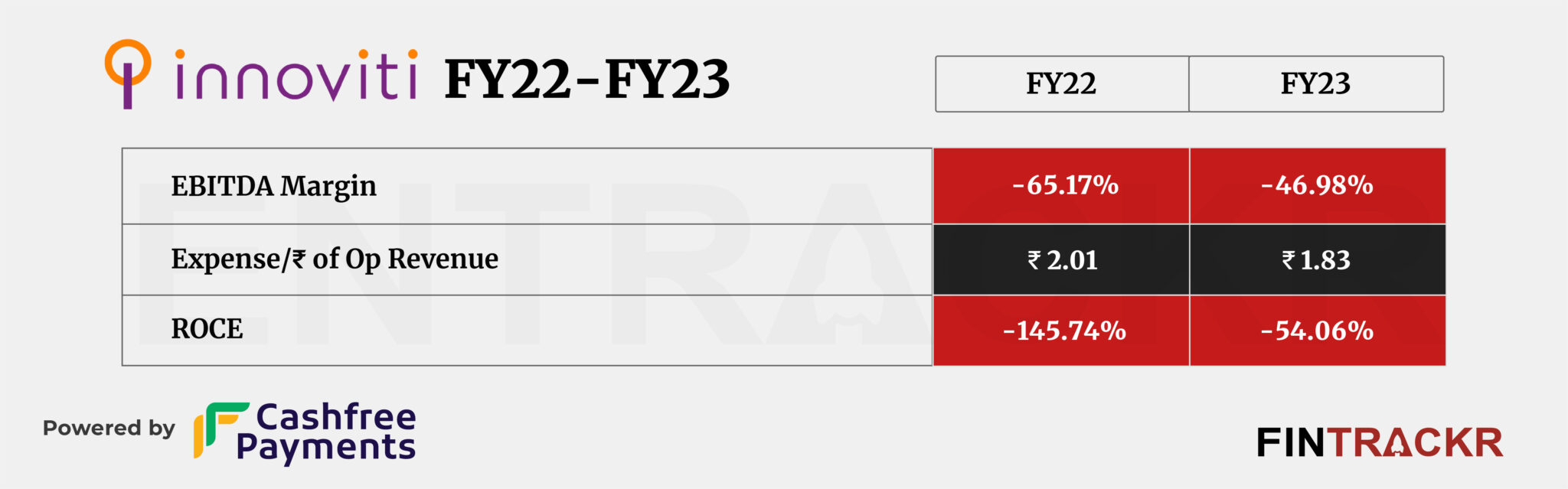

Control on expenses led to slow growth in losses which grew 17.8% to Rs 86.5 crore in FY23 in contrast to 2.3X spike in losses during FY22. Its ROCE and EBITDA margin registered at -54% and -49.98%. On a unit level, the firm spent Rs 1.83 to earn a rupee of operating revenue in FY23.

At just over 20 years since it was founded, Innoviti has seen the industry evolve, and to an extent, has also built a strong base of clients and volumes. On the other hand, in the same period, other competitors have come, and gone, and many have raised higher funding to accelerate their own growth and market shares. That is one reason why Innovity remains drenched in losses, and still facing huge challenges to find its own, profitable space. The firm could be a classic case for an acquisition, driven by investors who have competing investments in other, similar firms.