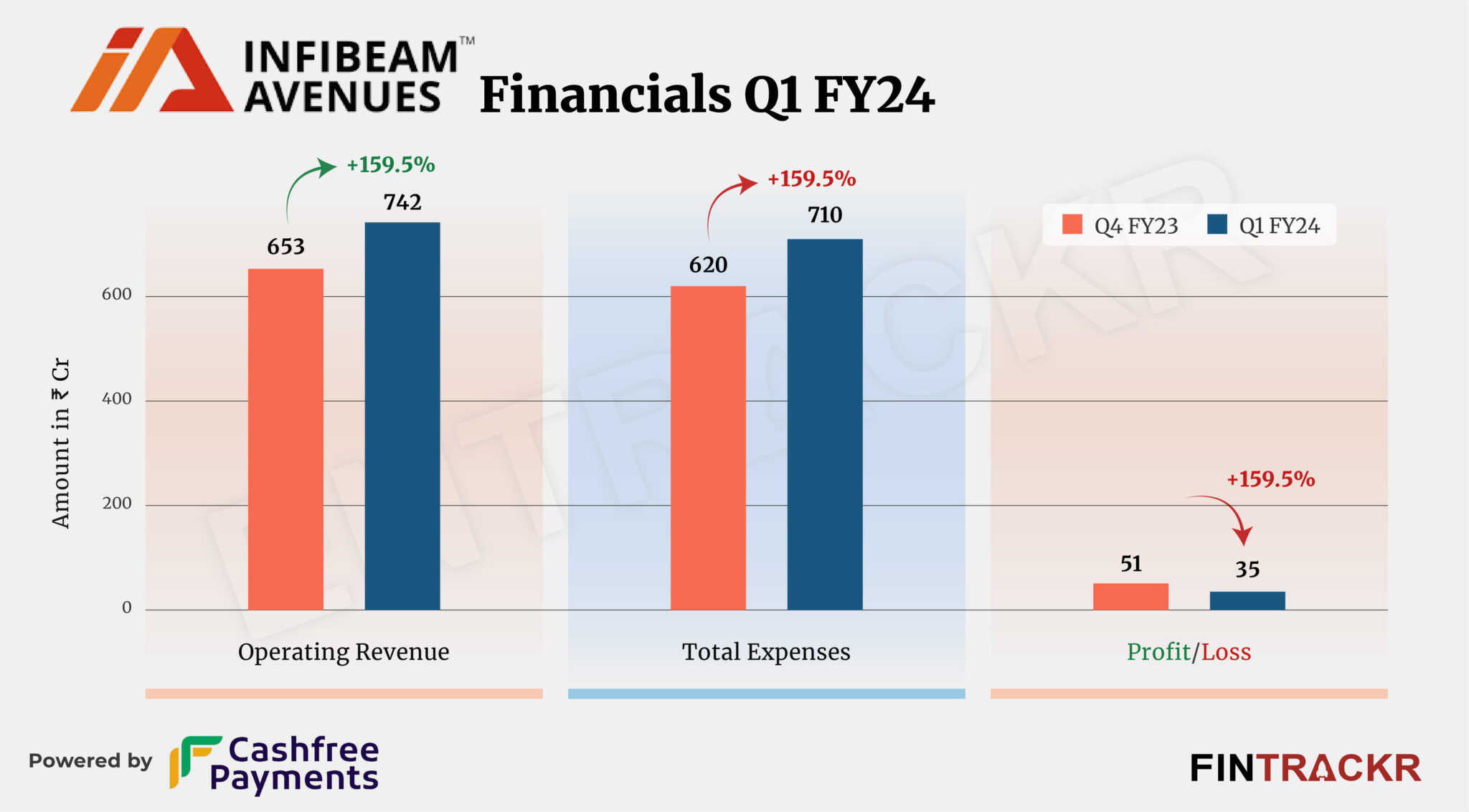

Fintech company Infibeam Avenues’ gross revenue jumped 13.6% to Rs 742 crore in the first quarter of the current fiscal year or Q1 FY24 from Rs 653 crore in Q4 FY23.

However, the net profit of the company declined by 31.4%to Rs 35 crore in Q1 FY24 from Rs 51 crore in Q4 FY23, according to the unaudited financial statements accessed through National Stock Exchange filings.

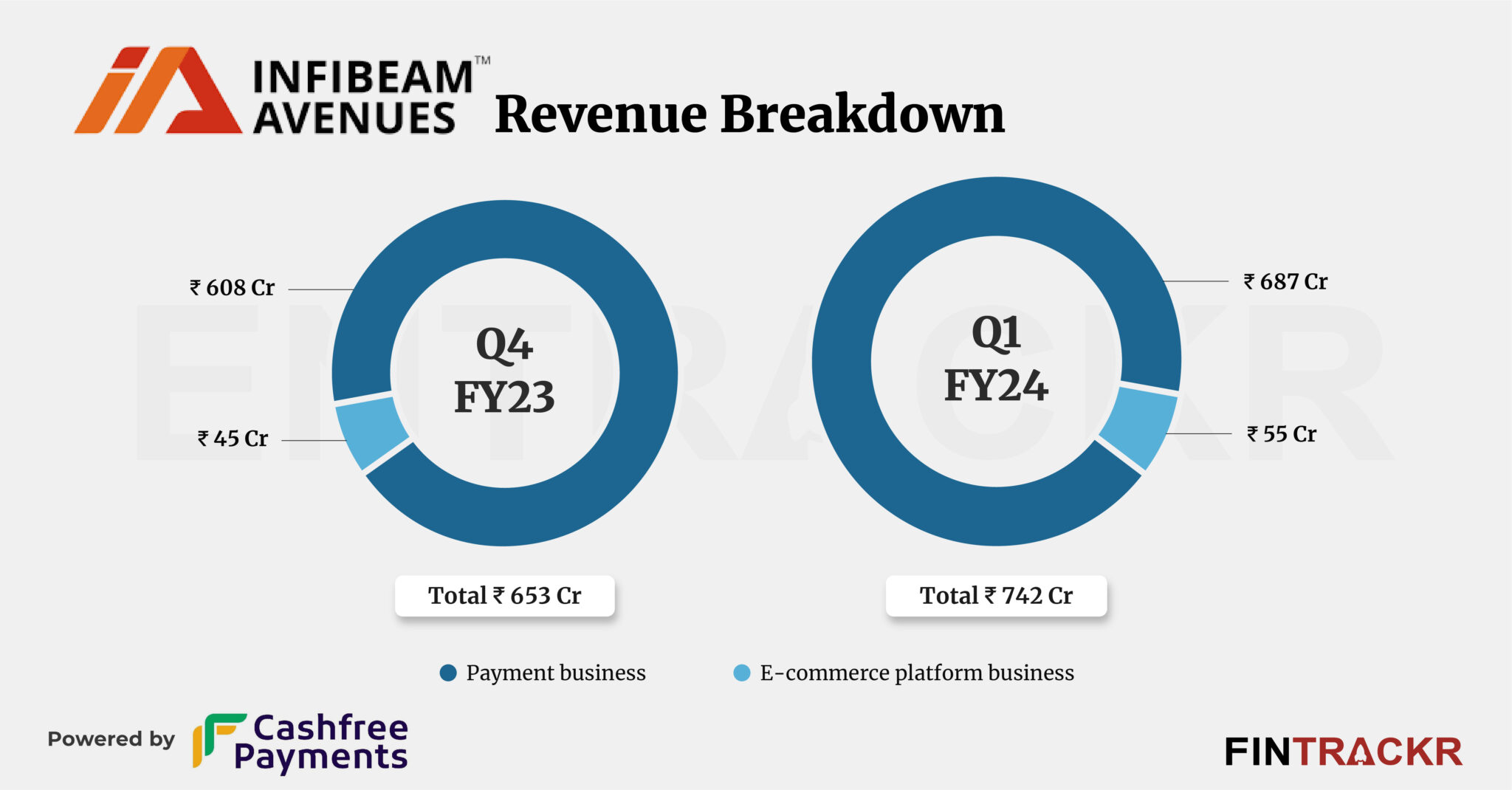

Infibeam payment business accounted for 92.6% of the operating income, which surged 13% to Rs 687 crore during Q1 FY24. The rest came from its e-commerce business platform, which increased 22.2% to Rs 55 crore in Q1 FY24.

The company claims to add 9,500 merchants on average daily and now has 10 million merchants across its online business. The company also experienced a surge in demand for its omnichannel mobile payment solution, CCAvenue TapPay.

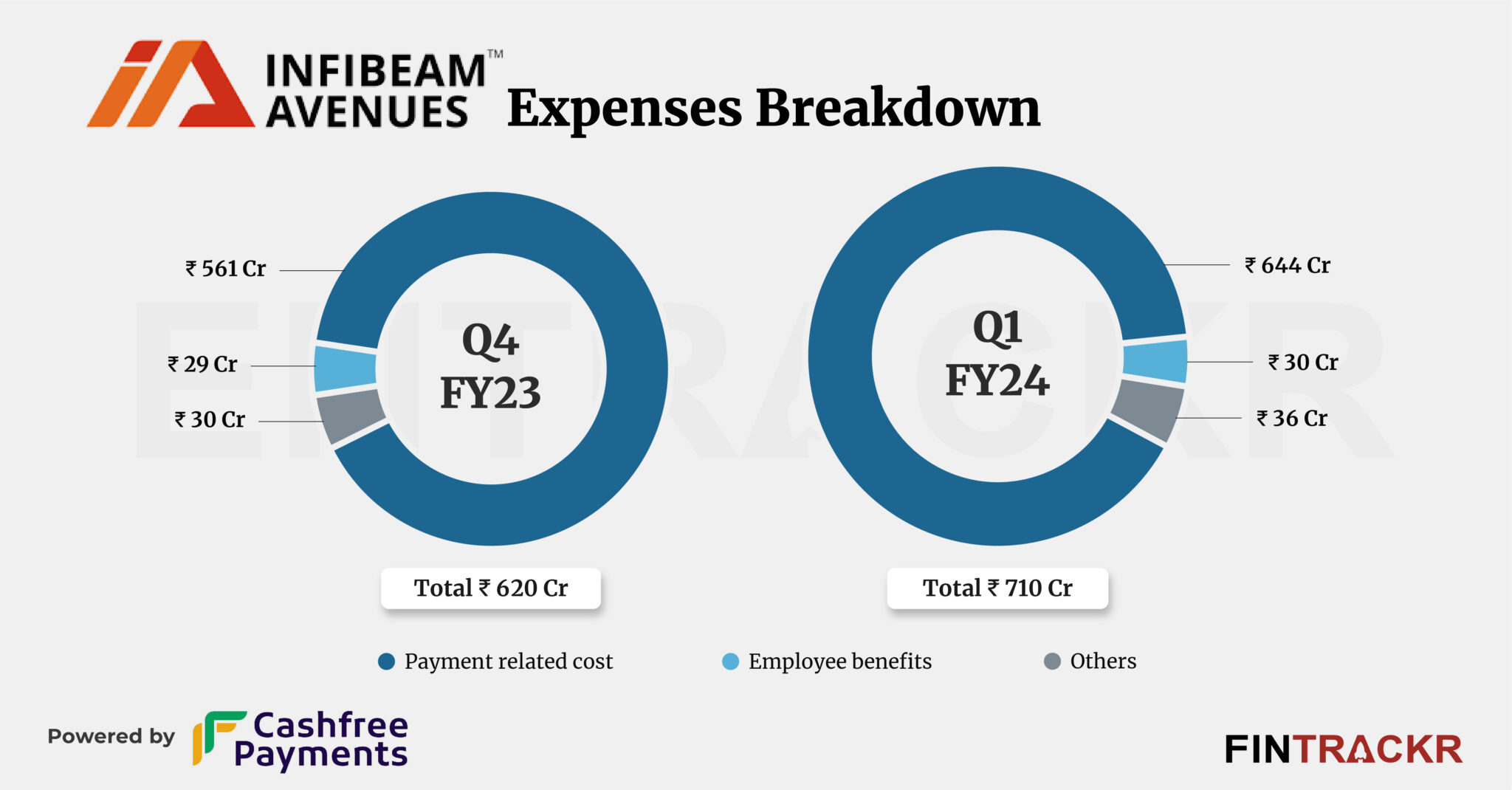

Its payment-related cost accounted for 90.4% of the overall expenditure. This cost increased 14.8% to Rs 644 crore in Q1 FY24 from Rs 561 crore in Q4 FY23. The company added Rs 30 crore towards employee benefits which took the overall cost to Rs 710 crore in Q1 FY24.

Infibeam closed FY23 with a 51.6% jump in its revenue to Rs 1,962 crore as compared to Rs 1,294 crore in FY22. During the period, the profit also surged 62.7% to Rs 136 crore from Rs 83.6 crore in the previous fiscal year.

Meanwhile, Infibeam has announced its foray into Artificial Intelligence to tap into the burgeoning AI-enabled fraud detection market. The new vertical will be led by industry expert Vishal Mehta. According to the company, it will also increase its stake in cross-border remittance provider Fable to 41% from 16% for a total cash consideration not exceeding Rs 3.2 crore and an additional Rs 1.4 crore through Compulsorily Convertible Debentures (CCDs).

Infibeam got listed on the stock exchange in April 2016. The company offers digital payment solutions and enterprise software platforms to businesses and governments across industry verticals. It claims to have processed transactions worth Rs 4.5 lakh crore ($54 billion) in FY23.