The government’s decision of imposing 28% GST on online real money games has already started impacting companies in the gaming industry. Weeks after the GST council refused to reconsider their decision, three Indian startups in the space have laid off staff while three other startups have shut down altogether.

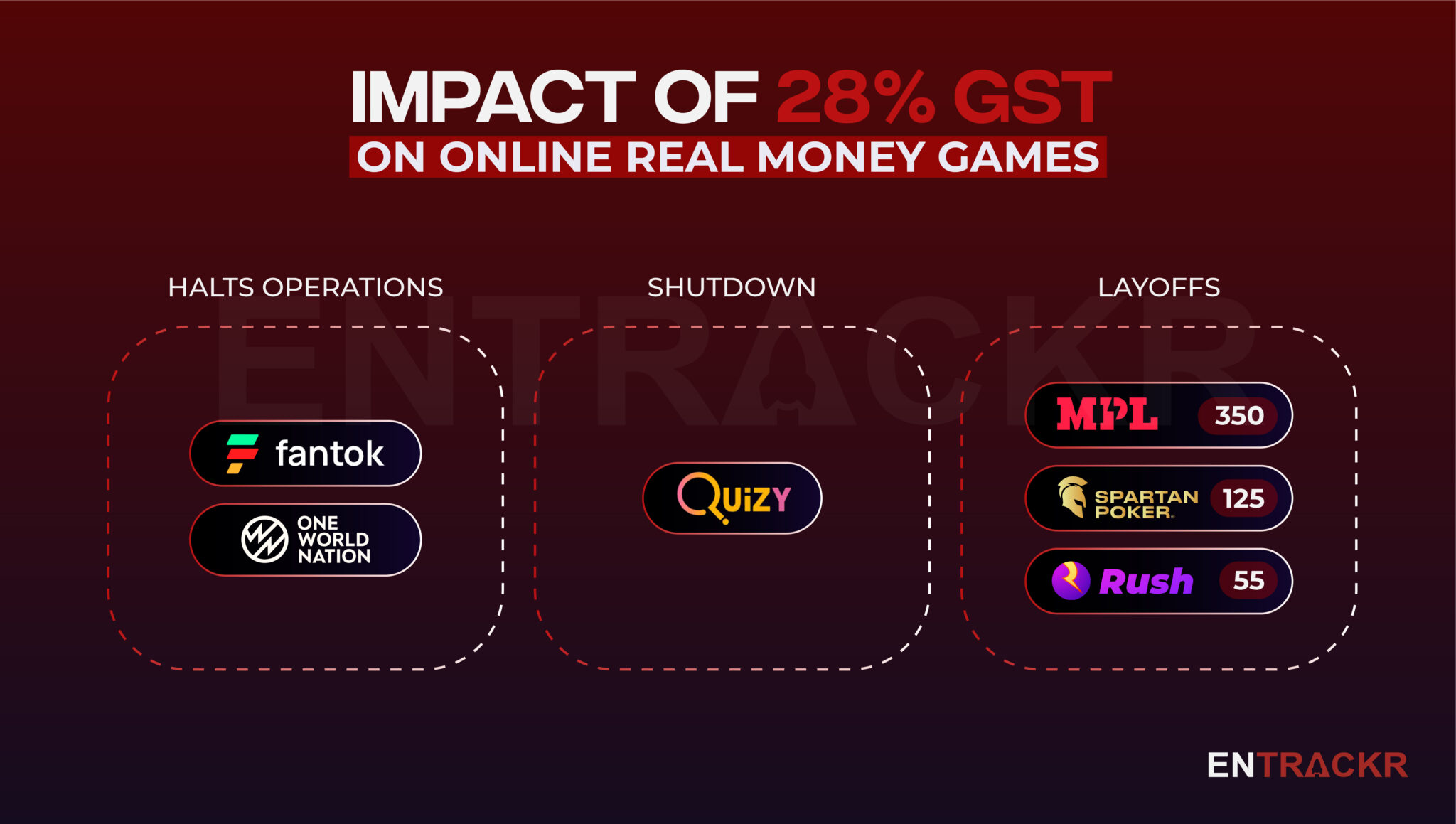

Mobile Premier League (MPL) was the first to announce the impact as the Peak XV Partners funded company let go of 350 employees. The company attributed the massive rise in tax burden due to GST to the layoffs.

Soon after MPL, online poker gaming platform Spartan Poker reportedly fired 125 employees. Kavin Bharati Mittal-led Hike Rush Gaming Universe also gave pink slips to 55 employees. “This 400% increase in GST is a bazooka pointed at us. We’ll need to absorb some of it,” Hike CEO Mittal had said in a statement.

The three layoffs collectively impacted more than 500 jobs. As three early stage companies announced halting their operations amid the mayhem, it became obvious that the bloodletting won’t stop. Real money gaming app Fantok and crypto gaming app One World Nation (OWN) halted their service temporarily while another gaming startup Quizy permanently shut its operations. Industry experts suggest that the odds are against these firms recovering. The move is likely to have impacted several employees working in these three companies. “We have laid off [a] 16 people team,” said Quizy founder and CEO Sachin Yadav in a statement to Entrackr.

According to Fantok, it let go of seven people team. We have reached out to OWN for comment.

Going forward, more layoffs, shutdowns and consolidations, especially among early stage firms, can’t be ruled out. In 2022, edtech accounted for nearly 50% of the total firings which was 20,000 across sectors. Going by current trends, gaming could be badly hit in 2023.

Business wise, MPL and Hike Rush Gaming Universe were loss making as of FY22. MPL’s losses soared 202% to Rs 1,122 crore in FY22 against Rs 497 crore revenue in the fiscal year ending March 2022. Hike, which pivoted to gaming, registered Rs 19 crore in revenue in FY22 while its losses stood at Rs 118.7 crore. In FY22, Spartan reported nearly Rs 80 crore revenue with Rs 1.61 crore profit. These companies are yet to file their FY23 numbers.

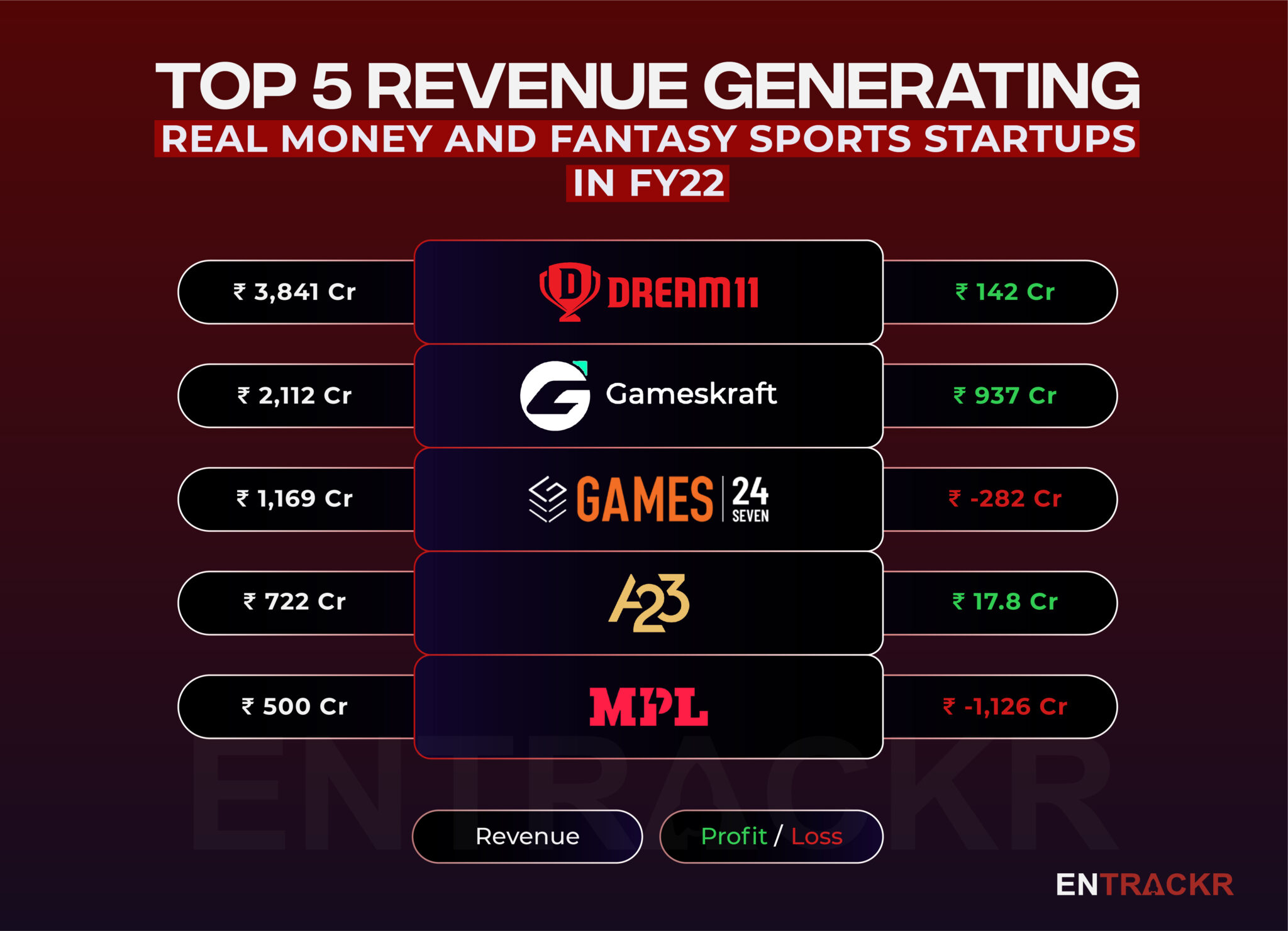

Overall, Dream11 is the highest revenue-generating fantasy sports company in India with Rs 3,841 crore revenue from operations in FY22, forming 42.2% of the overall industry revenues. Gameskraft, which runs RummyTime and Pocket52, and Games24x7, which runs RummyCircle and My11Circle, are in second and third positions with Rs 2,112 crore and Rs 1,169 crore operating revenue in FY22, respectively. Both Dream11 and Gameskraft posted huge profits in FY22 whereas Games24x7 slipped into losses in the fiscal year. A couple of companies including GameBerry and A23 also maintained profitability till FY22.

While FY23 would be smooth sailing for these companies, the impact of 28% GST will hamper their growth in the ongoing fiscal year or FY24. Dream11 has reportedly forecasted an 80% drop in EBITDA after the government move.

In a recent interview, Joy Bhattacharjya, the Director General of the Federation of Indian Fantasy Sports, said that most startups in the online gaming industry won’t survive 28% GST. He also added that a lot of consumers will move to foreign players for online gaming.

Earlier, several gaming companies including Nazara, Winzo, All India Gaming Federation, and around 30 investors wrote to the government to reconsider its decision on imposing 28% GST on such platforms.

At Entrackr, even as we covered the highs and lows of the sector, we have repeatedly stressed that the biggest risk to the gaming sector was policy risk. Unfortunately, that has been proved right by the government move, and even going ahead, we believe the vulnerability will remain. The obvious way out, to build strong earnings outside India remains a tough proposition for most of the firms, yet, the most necessary condition to long term growth and survival.

Meanwhile, some positive developments are also there. Recently, South Korean gaming company and BGMI-maker KRAFTON announced its commitment to invest $150 million in India over the next two to three years. Singapore-based gaming startup Ampverse also announced its plans to set up a gaming studio in India and scale up its local team.