Funding winters may come and go, but the incredible Quikr saga of scarcely believable numbers continues. The online marketplace and classified platform that was started in 2008 continues to deliver numbers that can barely be termed an embarrassment anymore. The Bengaluru-based unicorn, which raised about Rs 3,200 crore in its lifetime, posted less than Rs 50 crore in topline in FY22.

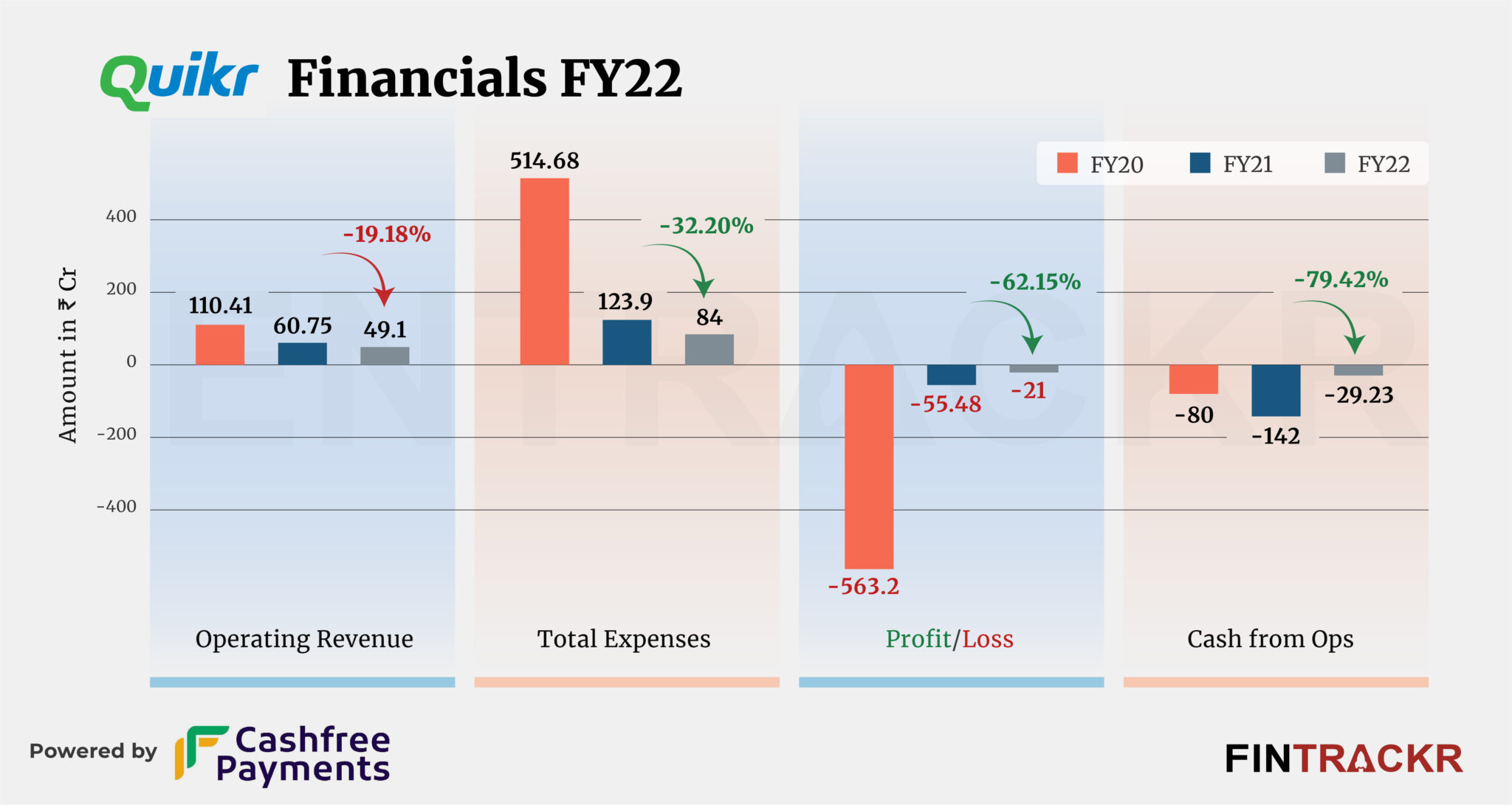

Quikr’s revenue from operations decreased 19.18% to Rs 49.1 crore during FY22, according to its consolidated financial statements filed with the Registrar of Companies on Wednesday [August 23, 2023].

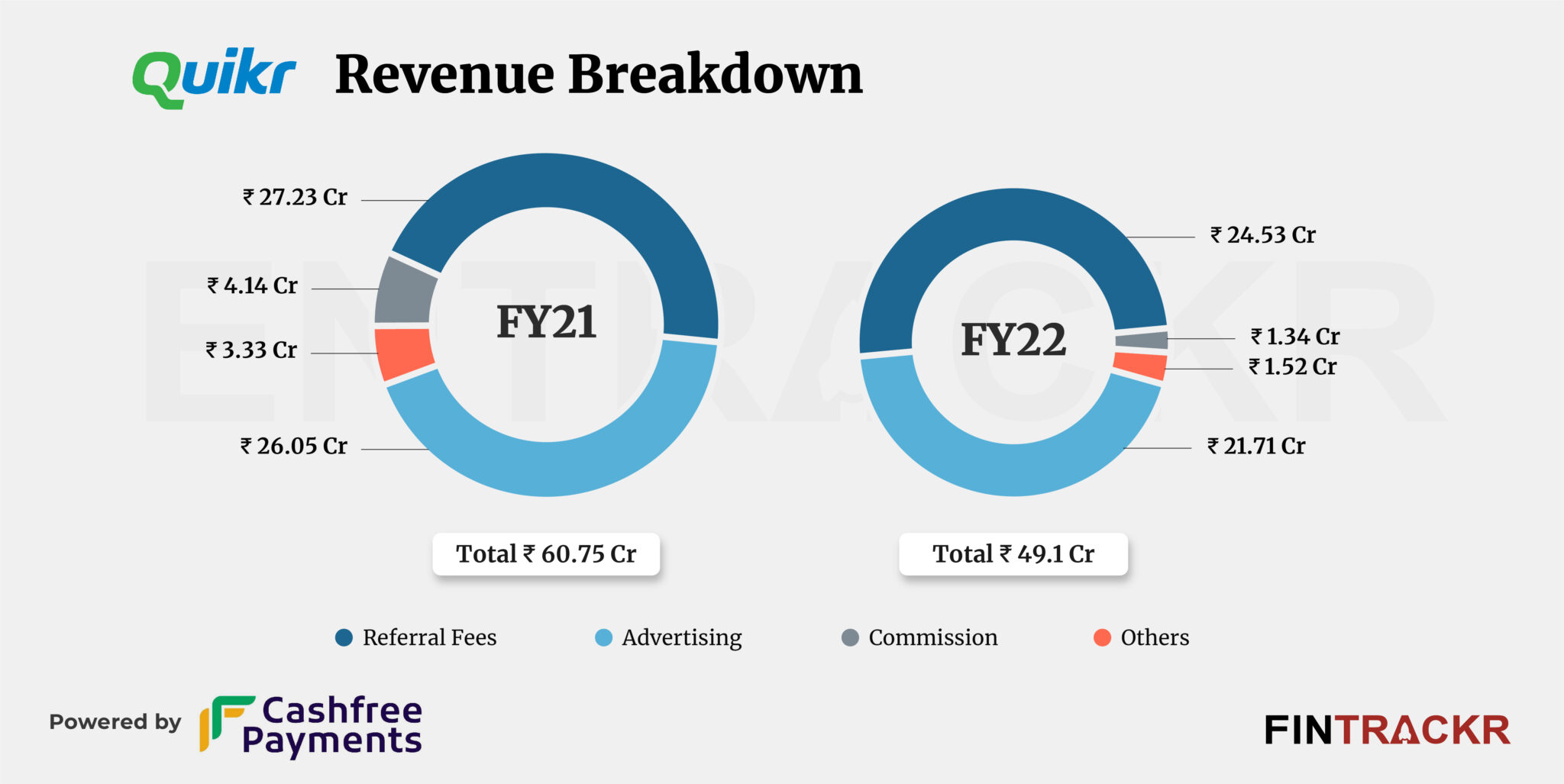

Quikr makes money from referral fees and advertising which decreased by 9.9% and 16.6% to Rs 24.53 crore and Rs 21.71 crore, respectively, during FY22. The rest of the income came from commissions and consultancy services which collectively contributed Rs 2.86 crore.

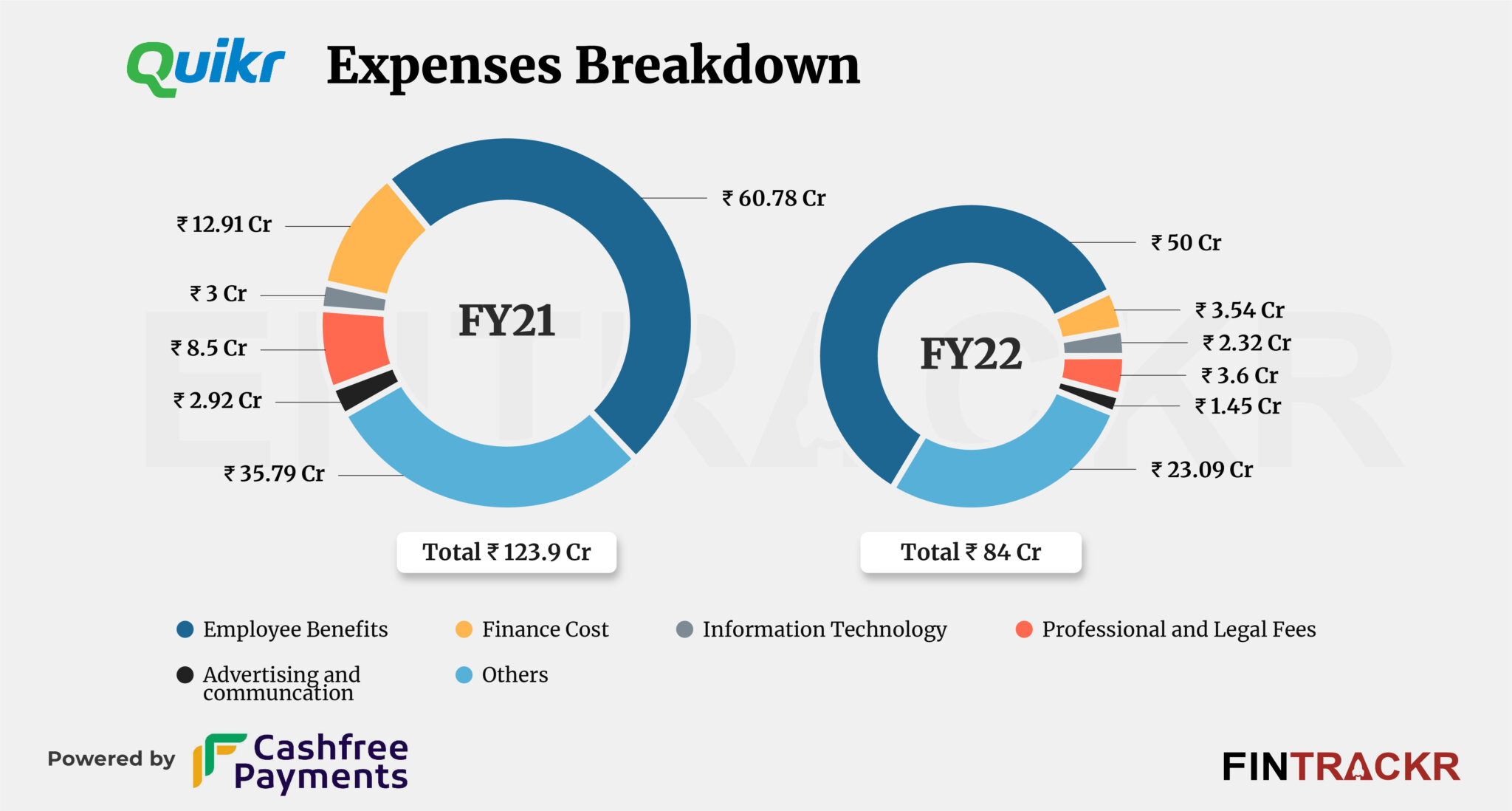

Akin to most unicorns, employee benefits was the largest cost center which accounted for 59.5% of the overall expenditure for Quikr. This cost contracted by 17.7% to Rs 50 crore during FY22. The company also cut down its finance cost by 72.5% to Rs 3.54 crore in FY22.

Quikr spent Rs 2.3 crore and Rs 3.6 crore towards IT costs and legal-professional fees which pushed its overall cost to Rs 84 crore during FY22. While the company’s scale continues to languish, Quikr managed to reduce its expenses. Consequently, the firm’s losses saw a notable decrease by 62.15% to Rs 21 crore in FY22.

Quikr has raised over Rs 3,200 crore across multiple funding rounds and its outstanding losses stood at Rs 3,092 crore at the end of FY22.

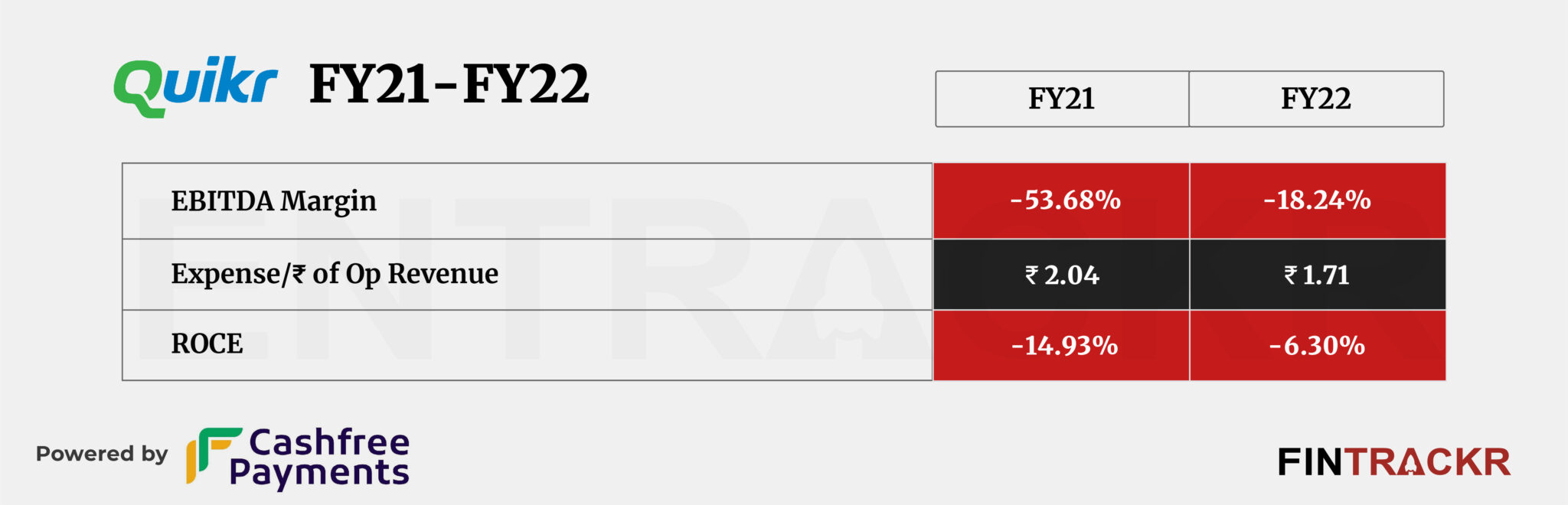

Its ROCE and EBITDA margins were registered at -6.3% and -18.24% d. The company spent Rs 1.71 to earn a unit of operating revenue in FY22.

Even as a writer, one really is at a loss for words when writing on a failure as colossal as Quikr. Ironically, it is one firm that has really dragged on way longer than it should have, and would really be better off being shut or sold, anything to make a real change at the unicorn. By avoiding any major allegations of corporate misgovernance, the firm has at least avoided a harsher spotlight into how its plans and projections failed so spectacularly.

With barely any receivables and cash balances at a bare Rs 8 crore, the firm looks set to fold up, to put an end to the saga, or perhaps, be brought out at a steep discount if its advertising income looks sustainable to anyone.