In 2018, a well-known investor named Mike Moritz wrote that Silicon Valley should follow China’s lead in the tech industry. He praised China’s fast-paced business environment and saw great investment opportunities in its top companies.

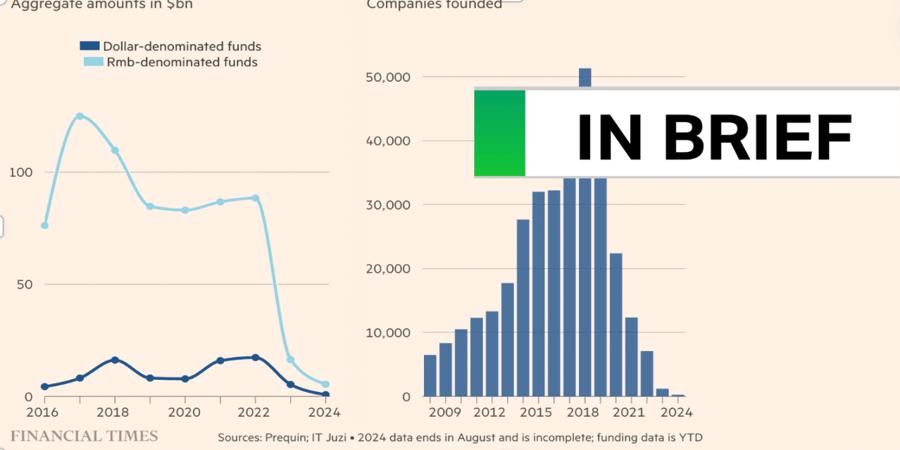

However, not long after, everything changed. The COVID-19 pandemic, a real estate market crash, increasing tensions between the US and China, and a government crackdown on tech companies made the situation worse. The result is that China’s economy may not fully recover, despite the government claiming it has finished its investigations.

Many entrepreneurs have lost faith in rebuilding their businesses in China. One former business leader told the Financial Times, “Our money is the country’s money,” implying that they feel their financial investments are tied to the country’s success. Meanwhile, venture capitalists and private equity executives who fueled China’s earlier growth are now feeling down and no longer attending industry events.