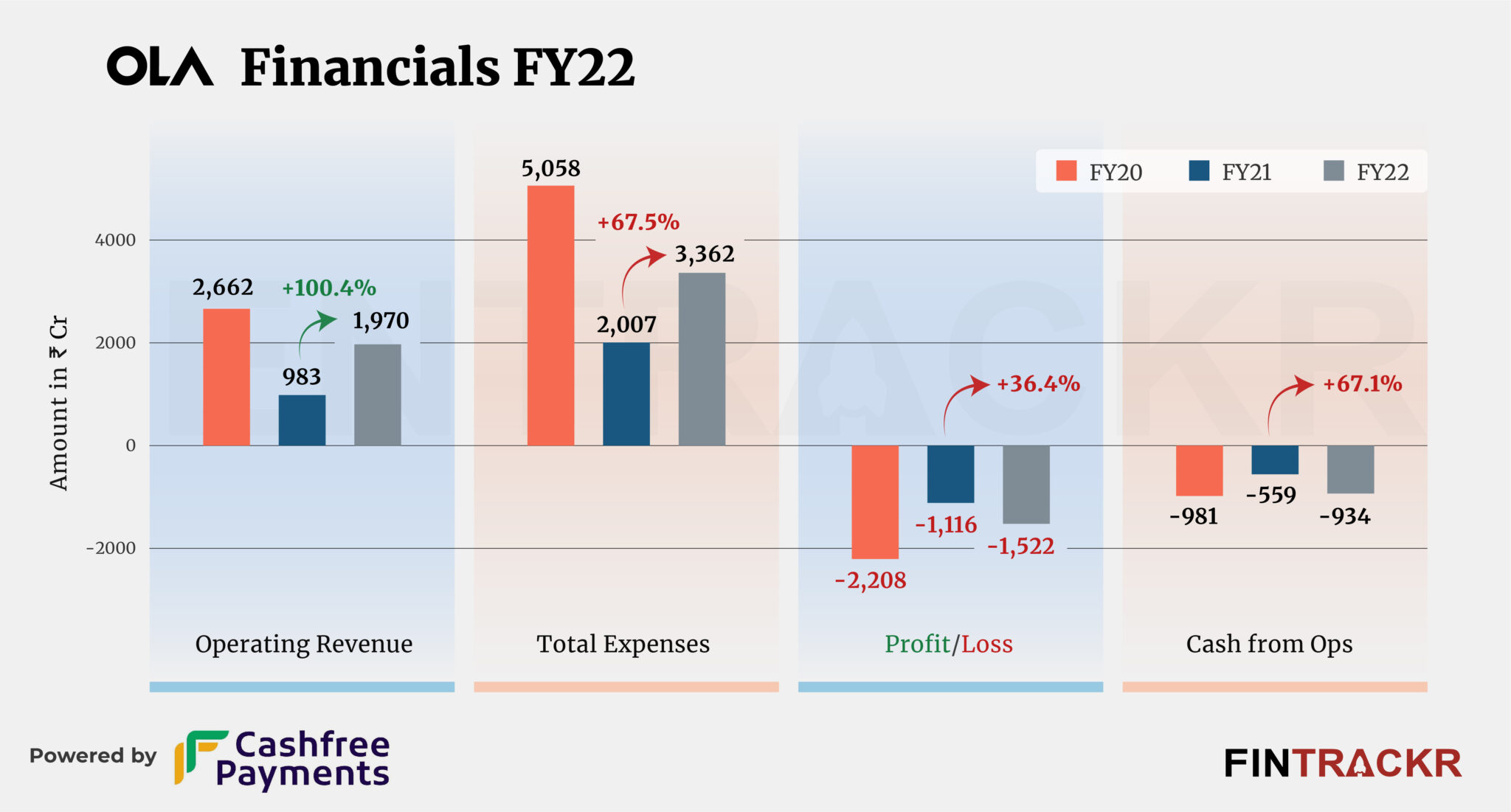

Ride hailing company Ola’s revenue from operations grew 100% to Rs 1,970 crore in FY22 when compared to Rs 983 crore in FY21, as per the company’s consolidated financial statement filed with the Registrar of Companies. The annual financial statement for the fiscal year ending in March 2022 or FY22 has been filed after a delay of over a year.

Let’s dive in to know the story as of March 2022. The company managed to recover from a sharp fall in revenue from Rs 2,662 crore in FY20 (pre pandemic) to Rs 983 crore in FY21. Its ops, however, remained severely affected during FY22 due to the pandemic-led lockdowns and restrictions on people movements.

Ola runs more than half a dozen verticals including mobility, financial services, cab hailing business outside India, buying and selling of used cars, and food comprising cloud kitchen and food delivery.

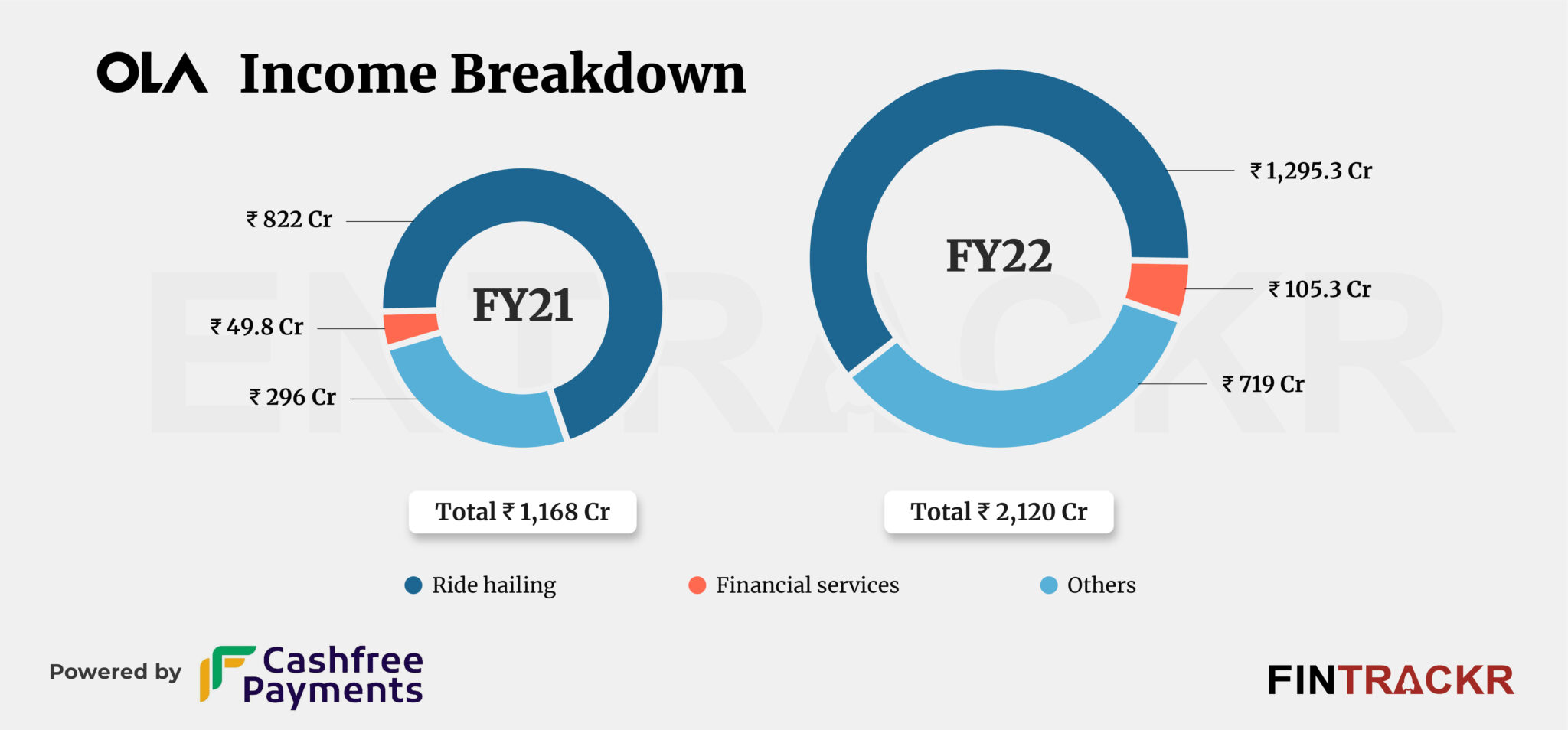

The company made 61% of its income from ride hailing services which surged 57.6% to Rs 1,295.3 crore during FY22. It made around 105 crore from financial services while the remaining came from other verticals.

Besides operating income, Ola also earned Rs 149.53 crore from non-operating income which includes marketing fees, data charges, subscription income et al.

Overall, its revenue stood at Rs 2,120 crore in FY22.

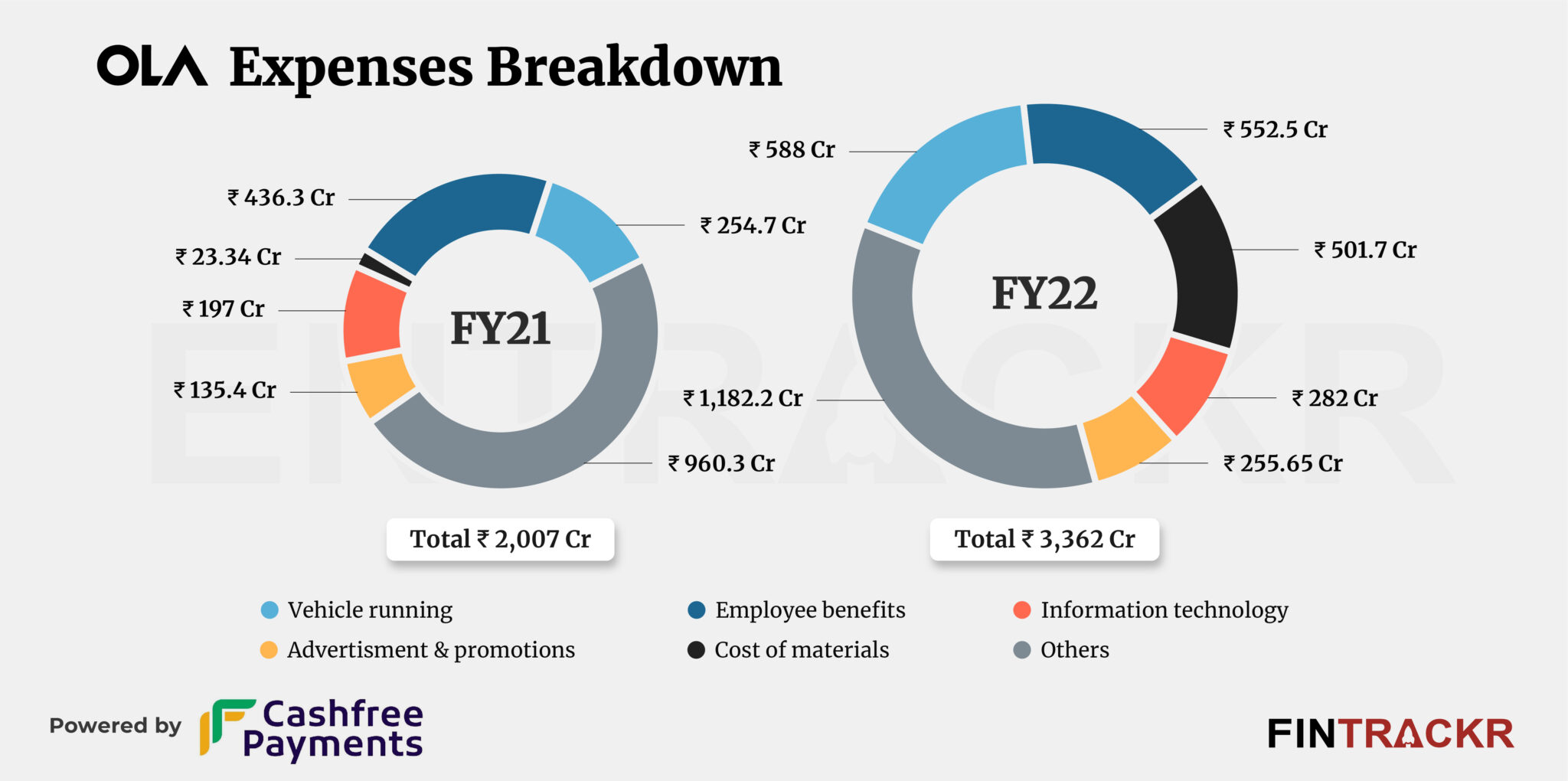

When it comes to expenditure, the company spent Rs 588 crore on vehicle running expenses, accounting for 17.5% of the total cost in FY22. This expense surged 2.3X from Rs 254.7 crore in FY21.

Employee benefit expenses went up 26.6% to Rs 552.5 crore during the year from Rs 436.3 crore in FY21.

Ola’s cost of materials shot up over 20X to Rs 501.7 crore in FY22 against Rs 23.34 crore in FY21. We didn’t understand the nature of this expense and have reached out to the company for clarification.

The company’s spending on information technology and advertising & promotions surged 43% and 89% to Rs 282 crore and Rs 255.65 crore respectively during FY22. Ola also incurred manpower supply, payment gateway, delivery, workshop, and other related costs which took the company’s overall expenses up by 67.5% to Rs 3,362 crore in FY22 from Rs 2,007 crore in FY21.

While the 13-year-old firm’s expansion in scale outpaced its burn, its losses surged 36.4% to Rs 1,522 crore in FY22 as compared to Rs 1,116 crore in FY21.

Ola’s outstanding losses rose to Rs 19,474 crore during FY22.

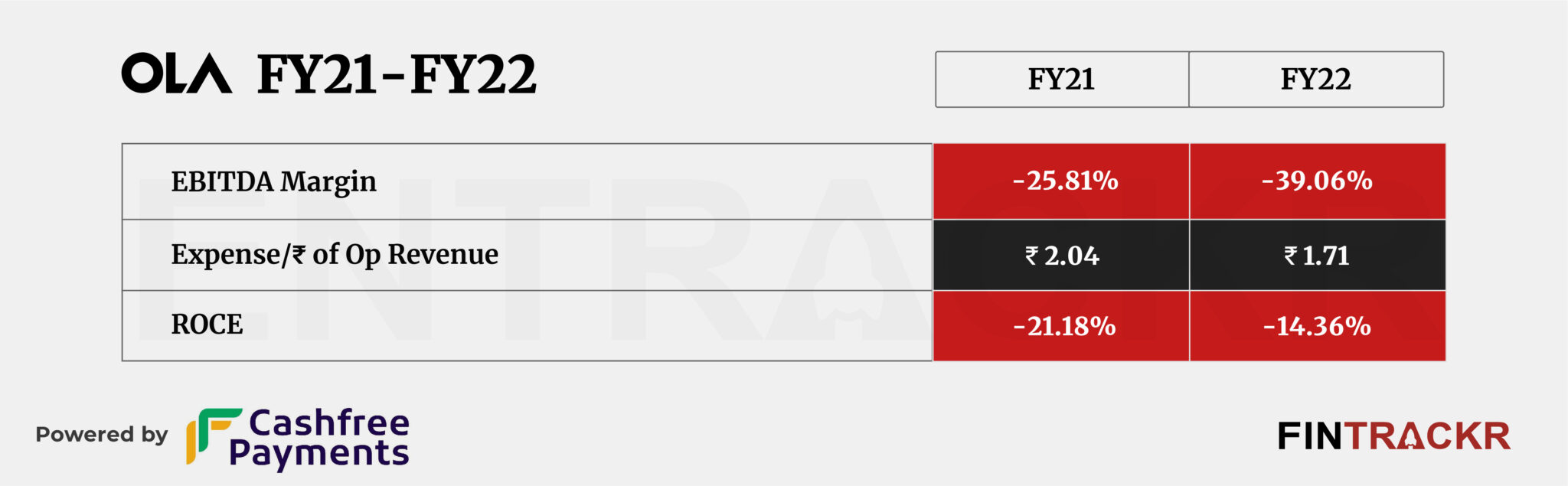

The company’s cash outflows from operations also worsened and went up 67% to Rs 934 crore in FY22. Its EBITDA margin and ROCE stood at -39.06% and -14.36% during the year. On a unit level, Ola spent Rs 1.71 to earn a rupee of operating income in FY22.

A bunch of late stage companies have been delaying their financial reporting for FY22. For instance, Byju’s is yet to file its FY22 numbers. In June, Deloitte resigned as auditor from the edtech unicorn as it failed to produce its financial statements for the fiscal year ending March 2022.

If the situation has improved in FY23, it is not apparent, going by the valuation markdows that continue to dog Ola. One of its backers, the Vanguard Group reduced Ola’s valuation by 35% to $4.8 billion in May this year from its peak value of $7.4 billion. Earlier this month, the firm further sliced its value by 27% to about $3.5 billion.

Ola’s arch rival Uber India’s revenue is complex to ascertain but its Indian entity registered a 7.3% rise in its operating revenue to Rs 397 crore during FY22 from Rs 370 crore in FY21. According to Fintrackr, its local arm cut down losses by 35.3% to Rs 216 crore from Rs 334 crore.

The cab aggregator market in India, for all the years it has put behind it , remains a very tough place to make money in. Ola, as the undisputed market leader, faces the daunting task of leading the market to a sustainable path, even as many of the promises made when these firms entered have failed to materialise. Be it decongestion of roads, lowering pollution, providing a dependable transportation option, and quality employment to thousands of driver ‘partners’, it’s safe to say that massive gaps remain. The market has also evolved significantly with the entry of newer players like Blusmart that have gone in for an all electric fleet, with an eye on building and controlling a charging network to covet, by the time EV penetration touches significant levels by 2025 or so .

Many other questions remain unanswered on Ola’s long term viability. But perhaps the unkindest cut of all is the answer to the question,” Will the firm be missed if it disappears tomorrow”? We suspect the answer will do nothing to reassure Ola or its current investors.